Covid-19 Crushes Beijing Office and Retail Space Markets in First Quarter

|

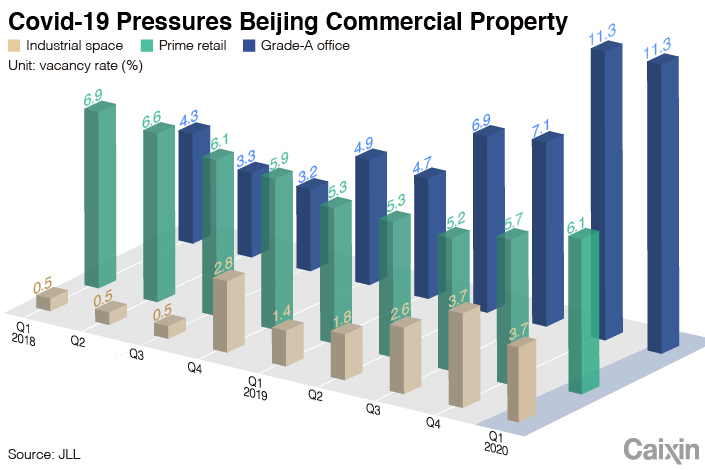

Beijing’s posted decade-high office vacancies and slipping rents in the first quarter, as properties remained closed and much of the nation’s business came to a standstill during the coronavirus outbreak, according to reports out this week.

A survey by U.S. property services giant JLL said the vacancy rate for top-grade office space in Beijing stood at 11.3% during the first three months of the year, unchanged from last year’s fourth quarter and a decade high. Global peer Savills said the average vacancy rate rose 0.5 percentage points to 13.2% quarter-on-quarter, marking the highest level since 2010.

Savills said net absorption of office space for the quarter was a negative 36,782 square meters, also a 10-year low. That means the total amount of office space vacated surpassed the amount of new rentals, a relative rarity in the hot Beijing office market for much of the last decade. The weakness put downward pressure on rents, which slipped 1.3% quarter-on-quarter to an average of 379 yuan ($53.56) per square meter in the first quarter, JLL data showed. That was the fifth consecutive quarter of decline for the market.

“The outbreak of coronavirus suspended leasing activity across sectors and intensified market pressures,” said Julien Zhang, managing director for JLL North China. “In the office market, the situation weighed on rents, resulting in further declines, as landlords prioritized stability over rent growth.”

The Covid-19 outbreak has wreaked havoc on China’s workplaces, forcing many companies and manufacturers to close up shop for weeks around the Lunar New Year holiday in late January. Businesses began to reopen gradually in mid-to-late February, but many have left their physical offices understaffed and asked some employees to work from home to reduce the threat of contagion.

|

Retailers have been hit even harder than office tenants as many consumers stayed home for much of February and March to avoid crowded places. Many shops were forced to close. JLL said the average vacancy rate for prime retail space stood at 6.1% in the first quarter, up from 5.7% the previous quarter. The rising vacancies put downward pressure on rents, which fell 0.5% quarter-on-quarter.

JLL pointed out that Beijing’s stricter standards relative to most other cities to contain the outbreak meant retailers in the nation’s capital suffered more than other parts of the country.

“As sales fall, both retailers and landlords are left in a hard place,” said Ji Ming, research manager for JLL Beijing. “Moreover, as further fallout in the market remains likely, we are expecting to see increases to vacancy and added downward pressure on rents in the coming months. In Beijing, where life is returning back to normal at a slower pace compared to other major Chinese cities, retail recovery is expected to take some time.”

Back in the office market, Beijing rents will continue to come under pressure for the rest of this year due to a large volume of new space coming onto the market, said Yan Quhai of global real estate services provider Colliers International. Yan said this year will mark a high point for such new space, with more than 800,000 square meters set to enter the market. But rents could start to stabilize next year as the addition of new space begins to subside, Yan said.

Contact reporter Yang Ge (geyang@caixin.com; twitter: @youngchinabiz)

- MOST POPULAR