Charts of the Day: China’s STAR Market Becomes an IPO Bonanza

Shanghai’s Nasdaq-style STAR Market, which was set up in part to act as a testing ground for stock market reforms in the country, has become a hotbed for IPOs.

The STAR Market, which was launched in June last year and started trading the next month, cut red tape and eased restrictions for tech-savvy IPO candidates eyeing fundraising for further expansion. In recent years, China has ramped up efforts to shore up its position in the technology sector across the globe.

|

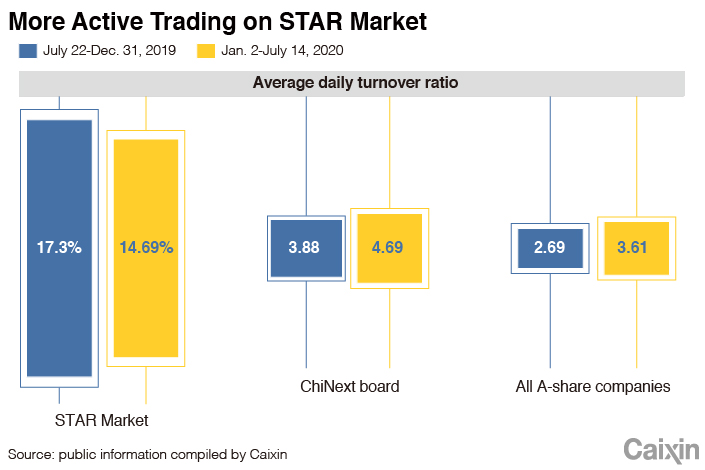

From the start of the year to mid-July, the high-tech board welcomed 54 new listed-companies, far surpassing 36 on Shenzhen’s SME board, 29 on Shanghai’s main board and 17 on Shenzhen’s ChiNext board. During the period, the average daily turnover ratio on the STAR Market was also far higher than any of its peers.

|

The data don’t include the July 16 STAR Market debut of Semiconductor Manufacturing International Corp., the Chinese mainland’s largest IPO in a decade. In another high-profile case, Ant Group, a financial affiliate of e-commerce giant Alibaba Group Holding Ltd., has recently unveiled its plan for a dual listing on the STAR Market and in Hong Kong.

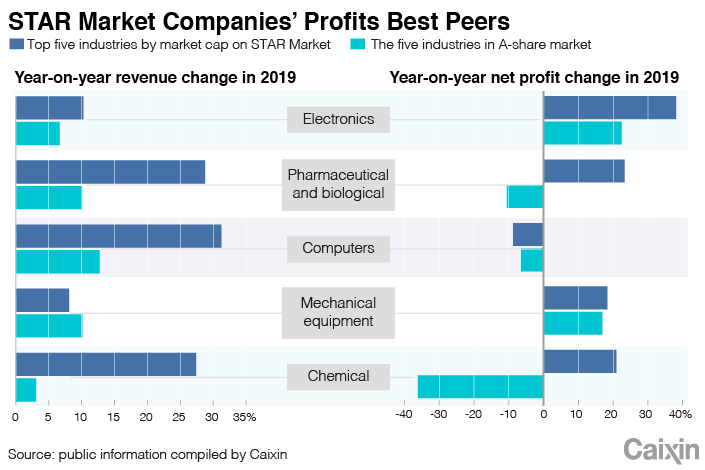

Investors have shown great enthusiasm for the high-tech board’s listings. That enthusiasm has been boosted by the performance of the companies listed there, which has been generally better than that of companies on the other boards. On average, companies in the top five sectors by market cap on the STAR Market reported higher revenue and net profit growth than their peers listed elsewhere on the mainland over the past year.

|

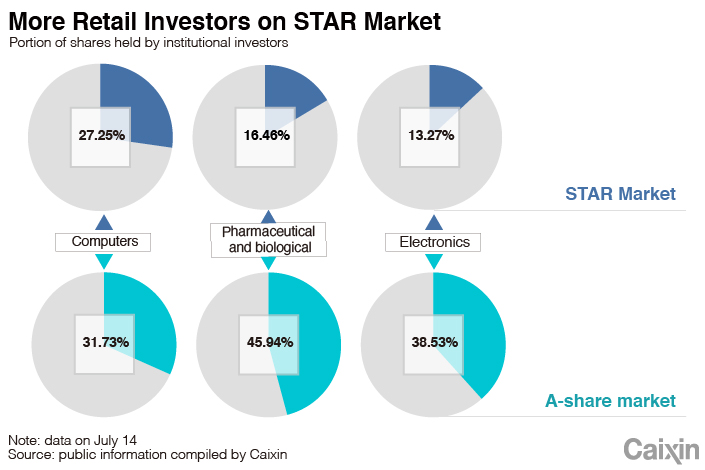

Meanwhile, the high-tech board has a greater proportion of mom-and-pop investors than its peers.

|

Contact reporter Tang Ziyi (ziyitang@caixin.com) and editor Joshua Dummer (joshuadummer@caixin.com)

Caixin Global has launched Caixin CEIC Mobile, the mobile-only version of its world-class macroeconomic data platform.

If you’re using the Caixin app, please click here. If you haven’t downloaded the app, please click here.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas