Caixin Insight: Proactive Local Governments Take the Recovery’s Reins

Welcome to the newest issue of the Caixin Insight newsletter, which provides more in-depth and incisive views each week on what’s happening in the world’s second-biggest economy as it gets back on its feet after Covid-19. This issue was compiled on April 29.

Further economic data releases over the last week provided us with a finer-grained picture of China’s economic recovery by industry and province, both making clear the depth of the crisis and revealing a few areas which have performed better than others.

There was relatively little new information on the much-anticipated central stimulus package, with local governments working hard to kick-start demand in their own jurisdictions, but a close reading of President Xi’s inspection trip to Shaanxi suggests that SMEs and new infrastructure will not be the sole beneficiaries despite their front-and-center position in the conversation thus far.

Finally, the “Two Sessions” have been confirmed for late May — we’ll be tracking the run-up closely over the next few weeks.

Macro update

Industrial profits fell by 34.9% year-on-year on average in March according to National Bureau of Statistics (NBS) data released Monday (link in Chinese). While the data do not paint a rosy picture, with large-scale enterprise profits down nearly 50 percentage points from a year earlier, there are signs of recovery, with profits recovering 3.4 percentage points from the January-February period. The decline in profits is narrowing at varying speeds by sector, with some improvement in most industries excluding oil and gas, ferrous metals, and auto manufacturing.

Recovery also varies quite dramatically by province (link in Chinese). As of last week, 24 provinces had released first quarter GDP data. Hubei was of course hit the hardest, with GDP down nearly 40%, whereas western provinces were relatively less affected, with Xinjiang for example down just 0.2%. Tianjin posted particularly poor data, the only area outside of Hubei with growth below the national average, due in large part to its high concentration of oil, chemical, and automobile industry. Provinces with a greater proportion of state-led investment unsurprisingly performed relatively better than those which rely more heavily on private money, and those which poised to take advantage of new infrastructure projects are well-positioned moving forward, with the director of Guizhou province’s statistics bureau pointing out that the outbreak has accelerated new infrastructure construction, promoted development of industrial chain clusters and pushed structural adjustments forward.

Unemployment

Employment pressure remains quite severe, with a 22 April report (link in Chinese) from Renmin University’s China Institute for Employment Research showing that in the first quarter, recruitment and job applications fell 22.6 percent and 9.4 percent respectively year-on-year. The China Employment Market Sentiment Index, which measures the ratio of applicants to openings, was down sharply from 2.18 in the fourth quarter of 2019 to 1.43 in the first quarter of 2020. In contrast to the slight drop in the official NBS urban unemployment rate, the China Institute for Employment Research Index is still falling and hit an all-time low of 1.02 in March.

Zhongtai Securities estimated (link in Chinese) in a now-retracted report that China’s actual unemployment rate has reached 20.5%, and that there may be more than 70 million newly unemployed people given how many self-employed people were hit hard by the pandemic. The report pointed out that the reported NBS unemployment rate is “obviously at odds” with the state of the economy, and called to improve the existing statistical indicators to better capture data on migrant and agricultural workers.

The report drew a great deal of attention in domestic and international media alike, but much of the discussion on its content has been fairly surface-level; the points made by the report about shortcomings in statistical data are already common knowledge, and some of the hype surrounding it has failed to acknowledge that Zhongtai was referring in particular to frictional unemployment. That isn’t to say the rise in unemployment is not a serious issue, but the report does note that migrant workers are something of a unique case in that when they lose their jobs in the cities, many can return to the countryside to become farmers, which is rather different from Covid-19 induced structural unemployment risks elsewhere.

Local governments turn to cars in desperate search for demand

The automotive sector, which accounts for 10% of China’s total retail sales, has been among the hardest-hit parts of China’s economy, with value-add growth of -26% in the first quarter. The China Association of Automobile Manufacturers (CAAM) predicts that the car industry may not recover to pre-Covid-19 levels until the second half of 2020.

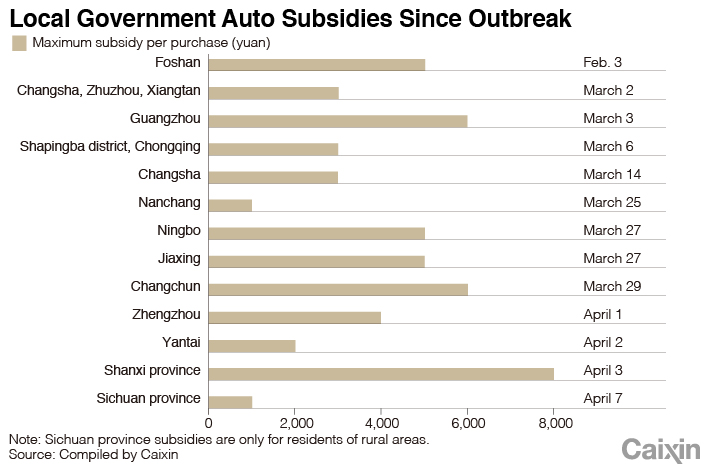

Numerous local governments have rolled out cash incentive programs in a bid to boost sales, seeking avenues to boost their economies however possible, especially after receiving clear signals from Beijing that real estate restrictions will not be loosened. Some cities are offering consumers as much as 8,000 yuan ($1,129) per vehicle, but industry groups like CAAM are calling for even more incentives, such as waiving purchase taxes, currently charged at 7.5%.

|

The industry is also hoping for further loosening of license plate quotas, which are a major constraint for the Chinese auto market in big cities. Since the beginning of this year, Shanghai and Hangzhou have increased their plate sales by 20,000 and 40,000 respectively.

|

Meanwhile, Guangdong and Sichuan provinces have moved to activate demand in a sometimes underestimated market segment: the countryside. The numbers of cars owned per 100 rural families in China grew from 9.9 in 2013 to 22.3 in 2018, but still remains considerably lower than in cities. On April 15, Guangdong announced several measures to tap this market, including offering 10% discounts and other subsidies for electric vehicles; Sichuan has offered subsidies exclusively for rural residents.

Registration-based ChiNext IPOs arrive

After a roughly 10 month trial on the Shanghai STAR Market, China’s pilot registration-based IPO system has been expanded to Shenzhen’s ChiNext market.

Registration-based IPOs on the ChiNext board have been widely anticipated, but nonetheless brought a ripple to A-shares when the news was confirmed April 28, with the Shanghai Composite Index falling some 2% in early trading.

Investors are worried that another registration-based tech-oriented board could siphon money away from the main boards and STAR Market, generating a liquidity shock. This concern seems hardly justified, however, given the ample supply of liquidity from the PBOC and commercial banks.

Some worried that with more registration-based IPOs, companies listed via the approval-based system might face a depreciation of their “listed company” status. But economists including Hong Hao, managing director and chief strategist of BOCOM International, argue that this is intentional and in fact exactly what the registration-based system should do, reducing arbitrage created by the approval based system such as backdoor listings and making the whole process more market-oriented.

Chinese banks look to alternative investments to boost returns

As China’s economy comes back to life, the potential surge in non-performing loans is becoming less of an issue for bankers than concerns that they won’t be able to deliver the returns they promised on asset and wealth management products. Returns on standard investments fell sharply this year; for example, by April 20, the returns on 1 year, 5 year and 10 year Chinese treasury bonds had fallen by more than 100 basis points.

Learning from successful pension investors such as GPFG and CPPIB, Chinese banks are now looking to alternative investments (link in Chinese) for higher returns. Currently, China’s banks tend to increase their exposure to alternative investments via asset management affiliates or external partnerships with securities companies. One of the reasons is that investment professionals in Chinese banks are still relatively unfamiliar with alternative investments, and benefit from some external expertise.

Regulators are also evaluating “side pocket” arrangements for banks’ publicly sold asset management products, a scheme previously reserved primarily for privately placed products. Kong Xiang, a research analyst at Societe Generale, estimates that roughly one-fifth of the 25 trillion yuan in off-balance sheet financing is non-standard assets, presenting a major opportunity for securities companies and others that can help provide investment “outsourcing.”

Weathervane

The National People’s Congress Standing Committee is meeting (link in Chinese) this week, with a combination of in-person and video attendees. The meeting covered quite a wide range of topics with few surprises, mostly pushing draft reforms forward, including amendments and draft laws on solid waste pollution, biosafety, animal epidemic prevention, copyright, and administrative sanctions against public officials accused of wrongdoing.

The meeting also set the date for this year’s Two Sessions, with the National People’s Congress plenary session kicking off on May 22.

More notable was a shift in tone from state-run media in covering the key takeaways from President Xi Jinping’s recent inspection trip to Shaanxi province. Xi did emphasize many of the same points made in the weeks previous, particularly in terms of stimulus for new infrastructure (which we discussed last week) but also made sure not to let anybody forget about old-school infrastructure, state-owned enterprises, and other traditional drivers of the Chinese economy. While much of the policy response up to this point has focused quite intensively on the troubles of small and midsize enterprises, most of which are private companies, Xi’s trip brought larger SOEs back into the spotlight and said on a visit to state-owned Shaanxi Automobile Holdings that “manufacturing is the lifeblood of our economy” and SOEs the “main force” driving economic resumption.

Contact analysts Gavin Cross (gavincross@caixin.com) and Zhang Qizhi (qizhizhang@caixin.com)