China’s Insurers Squeal as Swine Fever Hits Profits

China’s insurance companies that offer cover for the agriculture sector, especially livestock farming, have taken a severe hit from the devastating outbreak of African swine fever that’s wiped out a significant portion of the country’s hog population.

Firms are under growing pressure due to a surge in the number of farmers making claims partly due to the reluctance of local governments to classify hog deaths as being caused by the disease in order to avoid paying out subsidies, Lin Changqing, a deputy general manager at the agriculture insurance department of The People’s Insurance Co. (Group) of China Ltd. (PICC), told a forum in Beijing this week. As local authorities have shrunk from their responsibilities, insurance companies have had to pick up the bill in the form of higher claims payouts, Lin said.

The loss ratio on hog insurance has risen to around 130%, meaning that for every 100 yuan collected in premiums, companies are paying out 130 yuan, several industry insiders told Caixin on the sidelines of the forum. Before the outbreak of the disease, the payout ratio ranged from 50% to 60%.

State-owned PICC is the biggest player in China’s agriculture insurance market, with a share of around 50%. In the first half of this year, the insurance giant made net claim payments of 7.31 billion yuan, up 24.3% from a year ago, according to its financial report. The loss ratio on its agriculture insurance overall climbed to 75.9% from 62.8% a year earlier.

The outbreak of African swine fever has exposed long-standing shortcomings in the system for hog insurance, officials at the conference said.

The system for insuring live pigs currently has two parts – a policy-based component where underwriting and pricing are determined by various government departments at the beginning of the year, and a commercial insurance component where companies take in premiums and pay out on claims.

Unsustainable system

“Since 2008, the (pig) breeding industry has been in the red and this demonstrates that the current system of insuring live pigs is unsustainable,” said Bi Daojun, an official at the agriculture insurance office in the financial insurance department of the China Banking and Insurance Regulatory Commission, the country’s insurance watchdog. “The African swine fever outbreak has put this issue into a more prominent position, and we need to think about how to improve the system,” he said.

The high loss ratio and the unsatisfactory system of reinsurance have put even greater pressure on insurance companies, Bi said.

The insurance industry is watching closely to see how the pricing of live-hog insurance will be adjusted in the coming year. The consensus is that premium rates will have to go up, but the question now is by how much.

Bi said that in the long run, there will have to be adjustments in the price of live-hog insurance. “This is a policy-support insurance. That means that premiums tend to be sticky and it’s hard to adjust them,” he said. “We also have to consider what would happen if the market situation suddenly changes, for example if we get a breakthrough development in vaccine development, then there’s a danger that the premium cost will be too high. We also have to consider what will happen when pig prices drop over the course of the next pig cycle.”

The current pricing mechanism of pig insurance needs to be improved and local governments need to strengthen their financial support, Bi said. "The live-pig insurance plans made by many local provinces and cities are not based on big data analysis but are more like a compromise based on their (lack of) fiscal capacity,” he told the forum. “This has resulted in a mismatch in risk and pricing for insurance companies and has also dampened the enthusiasm of insurance companies to provide live-pig and other types of agricultural insurance.”

From their perspective, insurance companies want to see more support from the government and changes in the live-hog insurance system. Lin from PICC said insurers hope that government departments can strengthen administrative intervention and information sharing, strengthen the promotion of agricultural insurance, and coordinate the expansion of pig insurance.

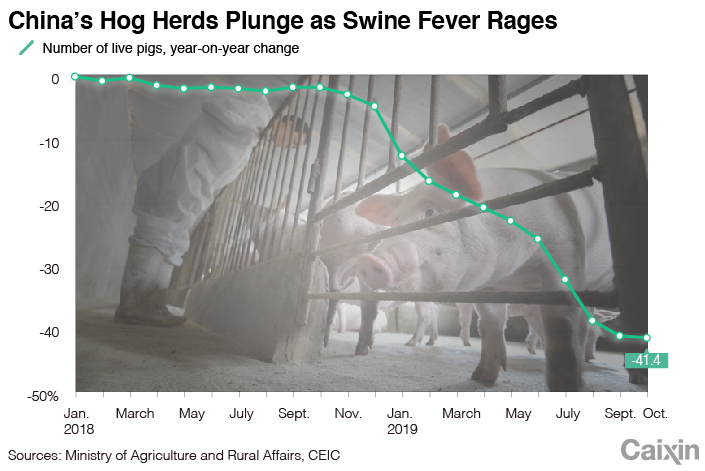

Since the first case of African swine fever was reported in China in August 2018, about one-third of the country’s hogs have died or been culled, which has caused an estimated $140 billion in direct losses, according to Li Defa, who heads the College of Animal Science and Technology at China Agricultural University. Industry analysts expect the country’s pork production will drop as much as 40% this year.

|

To stop the spread of the deadly disease, farmers were told to cull all their pigs once an African swine fever case has been confirmed and were promised that compensation for losses will be partly paid for through government subsidies before they need to claim on their commercial insurance policies. But some cash-strapped local governments chose not to report the disease and waited for infected pigs to die instead of being culled, leaving insurers to pick up the bill through claims from farmers.

Read more

In Depth: China’s Small Pig Farmers Stuck in Financing Mire After Swine Fever

This has led to a big burden for insurance companies and increased the risks to their business operations, Lin said. He called for new regulations to clarify compensation procedures and urged local governments to hand out subsidies promptly.

Farmers, especially smaller ones, have been reluctant to start raising pigs again because of the losses they have sustained and that in turn has led to a decline in premium income for insurance companies because of weaker demand for insurance, he said.

Contact reporter Tang Ziyi (ziyitang@caixin.com)

Caixin Global has officially launched Caixin CEIC Mobile, a mobile-only version of a world-class platform for macroeconomic and microeconomic data.

From now on, all users can enjoy a one-month free trial on the Caixin App through December 2019. If you’re using our App, click here. If you haven’t downloaded the App, click here.

- 1Luckin-Backer Centurium Capital to Buy Blue Bottle Coffee From Nestlé

- 2Two Sessions: With 4.5%-5% Growth Target, China Aims to Create Space for Reform

- 3China Business Uncovered Podcast: Brazil’s ‘Very Chinese Moment’

- 4Cover Story: How China’s Growing Gig Economy Has Left a Generation Adrift

- 5First Tanker Crosses Strait of Hormuz Since Iran’s Closure Threat

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas