Consumer Inflation Hits 15-Month High on Soaring Fruit Prices

* Economists played down fears of a large consumer inflation spike driven by low fruit stocks and swine fever

* Core consumer inflation, which doesn’t include fluctuations in food and energy prices, edged down to a near-three-year low of 1.6% in May

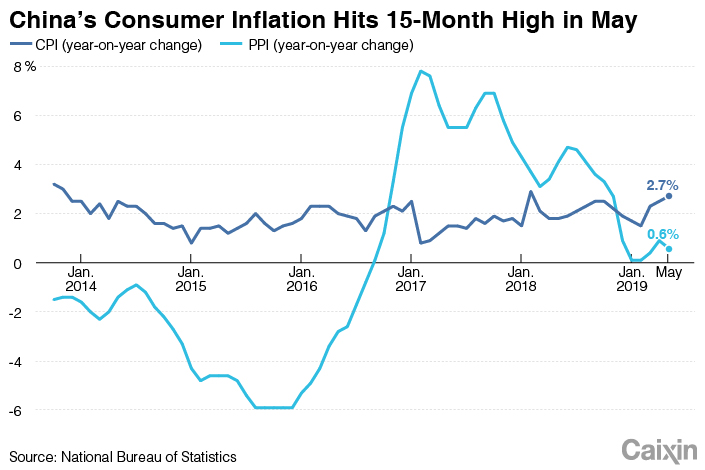

(Beijing) — Consumer inflation in China hit a 15-month high in May, as both growth in fruit and pork prices surged to multi-year highs, official data showed Wednesday. Yet economists don’t expect a big rise in consumer inflation going forward as a gauge that leaves out volatile food and energy prices remained subdued.

China’s consumer price index (CPI), which measures the prices of a select basket of consumer goods and services, rose 2.7% year-on-year in May, up from 2.5% growth in the previous month, according to data (link in Chinese) from the National Bureau of Statistics (NBS). The reading hit the highest level since February 2018, when the week-long Lunar New Year holiday drove up food prices, and marked the second-highest reading since November 2013.

|

Graphic: Gao Baiyu/Caixin |

The average price of fresh fruit soared 26.7% year-on-year in May, up significantly from 11.9% growth in the previous month and marking the fastest increase in more than eight years, NBS data showed. Amid a nationwide outbreak of African swine fever, the average price of pork rose 18.2% year-on-year last month, the highest growth in nearly three years.

Surging fruit prices were chiefly due to low stocks caused by cuts to apple and pear production last year, as well as short supply amid frequently overcast and rainy weather in southern China, NBS official Dong Yaxiu said in a statement (link in Chinese).

“The seasonal supply shortage in fresh fruit will ease as the summer season approaches,” Zhaopeng Xing and Betty Wang, economists with ANZ Research, said in a note. Hot weather is likely to help restrain further swine fever outbreaks, they said.

Analysts at Dutch bank Rabobank have forecast a 25% to 35% loss in China's pork production in 2019.

Read more

Core consumer inflation, which doesn’t include fluctuations in food and energy prices, edged down to a near-three-year low of 1.6% in May, NBS data showed. “It is clear that demand-side pressures on prices remain muted,” Shilan Shah and Franziska Palmas, economists with research firm Capital Economics, said in a note.

The producer price index (PPI), which tracks the prices of goods circulated among manufacturers and mining companies, rose 0.6% year-on-year in May, down from a 0.9% increase in the previous month, NBS data (link in Chinese) showed. The softer factory inflation was partly caused by a fall in raw material costs, particularly crude oil, the Capital Economics economists said.

“In all, the recent pick-up in headline inflation should not be interpreted a sign that domestic price pressures are building,” they said. Higher food inflation will probably push up the CPI in the near term, but there’s not much upside to the core consumer inflation and the PPI amid the weak economy and subdued industrial commodity prices, they added.

The current inflation level isn’t expected to impose much pressure on the central bank to throttle back their current bias toward monetary easing, economists with Nomura International (Hong Kong) Ltd. said in a note. They said that they expect Beijing to undertake further easing or stimulus measures to stabilize economic growth amid trade tensions with the U.S.

Over the past month, trade relations between the world’s two largest economies have further deteriorated. On May 10, the U.S. hiked punitive tariffs on $200 billion worth of Chinese goods to 25% from 10%. China retaliated by raising additional tariffs on more than 4,500 American products to between 10% and 25% on June 1.

Contact Reporter Liu Jiefei (jiefeiliu@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas