Charts of the Day: China’s Marathon Effort to Get Its Currency Used More Overseas

China has made some progress on its drive to increase the use of the yuan, also known as the renminbi (RMB), in cross-border settlement and global markets, but its tiny share means there’s a long way left to go.

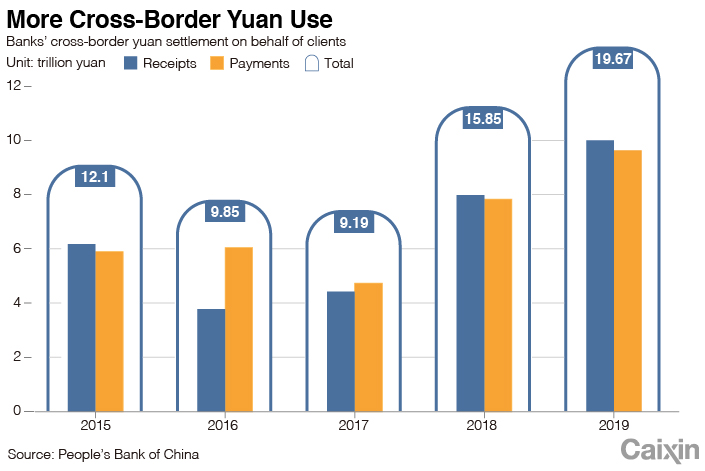

According to a central bank report, banks handled a record 19.67 trillion yuan ($2.83 trillion) in cross-border yuan payments and receipts on behalf of their clients last year, up 24.1% year-on-year and rising 62.6% compared with 2015.

|

“The RMB cross-border settlement maintained a relatively rapid growth, with the share of the cross-border RMB settlement in total cross-border settlement reaching a record high,” the report said. Receipts and payments were basically balanced, with a net inflow of 360.6 billion yuan, it said.

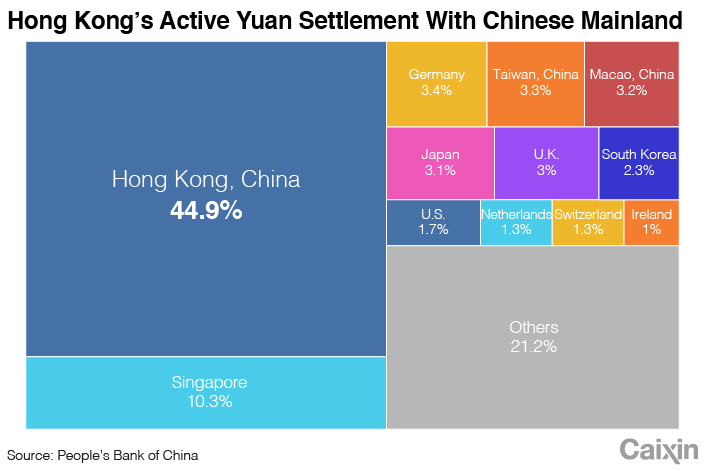

Hong Kong remained the largest offshore yuan market, settling 44.9% of cross-border yuan payments and receipts last year, far beyond runner-up Singapore’s 10.3% share.

|

At the end of 2019, Hong Kong’s yuan deposits came to 632.2 billion yuan, the most of any offshore yuan market and up 2.8% year-on-year.

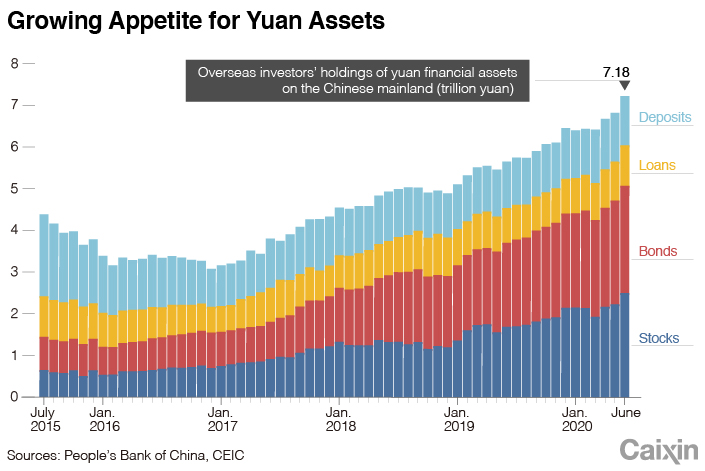

Overseas investors’ appetite for yuan financial assets has been growing. The yuan assets held by foreign institutional and individual investors — including domestic stocks, bonds, loans, and deposits — reached 7.18 trillion yuan at the end of June, up 28.1% from a year earlier, according to People’s Bank of China (PBOC) data.

|

Investors have also become more active in mainland financial markets as they proportionally held more bonds and stocks, while holding fewer deposits. The value of the bonds and stocks held by these investors reached 5 trillion yuan at the end of the first half of 2020, up 37.4% year-on-year and 268.4% over the same period in 2016, while overseas holdings of Chinese domestic deposits dropped 5.6% from four years ago. In China, the definition of overseas investors includes those from Hong Kong, Taiwan and Macao.

Although the yuan’s use in cross-border settlement and the size of overseas investor’s yuan assets have both grown, the currency still has a small share of the global market.

By the end of 2019, yuan assets made up only 1.95% of total foreign-currency reserves held by investors in about 150 economies, ranking fifth, based on data from the International Monetary Fund. The currency also ranked fifth as a global payment currency, with a 1.76% market share.

The PBOC said in the report that it will push forward yuan internationalization by opening up domestic financial markets, developing offshore yuan markets and preventing risks in cross-border capital flow, among other measures. Some analysts suggested that China should make it easier to exchange the yuan for other currencies and further open up capital accounts (link in Chinese).

Tang Ziyi contributed to this report.

Contact reporter Guo Yingzhe (yingzheguo@caixin.com) and editor Joshua Dummer (joshuadummer@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas