Chinese Airlines’ First-Half Losses Show They Can’t Shake Coronavirus Fallout

China’s major airlines nursed huge losses in the first half of this year as revenues plummeted due to the coronavirus pandemic, though narrowing losses in the second quarter indicated the battered industry had managed to stem the bleeding.

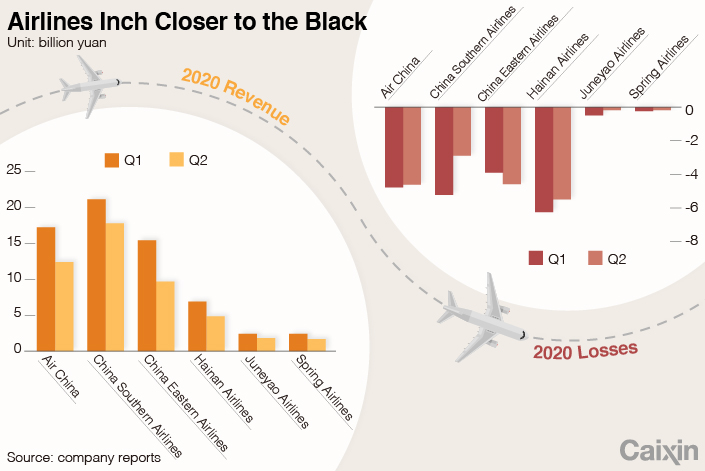

The three largest state-owned airlines — Air China Ltd., China Eastern Airlines Co. Ltd., and China Southern Airlines Co. Ltd. — reported a combined loss of 26.1 billion yuan ($3.8 billion) in the first half, according to Caixin calculations based on the airlines’ first-half earnings statements.

Zoom out and the losses get worse. The combined first-half net loss of six of China’s biggest airlines, consisting of the three state-owned majors plus Hainan Airlines, Spring Airlines Co. Ltd. and Juneyao Airlines Col Ltd., came in at 39 billion yuan. The figure is two and a half times more than their combined profits in all of 2019.

China’s biggest privately owned airline carrier, Hainan Airlines was the hardest hit, reporting a half-year loss of 11.8 billion yuan, followed by Air China, which posted a 9.4 billion yuan loss. Altogether, China’s airlines suffered a combined loss of 74.1 billion yuan in the first six months of this year.

“The first half of 2020 was extremely exceptional. The grave situation, huge challenges and the hardship in obtaining the current results during the half year were all unprecedented,” Air China said in a statement with its interim results.

Although China has more or less contained its coronavirus epidemic, its people have been reluctant to return to the skies. The number of passengers who flew on commercial airlines in the first half fell 54.2% from the same period last year to 150 million, according to data from the Civil Aviation Administration of China (CAAC).

Comparing the results between the first and second quarters, two major trends emerged.

First, all six of the airlines saw their revenue declines accelerate from the first to the second quarter as their international flight businesses ground nearly to a halt when countries around the world struggled to contain the pandemic with stricter restrictions on incoming travelers.

|

China Eastern’s revenue plunged 66.33% year-on-year in the second quarter to 9.68 billion yuan, accelerating from a 48.58% decline in the first quarter. Likewise, Shanghai-based Spring Airlines’ revenue fell 52.66% year-on-year, faster than the 34.5% drop in the previous quarter.

On March 29, the CAAC issued a policy limiting all airlines, regardless of where they are based, to one flight per week for each country they fly to. That led to the suspension of 90% of Chinese airlines’ international routes until June, when China eased up on the restrictions.

The reduction in international flights, along with falling ticket prices for domestic flights, choked off the airlines’ cash flow, according to a report published Sunday by Northeast Securities.

At the same time, five of the six listed airlines saw quarterly losses narrow during the second quarter as they took measures to acclimate themselves to a post-coronavirus market, such as cutting routes. The six airlines’ combined net loss narrowed 10% from the first quarter to the second quarter, when it came in at 34.25 billion yuan.

Shanghai-based Juneyao Airlines reported a second quarter loss of 184 million yuan, down from 491million yuan in the first quarter, according to Caixin calculations based on the company’s reports.

Shanghai-based China Eastern was the one exception. Its net loss swelled to 4.6 billion yuan in the second quarter, 17% higher than its 3.9 billion yuan loss in the first quarter.

Three months into the second half of 2020, China’s largest airlines are bracing themselves for greater uncertainty and more challenges. “As the pandemic continues to spread overseas, and local outbreaks have occurred in some areas in China, the impact of the pandemic on the civil aviation industry is expected to continue,” Southern China said in its interim financial report.

Contact editor Michael Bellart (michaelbellart@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.