Caixin Insight: QFII’s Renaissance, Anxin’s Financial Woes and the Coming of Another Bull Market

QFII’s Renaissance?

After the removal of QFII/RQFII quotas in May 2020, China is now deliberating sweeping reforms to the investment program. In an interview with Caixin, Yi Huiman, head of the China Securities Regulatory Commission (CSRC), said regulators would soon release new QFII/RQFII rules to improve the performance of risk control tools and trading systems.

Established in 2002 and 2011 respectively, QFII and RQFII created a channel for over 400 foreign financial institutions from 31 countries to invest in China’s A-share market. After 2014, however, as China instituted the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect to mobilize cross-border financial services, QFII and RQFII were less favored by foreign investors due to their high investment bar and inflexible settling of accounts. As of the end of the first quarter, only one-third of the foreign-held A-share market belongs to QFII/RQFII, while the rest lies in the Stock Connect services.

In January 2019, China published Measures for the Administration of Domestic Securities and Futures Investment that approved higher quotas and a wider range of investment tools for QFII/RQFII. The move was followed by a complete abolition of QFII/RQFII quotas in May 2020. But as more foreign investors lean towards the Stock Connects, analysts doubt the extent to which the change in quotas might help promote the QFII/RQFII investment channel. Some point out that foreign investors are looking for bolder moves from the Chinese regulators, such as increasing the upper limit of foreign stakes of companies listed in mainland bourses and making QFII/RQFII services more convertible with Stock Connects.

The proposed new changes, soon to be released by CSRC, might be intended to provide just that. Under the new rules, QFII users will be able to invest in more derivatives, including in financial and commodity futures and options, participate in private equity fundraising and bond buyback, as well as expand their reach to other new subsectors,

Some international investors are impressed by the proposed improvements. An investment professional at a British asset manager told us the new rules are “at a different level compared to previous minor fixes,” and with the commitment of all related regulators and facilitations for cross-border fund transfer and settlements, they will bring “a renaissance of the program.”

Others, however, pointed out that more can be done, and some new requirements need to be revised. One of the new requirements from the soon-to-be-released rules mandates that program users must disclose not only their own holdings through the QFII/RQFII program but also the holding status of their clients. This was argued to be an impossible task, and industry associations have also recommended revisions.

Anxin’s Financial Woes

Anxin Trust Co. Ltd, one of China’s most profitable trust companies, was found to have a $7 billion financial hole in April. Anxin’s inability to pay back its debt, along with a recent default of Sichuan Trust that caused hundreds of investors to protest at the company’s headquarter, adds to the woes in China’s trust industry.

Founded by Sichuan native Gao Tianguo in 1987, Anxin has grown to be a $27.5 billion asset behemoth backed by 50 financial institutions and 11,000 individual investors. Among the 68 trust companies in China, Anxin is one of the only two listed on mainland bourses and topped all others with a revenue of $797 million in 2017. Yet the company posted a 96.3% revenue drop in 2018 and had $11.4 billion in unpaid debts at the end of June, believed to be associated with Gao’s misappropriation of funds and illegal guarantees of returns.

According to Anxin employees, most of the funds have been invested in Gao’s own projects, a large part of are in the real estate sector. Gao also promised illegally high returns for several trust plans backed by Shanghai Gorgeous Investment Development, a financing vehicle controlled by himself.

Known as one of the “four carriages” of China’s finance sector, the trust industry has surpassed securities and insurance industries in asset volume, behind only the banking industry. The Anxin Trust fraud has alerted the China Banking and Insurance Regulatory Commission (CBIRC) to regulate China’s 2.8 trillion trust regime. In June, CBIRC ordered several trust companies to halt loan-like businesses, while asking others to reduce the volume of such businesses by no less than 20%, a move that will cut the size of the loan-like business in the trust industry by $142.5 billion. Currently, the regulator hopes to bail out Anxin through a restructuring with a group of companies led by Shanghai Electric.

Economic Data

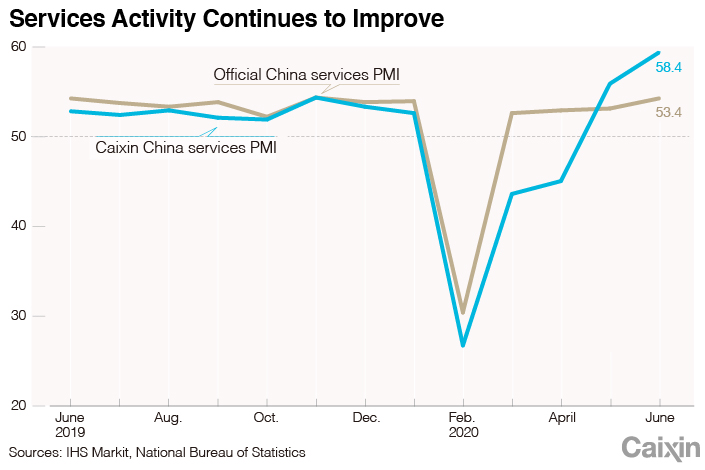

Services activity in China expanded at the quickest pace in over a decade in June as domestic and overseas demand recovered, adding to signs that the country’s economy is continuing to recover from the Covid-19 pandemic.

The Caixin Services PMI rose to 58.4 from 55 the previous month, the fourth monthly increase in a row. The reading was the highest since April 2010.

|

It wasn’t all good news, however. The employment gauge for the services sector remained in negative territory for the fifth straight month, slipping slightly from May. “Employment remained the key problem,” said Wang Zhe, a senior economist at Caixin Insight Group. “Although businesses were optimistic about the economic outlook, they remained cautious about increasing hiring, with employment in both the manufacturing and services sectors shrinking.”

China’s Consumer Price Index (CPI) rose 2.5% in June compared to the same time last year, according to a statement from National Bureau of Statistics on July 9. Food prices exerted a big impact on consumer inflation, as floods in southern China and a new wave of coronavirus in Beijing caused a rise in vegetable prices.

The 2.5% rise in CPI was slightly above the 2.4% gain in May but below the 2.6% prediction by a Caixin poll.

The Producer Price Index (PPI) fell 3% year-on-year, milder than a 3.7% drop in May and slightly lower than the 3.1% prediction.

China’s Stock Market Enters Another Bull

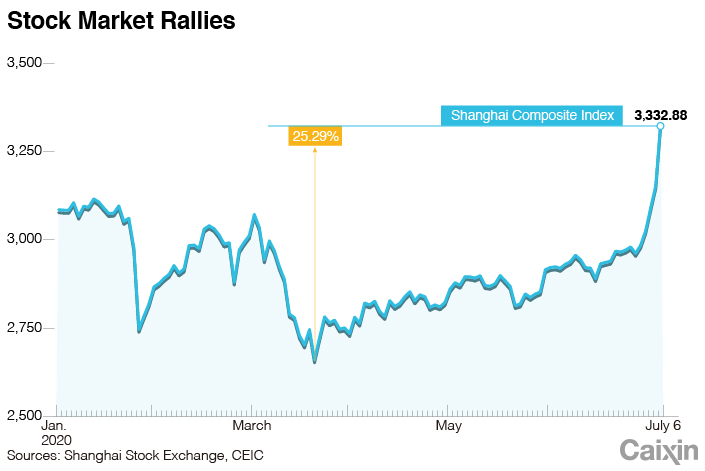

China has officially entered a bull market, with turnover on the Shanghai and Shenzhen stock exchanges reaching nearly 1.57 trillion yuan on Monday, the highest since July 2015 according to data from the bourses.

The benchmark Shanghai Composite Index closed up 5.71% on Monday at 3,332.88, entering technical bull territory, having risen by 25.29% to its highest close since February 2018 from a recent low of 2,660.17 on March 23.

|

“Pundits are attributing the surge to the first cut in a decade in rediscount loan interest rates by the PBOC,” Hong Hao, managing director of Bocom International Holdings Co. Ltd., said in a Sunday note.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas