Caixin Insight: Xi Tells Reform Pioneer City to Do More Reform

Shenzhen reform plan

The 40th anniversary of the Shenzhen special economic zone has brought the biggest policy news of the week by far, with a major new reform plan and high-profile speech from Xi.

On Wednesday, President Xi Jinping urged the city of Shenzhen, China’s pioneer of reform and opening-up in the southern Guangdong province, to take the lead in advancing the country’s reform agenda with “greater political courage and wisdom” amid “unprecedented challenges” including pressures of global competition for technology and talent.

His remarks followed a plan (link in Chinese) published Monday by the Party Central Committee and State Council, the “Implementation Plan of Comprehensive Reform for Shenzhen to Build a Pilot Demonstration Zone for Socialism with Chinese Characteristics (2020-2025).”

As outlined in a set of related Opinions last year, the plan takes a list-based approach in which the city can apply to the central government for authorization of reforms in batches, offering the city a great deal of autonomy to manage its own agenda, including in key areas such as factor markets (especially land) and improvements to the business environment.

The plan is hoped to generate some breakthroughs in those areas that could later be rolled out nationwide, particularly amid the current focus on China’s domestic market.

On land:

- the plan is meant to “explore and solve the problems of planning adjustment, land supply, income distribution and historical land use problems”

- Shenzhen is famously limited by its land supply, posing a range of problems including shortage of housing as well as health care and education

- approval for conversion of agricultural land to construction land (other than permanent basic farmland) will be entrusted to the Shenzhen municipal government for approval

- this level of autonomy is unprecedented, even for SEZs

- with more flexible approval of construction land, Shenzhen could revitalize its economy and better allocate existing land resources

Peng Peng, executive director of the Guangdong province branch of the China Society of Economic Reform and a senior research fellow at the Guangzhou Academy of Social Sciences, commented:

“This is really big news, but I hope that when it comes to real operation, the state can further authorize it and incorporate it into the SEZ legislation, so that Shenzhen can really get ahead of the curve, because production factors are very important; doing a good job could revitalize the wider economy.”

The plan also has a heavy emphasis on regional coordination, calling for Guangdong province to “actively create conditions for Shenzhen to carry out comprehensive reform pilot projects,” and “give Shenzhen more provincial-level economic and social management powers.”

The second primary focal point is market opening, including:

- a list of special measures to be drawn up for Shenzhen to relax market access, including for normally restricted areas such as energy, telecommunications, public utilities, transportation and education

- further relax restrictions on foreign investment in cutting-edge technology

-“an internationally competitive talent recruitment system” exploring ways to optimize the approval process for work permits and work-related residence permits for foreigners

Robust trade growth as global economy reopens

China’s exports grew by 9.9% year-on-year in dollar terms to $239.8 billion last month, up from 9.5% growth in August, marking the fastest expansion since March 2019, according to data (link in Chinese) from the General Administration of Customs. The robust growth was backed by a lower base in 2019 caused by the U.S. trade war, as well as rising manufacturing activity and a recovery in external demand as more economies lift their coronavirus restrictions.

Exports were broadly driven by pandemic-related products, including medical supplies and “stay-at-home”items. Exports of textiles (including face masks) and medical equipment grew 35% and 31% in September, respectively. That was slower than in August, but still well above average. Electric machinery also edged up in terms of its share of the total export value. Strong demand from the U.S. and emerging markets illustrated the accelerating global economic recovery.

China’s imports surged 13.2% year-on-year in September, dramatically outpacing the median expectation of 0.7% growth in a Caixin survey of economists and reversing a 2.1% decline the previous month, marking the highest growth since December. Notably, raw materials and other industrial inputs were the greatest contributors to growth, indicating strong momentum in domestic industrial production, according to Wang Dan, chief economist with Hang Seng Bank China.

|

Looking ahead, China’s exports may continue to benefit from the global growth recovery, albeit at a slower pace considering the resurgence of new Covid-19 cases. Meanwhile, recovery in imports is also expected to continue in the fourth quarter, albeit less dramatically than in September, given an expected slower acceleration of GDP growth recovery in fourth quarter, according to Wang Tao, head of Asia economics and chief China economist at UBS Investment Bank.

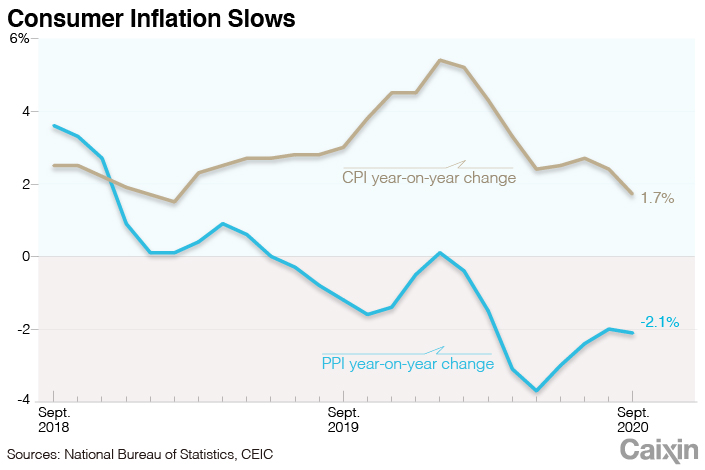

CPI and PPI digest

China’s CPI rose 1.7% year-on-year last month, slowing from 2.4% growth in August due to a high base and moderating pork and vegetable prices.

Food prices rose 7.9% year-on-year in September, down from 11.2% in August. The fall in CPI was mainly led by a continuous decline in pork price inflation, which eased to 25.5% in September from 52.6% year-on-year growth in August. Dong Lijuan, a senior NBS statistician, said (link in Chinese) that pork price inflation eased as hog production recovered.

Core CPI — which excludes more-volatile food and energy prices and may better reflect long-term inflation trends — remained unchanged at a low level of 0.5% year-on-year in September. “The rebound in core consumer price inflation will still leave it relatively subdued and food price inflation looks set to drop back further in the near-term as pork supply continues to recover,” economists at research firm Capital Economics Ltd. said in a note released Thursday.

|

On the production side, PPI fell 2.1% year-on-year in September, slightly steeper than the 2% drop in August, due to cheap oil. However, prices of coal, iron and cement rebounded, and the prices of industrial products continued to rise, indicating that industrial demand continues to recover.

PBOC cuts FX risk reserve ratio to zero

On Saturday, China’ s central bank announced (link in Chinese) that it would lower the foreign exchange risk reserve ratio for forward forex trading from 20% to zero, effective the following Monday. The move came after the onshore spot yuan rate ended at a 17-month high against the dollar on Oct. 9, its biggest one-day percentage gain since 2005.

The People’s Bank of China (PBOC) initially announced inclusion of banks’ FX forward sales in its macro-prudential policy framework after the ’8.11’ yuan exchange rate reform in 2015. It’s generally believed that adjustments of the foreign exchange risk reserve ratio provide a signal of regulators’ attitudes.

The PBOC’s move could be interpreted as telling the market that it hopes to stabilize the currency and does not want the yuan to appreciate further. Looking back at three similar adjustments in September 2015, September 2017 and August 2018, they did help to mitigate the risk of exchange rate fluctuations in the short term. But in the long run, exchange rate trends are of course still a function of economic fundamentals.

However, this most recent adjustment might not have much effect even in the short-term. Analysts see it as “a small technical adjustment,” and believe that China’s yuan will continue to rally despite the central bank’s moves to curb its strength. Peter Chia, senior foreign exchange strategist at United Overseas Bank, said that as long as the “bigger macro factors” weighing down the U.S. dollar remain, it could weaken further against the yuan.

Contact analysts Li Huizi (huizili@caixin.com) and Gavin Cross (gavincross@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas