Weak Economic Data Bolster Expectations for Further Policy Easing

China’s government is likely to roll out more supportive policies to stabilize the economy after major activity data for May indicated mounting downward pressure on growth, analysts said.

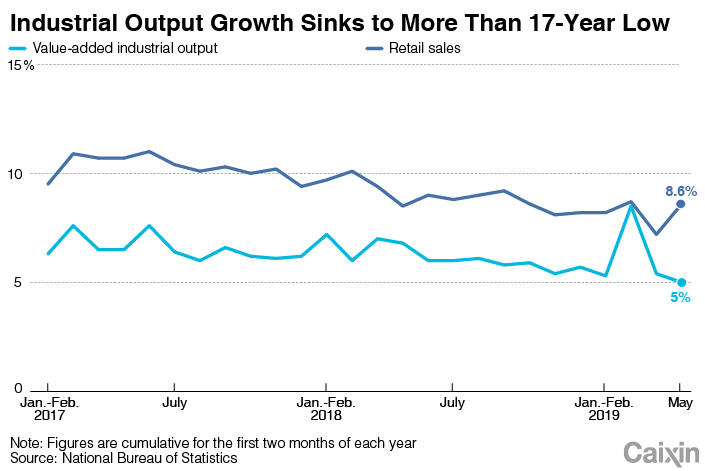

Production at factories, mines and utilities, rose 5% year-on-year in May, down from a 5.4% pace in April, the National Bureau of Statistics (NBS) reported on Friday. That was the weakest increase since February 2002, when growth was 2.7%, and missed the median forecast of a 5.4% increase in a Bloomberg News survey of economists.

|

“Generally speaking, the national economy sustained the momentum of progress in overall stability in May, continuing to perform within the reasonable range,” the NBS said in a statement. “Meanwhile, we must be aware that given the increasing instabilities and uncertainties from the external environment and the acute problem of unbalanced and inadequate development at home, the foundation for sustainable and healthy development of economy still needs to be consolidated.”

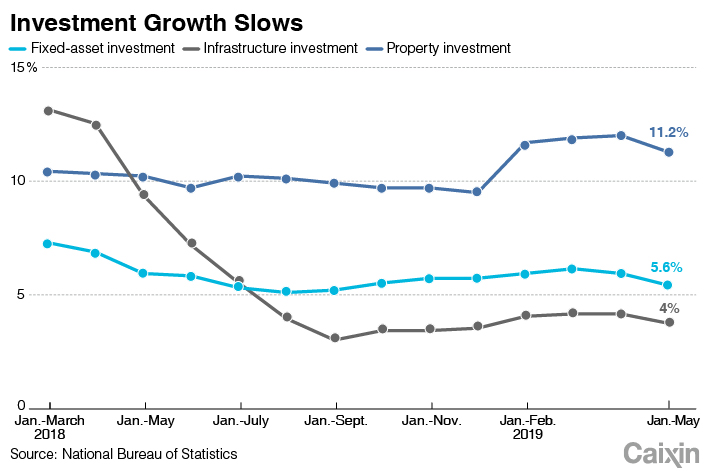

Excluding investment by rural households, fixed-asset investment — a key driver of domestic demand that includes government-backed infrastructure spending — grew 5.6% year-on-year in the first five months of 2019, the lowest since the January-September period in 2018, NBS data showed. That was down from a 6.1% pace in the first four months of the year, and missed the Bloomberg median forecast of a 6.1% increase. Growth in infrastructure investment slipped to 4% from 4.4% in the January-April period.

|

“Beijing will surely step up its policy easing measures to arrest the worsening slowdown and has already planned to enable local governments to leverage up to speed up infrastructure investment,” Nomura International economists led by Lu Ting wrote in a report after the data release. “But we believe the scope for local governments to add significant debt is limited.

“We expect Beijing to again allow local governments more freedom to scrap some restrictions in property markets to boost growth,” they said, adding that the chance of the central bank cutting lenders’ reserve requirement ratio in the near term is growing as the government needs faster credit growth to stabilize economic expansion.

Property slows

The Nomura economists said they also expect China to allow the yuan depreciate further if the U.S. carries out its threat of imposing additional tariffs of 25% on $300 billion of Chinese exports.

Growth in retail sales, which include spending by governments, business and households, recovered to 8.6% year-on-year in May from 7.2% in April which was the weakest pace since May 2003, although vehicle sales, the biggest individual category in the NBS report and a key pillar of the industrial economy, rose by just 2.1% in value terms.

Investment in real estate development rose 11.2% year-on-year in the first five months of 2019, down from an 11.9% increase in the first four months, while investment in residential property development, which accounts for more than 70% of the total, rose 16.3%, down from a 16.8% pace in the first four months, NBS data showed. Growth in new housing starts in the January-May period slid to 11.4% from 13.8% in the first four months, and the value of sales rose by 8.9%, down from a 10.6% pace in the January-April period.

“The poor investment data contrasts with the solid loan growth during the past few months, challenging the conventional wisdom of gauging the momentum of China’s economy based on its credit impulse,” economists at Australia and New Zealand Banking Group Ltd. (ANZ) said after the data release.

China’s outstanding M2, the central bank’s broadest measure of money supply, grew 8.5% year-on-year in May, unchanged from a month earlier, while growth in outstanding yuan-denominated loans was little changed at 13.4%, the People’s Bank of China (PBOC) said on Wednesday.

The credit data show that policy easing has not yet been effective in generating a sustained pick-up in credit growth which indicates there won’t be a strong recovery in economic growth in the near future, Franziska Palmas, an economist at research firm Capital Economics, said in a note on Wednesday.

Risks rising

ANZ economists said on Friday they had cut their estimate for China’s gross domestic product (GDP) expansion for 2019 to 6.2% from 6.4% and for 2020 to 6.0% from 6.1% because of worse-than-expected economic data over the past two months and forecast the industrial outlook will “remain gloomy” for the next few months.

“As growth risks have risen, we now expect the PBOC to send more supportive signals soon,” they said, forecasting the PBOC will lower banks’ reserve requirement ratio by a total of 100 basis points over the remainder of the year

The International Monetary Fund lowered its forecast for China’s economic growth this year to 6.2% from 6.3% on June 5, warning that “uncertainty around trade tensions remains high and risks are tilted to the downside.”

U.S. President Donald Trump threatened to impose punitive tariffs of 25% on an additional $300 billion of Chinese imports in May after talks to reach a trade agreement broke down. Although he and China’s President Xi Jinping may meet during the G-20 summit in Japan at the end of June, analysts don’t see much likelihood of a breakthrough.

“The chance of further deterioration of US-China relations has increased, with potentially adverse consequences for China’s economy,” Louis Kuijs, head of Asia economics at Oxford Economics, said in a research note on Friday. “Further escalation of tension with the U.S. will certainly weigh heavily on Chinese exports to the U.S. and hurt consumer and investment confidence in China and undermine China’s growth outlook beyond the near term.”

A previous version of this story mistakenly reported that NBS data showed fixed-asset investment in the first five months of 2019 grew at the lowest rate since the January-October period in 2018. It was actually the lowest rate since the January-September period in 2018.

Contact reporter Liu Jiefei (jiefeiliu@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas