China Luxury Market Booms on Better Pricing

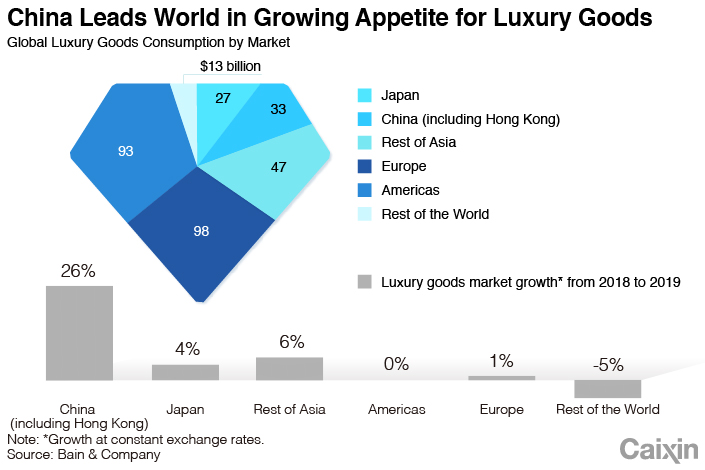

China’s market for personal luxury goods is set to grow 26% this year, more than six times the global pace, as Chinese consumers continue to make up some of the world’s strongest buyers of high-end handbags, makeup, shoes and other designer products.

Sales of personal luxury goods in China, which does not include big-ticket items like cars, are expected to reach 30 billion euros ($33.4 billion) this year, according to the annual Bain-Altagamma 2019 Worldwide Luxury Market Monitor report published on Wednesday. By comparison, the global personal luxury goods market is expected to grow by a much slower 4% this year to about 281 billion euros, according to the report.

Bain attributed the modest worldwide growth to concerns about the global economy and uncertainties in the global environment. By comparison, China benefitted from an ongoing policy by many luxury brands aimed at reducing price discrepancies between their goods sold in China and those sold elsewhere. In the past, the same luxury goods often sold for far more in China than identical products in other countries, leading many Chinese to do their shopping abroad.

|

China is one of the world’s fastest growing luxury goods markets, as millions of newly minted middle class Chinese become more discerning consumers in search of the latest designer products. Such consumption fueled a boom for the global personal luxury goods market between 2010 and 2014, a period that Bain described as a “Chinese shopping frenzy.”

Despite the attempts to equalize prices across different markets, still only a fraction of purchasing by Chinese consumers was taking place in their home market this year. China is set to account for about 10.7% of global sales of personal luxury items in 2019, according to Bain. But Chinese consumers are behind a far higher percentage of personal luxury goods buying, accounting for 35% of the world’s total this year, the report showed.

By comparison, Americans were the second-largest group, accounting for 22% of such buying, followed by Europeans at 18%.

While the China market as a whole boomed, the opposite was true for Hong Kong, once a powerhouse for luxury goods buying. Spending on personal luxury goods is set to fall 20% to 6 billion euros for the year, according to the report. The figure first fell into negative territory in 2013 and has contracted on average by 5% each year between then and 2018.

The downward spiral has gone into free-fall this year due to more than six months of unrest — sometimes violent —against the local government. That unrest has scared off many visitors to one of Asia’s top tourist destination. The number of visitors to the city tumbled 44% in October to 3.3 million, led by a 46% plunge in Chinese mainland visitors, who account for more than two-thirds of the total, according to the Hong Kong Tourism Board.

The Bain report pointed out that Hong Kong’s troubles could benefit other nearby markets, as Chinese shoppers do their purchasing at home or elsewhere in Asia.

Contact reporter Yang Ge (geyang@caixin.com; twitter: @youngchinabiz)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 4Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas