In Depth: Behind the Bet on China’s Pricey, Technologically Lagging Chipmakers

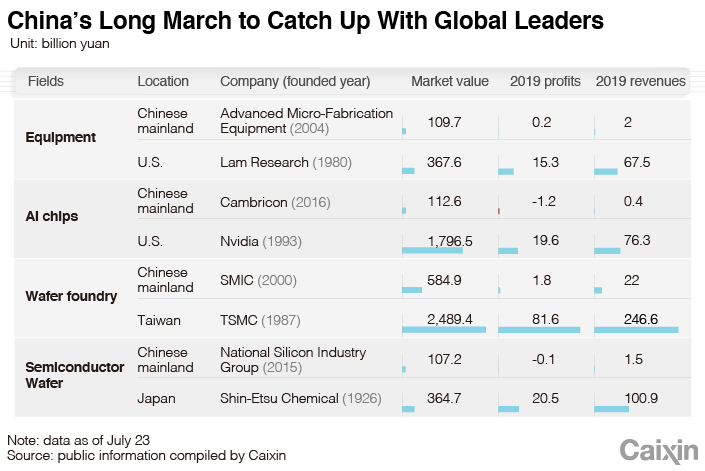

Chinese chip startup Cambricon Technologies Corp. is now worth more than one-third of prominent global chipmaker MediaTek Inc., even though it doesn’t bring in one-hundredth of the latter’s 60 billion yuan ($8.56 billion) in revenue.

National Silicon Industry Group Co. Ltd., a manufacturer and distributor of silicon products, is currently valued nearly four times higher than the industry’s No. 2 player SUMCO Corp., even though the Japanese company holds nearly 25% of the market (National Silicon has less than 3%).

The two companies have both benefited from the mad rush Chinese mainland investors have made into the domestic semiconductor industry, propelling both companies’ valuations to around 100 billion yuan.

|

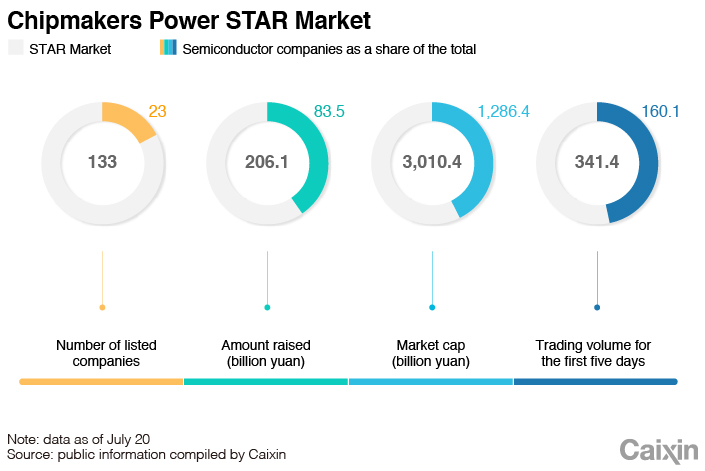

They are far from alone. Earlier this month, the shares of Semiconductor Manufacturing International Corp. (SMIC) tripled from their offering price on their first day trading on Shanghai’s STAR Market, a one-year old board designed with relaxed rules to attract technology companies.

Of the 133 companies listed on the STAR Market, 23 were in the semiconductor industry as of July 20. The combined market cap of these companies accounts for more than 40% of the board’s total, and dozens more are in the pipeline to list.

|

Despite these Panglossian valuations, investors are betting that current industry trends will favor Chinese companies as Beijing has sought to the bolster domestic industry and create new national champions in the face of growing U.S. export restrictions on technology.

The frenzy in the public market, however, could come back to bite investors because the Chinese semiconductor industry remains dependent on U.S. technology, leaving China to play catch-up, industry executives and investors said. Although the market’s embrace has made it easier for Chinese companies to raise money, their current valuations are already so high that there may not be much room left to grow, despite the fact that many are in an early stage of development.

Pricey valuations

Chinese semiconductor companies have done very well in their recent mainland IPOs. National Silicon’s share price rocketed more than tenfold over its offering price in the three months after its shares hit the market in April. Cambricon had a similarly strong debut.

Investors are betting current circumstances favor Chinese semiconductor companies even though they largely lag behind their international competitors in both technology and scale.

Still, simple comparisons between China’s semiconductor upstarts and their global peers may miss the point, said Yin Hong, head of new economy research at China Renaissance Securities. Yin said the market frenzy is partly driven by current political climate — what he called an ongoing technology cold war between China and the U.S.

In 2019, the U.S. banned telecom and smartphone giant Huawei Technologies Co. Ltd. from procuring chips from U.S. suppliers without a U.S. government license, leading the Chinese company to ramp up a years-long effort to design its own chips. This May, the U.S. government announced that it would expand that decision to not only cover Huawei’s U.S. suppliers and other business partners, but any of Huawei’s foreign chipmaking partners whose production lines include U.S.-made equipment. That includes industry leader Taiwan Semiconductor Manufacturing Company (TSMC). Facing the possibility that the U.S. might broaden this measure to include other Chinese companies, China has been pushing to build up its own semiconductor industry.

Cambricon, which was spun off from the Chinese Academy of Sciences in 2016, is still small for a semiconductor company, and it is losing money. It has also suffered a double blow from losing Huawei as a major customer, combined with the economic fallout from the global coronavirus pandemic. After deducting nonrecurring gains and losses, it has estimated a net loss of 270 million yuan to 300 million yuan for the first half, almost triple the figure from the same period in 2019.

On the tech front, SMIC, the mainland’s most advanced contract chip manufacturer, remains at least two generations behind TSMC in chipmaking technology, but you wouldn’t know it from its valuation. With a market cap around 600 billion yuan, SMIC has a price-to-earnings ratio of 300 — around 15 times higher than TSMC’s.

A bet on poaching

Although China’s semiconductor industry pales in comparison to the global heavyweights in terms of size, profitability and stock price value, it does have this advantage: China is a huge semiconductor market dominated by foreign companies.

Mainland investors see that as potential, particularly if Beijing pushes for more companies to begin buying more of their chips from domestic firms to hedge against the possibility of losing access to U.S. technology.

What wonks refer to as a technology “decoupling” between China and the U.S. can be considered a good opportunity for Chinese chipmakers, said Yin of China Renaissance.

Being cut off from TSMC, Huawei has shifted its orders for some less-sophisticated chips to SMIC. Huawei accounted for about 15% of SMIC’s revenues in 2019, according to an executive at a Chinese semiconductor company who is familiar with Huawei’s business. Still, SMIC remains subject to the U.S.’ latest sanctions set forth in the amendment to the rule in May, casting doubt on Huawei’s model of outsourcing its chip manufacturing.

Yin mentioned that investors are currently interested in areas of the domestic market where U.S. companies have a large presence and there are Chinese companies already making competing products.

Calls to use domestically made chips have begun to echo among officials at government agencies and state-owned companies, which generally are not under the same pressure as private companies to buy chips featuring the most cutting-edge technology.

Cambricon is one of the Chinese chipmaker that has benefited from this. Last year, about two-thirds of its 440 million yuan in revenue last year came from two buyers — the government of the southern city of Zhuhai and provincial government of Northwest China’s Shaanxi province.

For most buyers, however, product quality still counts more than political calculations, company executives and investors said. The current U.S. sanctions target a small proportion of companies, and most buyers have not been affected. That means for most of companies, the need to replace their foreign suppliers with domestic ones is still not pressing, said a manager who worked for a consumer tech company.

Contact reporter Mo Yelin (yelinmo@caixin.com) and editor Michael Bellart (michaelbellart@caixin.com)

- MOST POPULAR