Chinese Outbound M&A Slumps on Trade War, Tougher Regulation

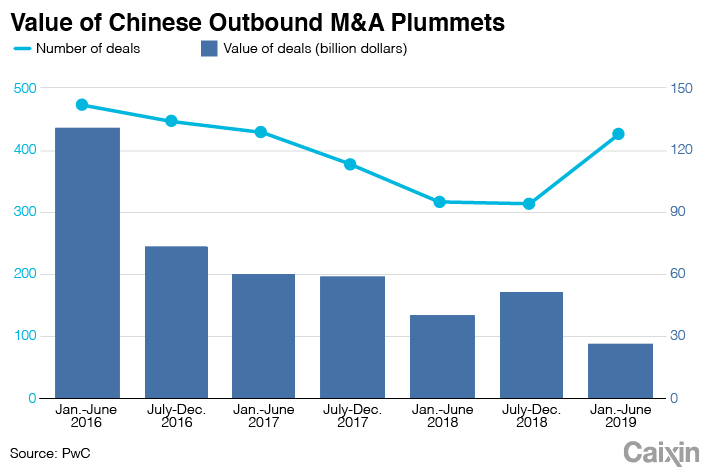

The value of Chinese outbound deals slumped by one-third in the first half of the year, as rising global trade tensions appeared to push back deal-making from China, a new report says.

The value of outbound merger and acquisition (M&A) deals by Chinese companies dropped 33.3% to $26.8 billion for the first six months of 2019, the third straight year of decline for the period, according to a report released Wednesday by accounting firm PwC, also known as PricewaterhouseCoopers.

But the total number of cross-border deals from China increased to 426 from 315 in the same period last year, the report said.

The shrinking outbound M&A value was dragged down by the decline of large deals made by Chinese buyers, said George Lu, PwC Chinese mainland and Hong Kong outbound deals leader. There were only four outbound deals valued over $1 billion compared with seven in the first six months of last year.

|

Smaller deals included Chinese investment firm Hony Capital Ltd. investing $700 million in U.S. filmmaker STX Entertainment in May, and retail giant Suning.com Co. Ltd. buying an 80% stake for 4.8 billion yuan ($699 million) in French supermarket chain Carrefour SA in June.

The decline comes as Chinese companies face growing hurdles erected by foreign regulators, particularly in the U.S. and Europe, Lu said.

Foreign governments are being more cautious about selling large and sensitive assets, such as those with security and military applications, he said.

That has scuttled a number of deals proposed by Chinese investors since 2017. They include an attempted takeover of U.S. microchip testing specialist Xcerra Corp. and the sale of U.S. high-tech chipmaker Lattice Semiconductor Corp. to a group of Chinese buyers led by private equity firm Canyon Bridge Capital Partners LLC.

Chinese firms’ U.S. and European M&A activity declined to $7 billion and $6 billion respectively, report said.

Outbound deals in the technology industry ranked No.1 amounting to 189, as China’s technology giants remained active in the sector. Consumer deals tallied 139 and health-care deals 116. Investment is expected to rebound in 2020, Lu said.

Contact reporter Tang Ziyi (ziyitang@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas