China Business Digest: Alibaba’s Ant Group Marches Toward Dual Listing; China to Connect Interbank, Exchange Bond Markets

|

|

|

|

Alibaba’s financial affiliate Ant Group said it has formally launched the process to make concurrent IPOs in Hong Kong and Shanghai. Meanwhile, China is linking up its interbank and exchange bond markets. And CATL, its largest electric vehicle battery-maker, has raised about $2.8 billion from investors including UBS and JPMorgan.

— By Mo Yelin (yelinmo@caixin.com)

** TOP STORIES OF THE DAY

BAIC takes over car rental stake from troubled Luckin founder

Ucar Inc., a limousine services company controlled by Luckin founder Lu Zhengyao, will sell its 20.9% stake in Car Inc. to Jiangxi Jinggangshan BAIC Investment Management for as much as HK$1.4 billion ($180.6 million), Car Inc. said Monday in a statement. Jinggangshan BAIC will acquire an additional 171 million Car Inc. shares, or 8%, from U.S. private equity firm Warburg Pincus. The deal settled a month-long battle for ownership of Car Inc. and made the BAIC unit the largest shareholder of the company.

Hong Kong jobless rate jumps to highest in 15 years

Hong Kong’s unemployment rate rose in June to the highest in more than 15 years as the city’s economy remains under pressure from the coronavirus pandemic as well as escalating U.S.-China tensions. The jobless rate rose to 6.2% for the April-to-June period, compared with the median forecast of 6.4% among economists surveyed by Bloomberg.

China to connect interbank, exchange bond markets

China will link up its interbank and exchange bond markets, the central bank announced (link in Chinese) Sunday, bringing together markets that are overseen by different regulators. The move is expected to provide greater liquidity to both markets.

Alibaba’s Ant Group marches toward dual listings in Hong Kong, Shanghai

Ant Group, the financial affiliate of e-commerce giant Alibaba Group Holding Ltd., said Monday it has formally launched the process to make concurrent IPOs in Hong Kong and Shanghai, in what could become the world’s biggest new listing this year.

Ant, whose crown jewel is the Alipay electronic payment service, has been the subject of intense speculation about its plans to make an IPO for years. But last year it completed a restructure that saw Alibaba become its 33% stakeholder, in a long-delayed deal that also relieved it of a major related financial obligation. That cleared the way for the current listing plan.

Chipmaker Cambricon Soars on STAR Market Trading Debut

Shares of artificial intelligence (AI) chipmaker Cambricon Technologies Corp. more than tripled (link in Chinese) in their trading debut on Monday, days after leading contract chipmaker SMIC made a similarly strong IPO, as investors bet on strong state support for China’s homegrown sector.

UBS, JPMorgan fuel biggest Chinese battery-maker’s $2.8 billion fundraising round

Shenzhen-listed Contemporary Amperex Technology Co. Ltd. (CATL) said on Friday it had raised nearly 19.7 billion yuan ($2.8 billion) through a private share placement from a total of nine investors that include global investment banking giants UBS AG and JPMorgan Chase & Co.

Japan reveals 87 projects eligible for ‘China exit’ subsidies

Japan’s Ministry of Economy, Trade and Industry on Friday unveiled the first group of Japanese companies to receive subsidies for shifting manufacturing out of China to Southeast Asia or Japan. Eighty-seven companies or groups will receive a total of 70 billion yen ($653 million) to move production lines, in a bid to reduce Japan’s reliance on its large neighbor and build resilient supply chains.

|

** OTHER STORIES MAKING THE HEADLINES

• Electric-vehicle maker Xpeng Motors raised about $500 million from a group of venture capital investors, showing Chinese startups with promising car models can attract funding even as the industry’s sales slump.

• BlackRock Inc., the world’s biggest money manager, is joining a wave of global investors taking profits in Chinese equities after a historic rally, and plans to shift some of the funds to emerging markets that are in a more nascent stage of recovery.

• China’s top banking regulator is set to slap two commercial banks with more than 100 million yuan ($14.3 million) in fines each, marking the first time it has hit a bank with a penalty that high since early 2018, Caixin has learned.

• The new national security law for Hong Kong won’t impact global banks and other financial institutions or the way they operate their business in the city, Ashley Alder, the chief executive of Hong Kong’s Securities and Futures Commission, said on Sunday (link in Chinese).

• A total of eight securities companies, including Citic Securities Co. Ltd., were put under investigation (link in Chinese) for allegedly predatory behavior – offering extremely low prices – in their bidding to underwrite a 2.1 billion yuan bond-issuance project by a state-owned company.

• TCL Industries, the smart device unit of TCL Technology, plans to expand by acquiring other firms as it eyes annual revenue of 200 billion yuan by 2023, the unit’s CEO Wang Cheng told Caixin (link in Chinese) in an interview.

** ON THE CORONAVIRUS

• Hong Kong saw its highest single-day increase in cases since the pandemic began. In the eight hours between 4 p.m. and midnight on Saturday, the city reported 108 new cases, Chief Executive Carrie Lam announced (link in Chinese) at a press conference on Sunday.

The latest government measures to contain the spread include mandatory mask-wearing in public spaces and a stay-at home order for many of the city’s government workers.

• On Sunday, the Chinese mainland reported 22 new coronavirus cases with symptoms, five of which were imported, according to official data (link in Chinese). The remaining 17 were all locally transmitted cases in the northwestern region of Xinjiang, the country’s latest Covid-19 hotspot.

The government plans to roll out a program to test all residents of the region’s capital of Urumqi, where most of the cases were reported, local health officials announced (link in Chinese) on Saturday.

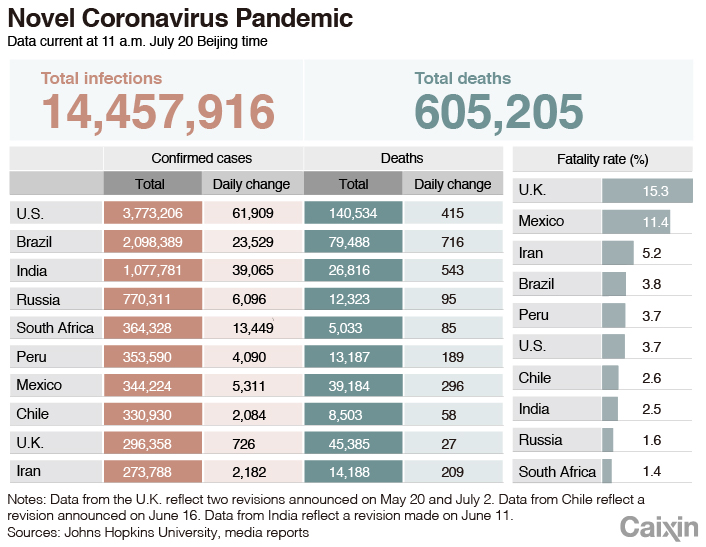

• As of Monday afternoon Beijing time, the number of coronavirus infections globally surpassed 14.5 million, with the death toll passing 606,000, according to data compiled by Johns Hopkins University.

** AND FINALLY

Starting today, movie theaters across China will gradually reopen to the public after months of closure due to the Covid-19 pandemic. Zhejiang Oscar Movie World, a movie theater in the eastern city of Hangzhou, marked the occasion by airing a show right as the clock struck midnight on Sunday evening. The tickets for the 32 available seats sold out quickly after going on sale earlier that day.

|

At 23:14 p.m., all 32 moviegoers were seated and ready to watch the show, “A First Farewell,” a film about Uygur children. |

Contact reporter Mo Yelin (yelinmo@caixin.com) and editor Yang Ge (geyang@caixin.com)