Who Will Get Rich or Richer from Ant Group’s $30 Billion IPO?

Chinese fintech giant Ant Group Co. Ltd.’s blockbuster dual listing in Shanghai and Hong Kong will create a group of new billionaires among employees and will make a group of early investors even richer, including Jack Ma and his billionaire friends.

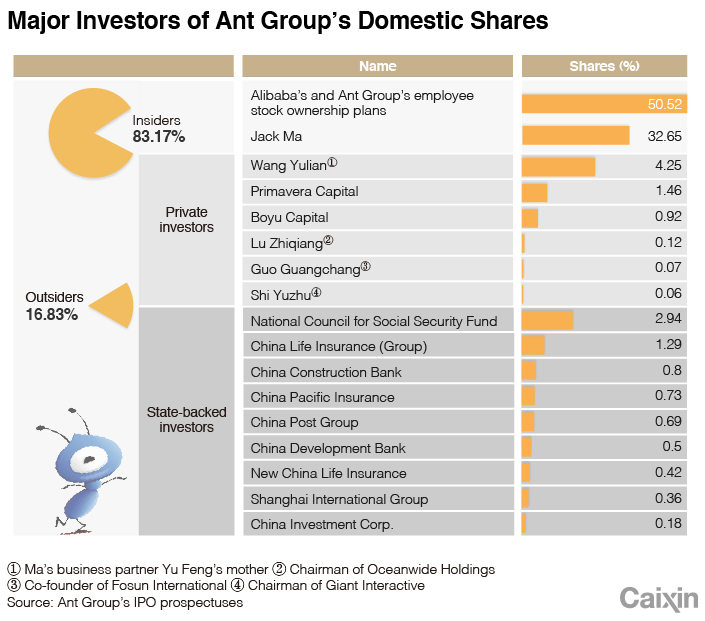

Ant’s initial public offering prospectus unveiled a complex shareholding structure and a long list of more than 70 outside shareholders, showing how coveted the world’s highest-valued fintech company is by private and state-backed investors.

The value of the shareholders’ stakes is still to be determined as Ant has not disclosed the size or price of the offering. But sources with knowledge of the listing told Caixin the company is looking to raise around $30 billion. That might make it the world’s largest IPO, surpassing Saudi Arabian oil giant Saudi Aramco’s $29.4 billion IPO about half a year ago.

Some analysts said the IPO could value the company as high as $220 billion, a significant premium over the values when early investors bought in. When the National Council for Social Security Fund invested in Ant’s Series A round of financing in 2015, the company was valued at $45 billion. Three years later, when investors ploughed $14 billion into Ant’s last major fundraising, the company was valued at $150 billion.

If Ant hits an overall valuation of $220 billion, a 1% stake would be worth $2.2 billion.

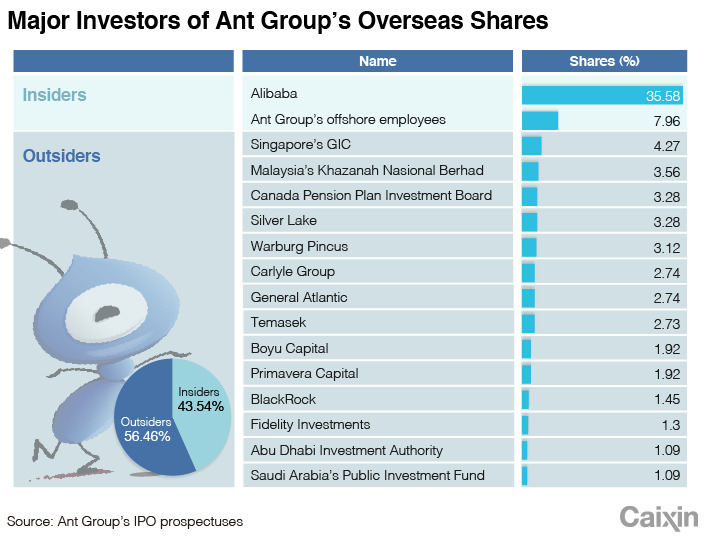

All domestic investors hold Class A ordinary shares with one vote per share, while foreign investors hold Class B and C shares with no voting rights. After Ant goes public, Class B and C shares will be convertible into Ordinary H shares, with one vote per share.

|

Alibaba Group Holding, controlled by co-founder Jack Ma, owns 32.65% of Ant’s Class A shares, while two employee holding partnerships together own 50.52%. Through Class B shares, Ant’s offshore employees hold about 8% of the company’s overseas shares. Through Class C shares, Alibaba and foreign investors hold the rest of the overseas shares, according the prospectus.

Read more

Cover Story: How Ant Grew Into an Elephant-Sized Behemoth

Among domestic investors, billionaire entrepreneur Guo Guangchang, co-founder of Fosun International Ltd., holds 0.07% of Ant’s Class A shares; Shi Yuzhu, chairman of online game developer Giant Interactive, holds 0.06%; and Lu Zhiqiang, chairman of property developer Oceanwide Holdings, holds 0.12%.

Ma’s close friend and investment partner David Yu, also known as Yu Feng, holds 3.01% of Ant’s overseas shares through the company’s third round of financing. Yu’s mother also controls multiple investment platforms that own 4.25% of Ant’s Class A shares.

Investors behind these platforms cover almost every part of Chinese private enterprise. They include Joincare Pharmaceutical Group Vice Chairman Liu Guangxia, Chinese movie mogul Wang Zhongjun, small kitchen appliance maker Joyoung Group Chairman Wang Xuning, agricultural conglomerate New Hope Group Chairman Liu Yonghao, and property developer Kingkey Group founder Chen Hua’s son Chen Jiarong.

Others are department store chain operator Intime Retail Group founder Shen Guojun, household appliance maker Midea Group Chairman Fang Hongbo, express delivery company STO Express Co. Chairman Chen Dejun, medical device maker Mindray Chairman Xu Hang, clothing brand Septwolves Vice Chairman Zhou Shaoming, furniture maker JSWB Corp. Chairman Zou Wenlong and Minsheng Securities Chairman Feng Henian.

Ant has also attracted many state-backed institutional investors, including the National Council for Social Security Fund, which got a 20% discount in Ant’s Series A round of financing in 2015 for a 4.4% stake. Sovereign wealth fund China Investment Corp. took a 3% stake in series B financing. Other state-owned investors include China Construction Bank, China Development Bank, China Post Group, China Life Insurance Co., Shanghai International Group, China Pacific Insurance Co and New China Life Insurance.

Another notable private investor is Chinese private equity firm Boyu Capital, founded by Alvin Jiang, also known by his Chinese name Jiang Zhicheng. He is the grandson of former Chinese President Jiang Zemin.

|

The list of overseas investors is also filled with prestigious names, including Hong Kong tycoon Li Ka-shing, Hong Kong’s former Chief Executive Tung Chee-hwa and members of his family, the billionaire Mulliez department-store family of France, Thai conglomerate Charoen Pokphand Group and Taiwan insurance giant Nan Shan Life Insurance Co. Ltd. Vice Chairman Yin Chung-yao.

Li Ka-shing, through his two flagships, CK Asset Holdings and CK Hutchison Holdings, owns about 0.54% of Ant’s class C shares. Tung Chee-hwa’s three children together hold 0.05% of Ant’s class C shares.

Some of the world’s biggest sovereign wealth funds as well as pension and education investment funds are among foreign institutional investors. Singapore’s sovereign wealth fund GIC owns a 4.27% stake; Singapore government investment firm Temasek, 2.73%; Malaysia’s sovereign wealth fund Khazanah Nasional Berhad, 3.56%; United Arab Emirates sovereign wealth fund Abu Dhabi Investment Authority and Saudi Arabia’s sovereign wealth fund Public Investment Fund, 1.09% each; the Canada Pension Plan Investment Board, 3.28%; and the board of the University of California, 0.55%.

A number of current and former management members of U.S. private equity fund KKR used personal funds to participate in Ant’s Series C fundraising in their own names, together holding 0.19% of class C shares.

Other well-known foreign institutional investors include BlackRock, Fidelity, the Carlyle Group, Sequoia Capital, Warburg Pincus LLC, Silver Lake, General Atlantic and Credit Suisse.

Luo Meihan contributed to this report.

Contact reporter Denise Jia (huijuanjia@caixin.com) and editor Bob Simison (bobsimison@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.