Update: China Moves to Ease Foreign Access to $15.4 Trillion Bond Market

China’s top financial regulators unveiled new draft rules to make it easier for foreign investors to access the country’s $15.4 trillion bond market in a further effort to open up and bolster domestic financial markets.

The draft rules would simplify application procedures for foreign bond investors and unify rules governing various investment channels, according to a set of draft regulations (link in Chinese) issued Wednesday by China’s central bank, foreign exchange regulator and securities watchdog.

The rules are aimed at making it easier for overseas institutional investors to invest in yuan-denominated bonds, the People’s Bank of China said on its website.

The draft regulations mark an important step in China’s long-pursued strategy of opening the domestic bond market, the world’s second-largest, more widely to foreign investors. Regulators are collecting public comments on the draft rules until Oct. 1.

Currently, foreign investors can invest in China’s two bond markets — interbank and exchange markets — through three main channels: the Qualified Foreign Institutional Investor program and its sibling, the RMB Qualified Foreign Institutional Investor program — widely known as QFII and RQFII; the Bond Connect program linking Chinese mainland and Hong Kong markets; and directly investing in China’s interbank bond market. These channels are regulated by different authorities and have different requirements for applicants.

Only investors in the QFII and RQFII channel can invest in both bond markets, while investors in the other two channels can only invest in the interbank market.

The draft rules said that foreign investors already in the interbank bond market through the other two channels would be allowed to buy and sell exchange-traded bonds without additional approval.

In addition, the rules would streamline procedures for foreign investors to invest in the interbank bond market. Under the current single-tier custody system, foreign investors who directly invest in the market have to open accounts under their own names in China’s central depositary, which some say can lead to low efficiency and high costs. Under a multitier custody structure introduced by the draft rules, however, the investors would be allowed to open accounts through overseas custodians, who then appoint mainland custodians for account handling.

The multitier custody structure, which had applied to the Bond Connect program, is more in line with international standards, the draft rules said.

Besides, the rules said foreign institutional investors and their custodians would no longer need to obtain regulatory approval for products investing in Chinese bonds on a case-by-case basis. Also, they would be allowed to trade bond derivatives and funds, including exchange-traded bond funds.

The new system will give more options and greater convenience for foreign institutional investors trading in China’s onshore bond market, said an official at bond clearing house China Central Depository and Clearing Co. Ltd. (CCDC).

Chinese regulators in recent years have stepped up efforts to restructure the domestic bond market to lure more foreign funds. In July, regulators moved to unify the country’s fragmented interbank and exchange bond markets to make the market more attractive to overseas investors.

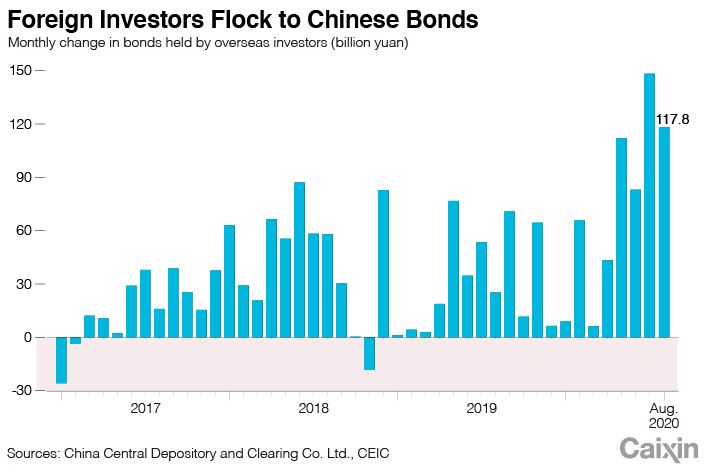

In recent months, foreign investors have shown growing enthusiasm for Chinese bonds partly due to a stronger yuan and a wider gap between the yields of Chinese and U.S. bonds in general, analysts said.

|

In July, the net inflow of overseas funds into onshore bonds for which CCDC provided custodial services reached about 148.1 billion yuan ($21.3 billion), the highest since the data set was made available in mid-2014, according to CCDC data. In August, the net inflow stood at 117.8 billion yuan (link in Chinese), marking the 21st consecutive month of net purchases.

By the end of June, the outstanding value of foreign holdings of onshore bonds reached $369 billion, up 13.7% from the end of 2019 and triple the value at the end of 2016, official data showed. Still, the share remained less than 3% of the market.

Timmy Shen contributed to the story.

Contact reporter Han Wei (weihan@caixin.com) and editors Bob Simison (bobsimison@caixin.com) and Michael Bellart (michaelbellart@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

- PODCAST

- MOST POPULAR