Chart of the Day: Chinese Bonds Get More Love From Overseas

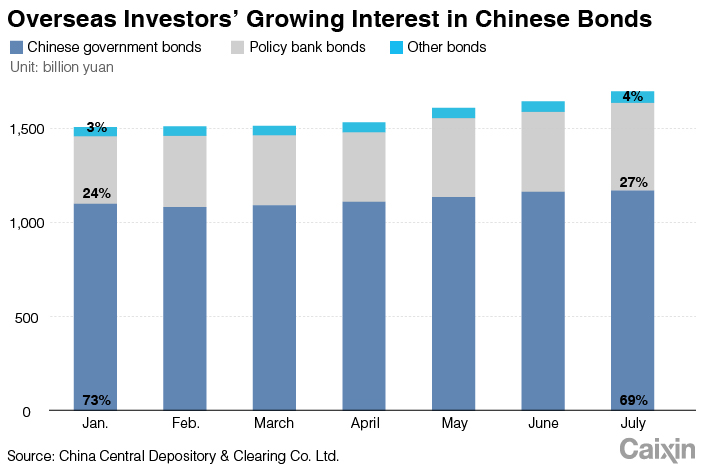

Overseas institutional investors have been increasing their holdings of Chinese debt securities over the first seven months of 2019, with their holdings making up nearly 3% of the world’s second-largest bond market.

The institutional investors held 1.7 trillion yuan ($240 billion) worth of Chinese bonds at the end of July, making up of 2.74% of the 62.1 trillion yuan in outstanding bonds which China Central Depository & Clearing Co. Ltd. provided custody service for.

China has the world’s second-largest bond market after the U.S., with nearly $13.7 trillion in outstanding debt securities at the end of March, according to data from the Bank for International Settlements.

|

“The decisions of overseas institutional investors are mainly affected by the interest rate spread between China and the U.S. bonds and the exchange rate,” analysts with Shanghai-based Shenwan Hongyuan Securities Co. Ltd. said in a note (link in Chinese) in late July. When the spread between Chinese and U.S. rates increases, or when the yuan strengthens against the U.S. dollar, it gives overseas investors more of an incentive to invest in Chinese bonds, they said.

Currently, overseas institutional investors have several ways to invest in China’s bond market, including: the Qualified Foreign Institutional Investor, RMB Qualified Foreign Institutional Investor, Bond Connect and China Interbank Bond Market (CIBM) programs. The last two are the most popular investment channels.

The People’s Bank of China, the country’s central bank, gave the go-ahead for overseas institutions to begin underwriting all types of debt securities on China’s interbank bond market in late July. Before that, overseas companies were only allowed to be the lead underwriters on “panda bonds,” or yuan-dominated corporate bonds issued by overseas nonfinancial institutions in China.

In April, Bloomberg began adding yuan-denominated bonds issued by the Chinese government and policy banks to its Bloomberg Barclays Global Aggregate Bond Index, further opening China’s debt market to international investors with money in investments that track the index.

Contact Reporter Liu Jiefei (jiefeiliu@caixin.com)

- 1Luckin-Backer Centurium Capital to Buy Blue Bottle Coffee From Nestlé

- 2Two Sessions: With 4.5%-5% Growth Target, China Aims to Create Space for Reform

- 3China Business Uncovered Podcast: Brazil’s ‘Very Chinese Moment’

- 4Cover Story: How China’s Growing Gig Economy Has Left a Generation Adrift

- 5First Tanker Crosses Strait of Hormuz Since Iran’s Closure Threat

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas