After Landlords and Tenants Demand Cash From Rental Giant, Workers Join the Fray

Besieged online rental giant Danke Apartment could be facing a new source of pain, with employees telling Caixin they plan to take the company to court over unpaid wages.

With a business model based on rental arbitrage that has been compared to WeWork, the money-losing firm is accused of failing to make monthly and quarterly payments to the landlords from whom it rents properties, even after it encouraged tenants to pay rent up front using long-term loans from a partner bank, and invested the difference.

The upshot, according to security staff at Danke’s Beijing headquarters, is that some 300 disgruntled landlords and tenants have been showing up each day demanding overdue rent, refunds and compensation.

Compounding matters, an employee at the company’s Chengdu branch says they have not been paid since October, and that the local office has closed.

The employee told Caixin staff were asked to sign a notice of termination saying they had no dispute with the company, which they said was not true. Several colleagues are now preparing to file arbitration, the person said.

It comes as landlords continue to try to evict their tenants by cutting off electricity and water or changing the locks on their apartments. One tenant renting a Danke apartment in Beijing’s Chaoyang district told Caixin the landlord had removed the apartment’s front door one night in an attempted eviction, despite police on the scene advising the landlord not to.

One landlord who visited Danke headquarters on Nov. 27 told Caixin that people had to queue to get a position on the complaint registration waitlist. Local governments and Danke have jointly set up 35 registration stations across the 12 districts in Beijing for people to list their issues.

|

Never made a profit

Shares of Phoenix Tree Holding Ltd., the operator of Danke that listed on the New York Stock Exchange in January, have fallen about 75% since then. They closed at $3.39 on Tuesday.

Danke – which manages some 415,000 flats across 13 big cities in China – has been preserving its cash reserves by asking tenants to apply for loans from Tencent-backed Shenzhen-based WeBank to pay one-year rentals upfront. It then uses tranches of money from the bank to pay the landlords on a monthly or quarterly basis.

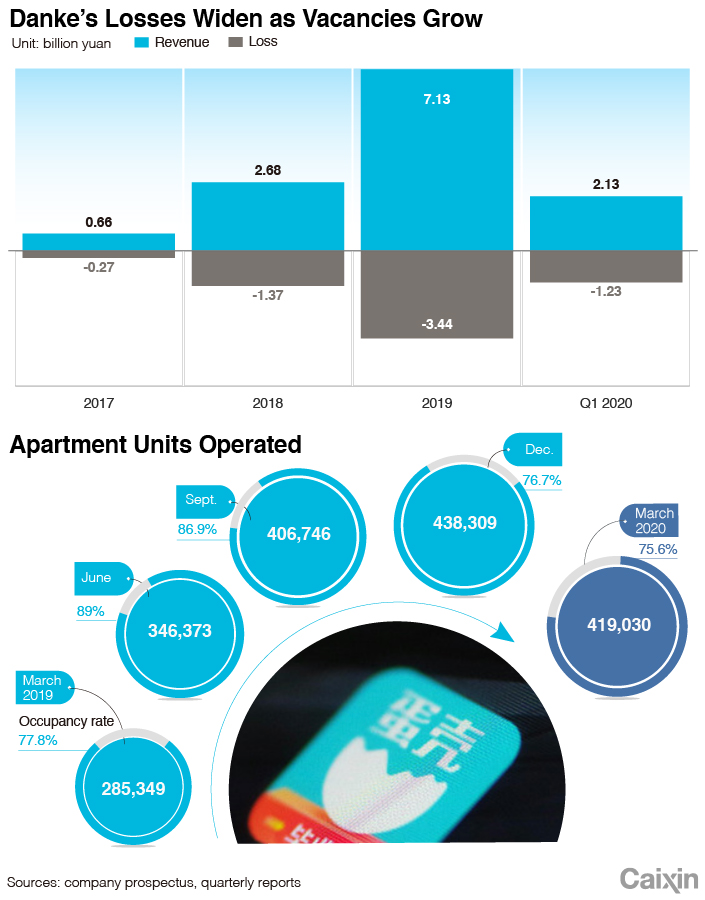

But this business model has not helped Danke turn a profit since its launch in 2015. In contrast, the cash-strapped company has seen its annual losses balloon over the years, from 271.5 million yuan ($41.3 million) in 2017, to 1.37 billion yuan in 2018, then to 3.44 billion yuan last year.

The company posted a loss of $174.3 million in the first quarter, a 51% jump it attributed to the adverse impact of the pandemic. The diminished market demand for house rentals during has added pressure to the company’s cash pool which is needed for apartment furnishing and maintenance.

Many of the unpaid landlords have terminated their contracts with Danke and evicted tenants, some of whom now find themselves homeless and having to repay initial rental loans. Around 66% of tenants were on such loans last year, compared to 91.3% in 2017, according to the company prospectus in January.

The company accelerated the expansion of its house rental business last year in preparation for its Wall Street listing. Multiple landlords who signed a commission agreement with Danke in 2019 said the company was paying more in rentals than they charged the tenants. The number of apartment units it managed had increased nearly 50% year-on-year as of March 31, and its operating expenses, including renovation and decoration fees, grew 58.5% year-on-year in the first quarter.

Tencent-backed digital lender WeBank, Danke’s partner bank, said in a statement last month that it would help tenants resolve their loan disputes, and that their credit scores would not be affected until at least the end of March.

Contact reporter Anniek Bao (yunxinbao@caixin.com), and editor Flynn Murphy (flynnmurphy@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

- PODCAST

- MOST POPULAR