Logistics Outshines Rest of Asia-Pacific Property Market, PwC Report Says

Logistics will probably be the only asset class in the Asia-Pacific property sector to become stronger in the wake of the Covid-19 pandemic, according to a new report.

In the region, transaction volume in logistics facilities rose 15% year-on-year in the first nine months of the year, while that for offices and retail properties dropped 38% and 53%, according to a report that cited data from property research firm Real Capital Analytics Inc. as saying.

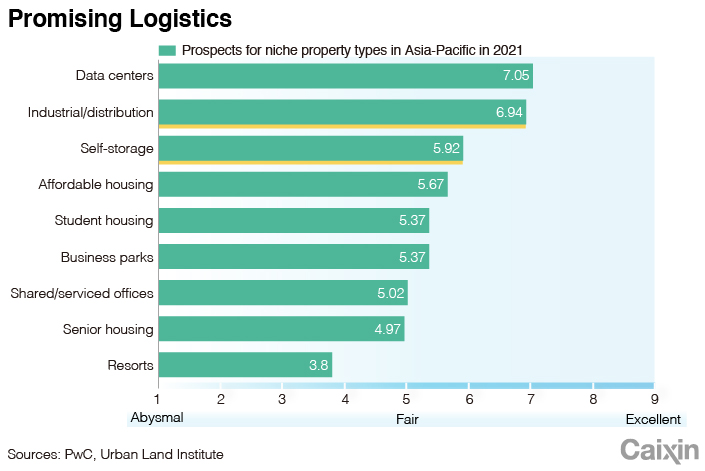

In the first half-year, investment funds raised nearly $7 billion in new capital for logistics projects in the Asia-Pacific region, more than half the total raised for investment in the region’s entire property sector, according to the report from consultancy PricewaterhouseCoopers LLP (PwC) and U.S.-based research body Urban Land Institute.

|

The figures show how logistics facilities are moving from being noncore assets in the property sector to a kind of core assets. Demand for the facilities in the region was already high pre-Covid due to “longstanding structural undersupply and a number of cyclical and secular drivers,” the report said, adding that the e-commerce boom caused by the pandemic accelerated logistics demand.

Demand was also stimulated as the pandemic “exposed the shortcomings of the modern ‘just-in-time’ supply chains,” the report said. While this supply chain model seeks to minimize the size of manufacturers’ inventories of components, disruption to factory production and distribution amid the pandemic has led to shortages and a subsequent push by manufacturers to increase their stockpiles.

While the PwC report didn’t define logistics, a report on the sector in June 2019 from Ping An Securities Co. Ltd. defined the real estate asset as covering storage and distribution centers. Major players in the market include logistics real estate developers, traditional property enterprises and e-commerce enterprises, it added.

Many analysts are upbeat about logistics facilities’ prospects in China given the huge market and relatively high returns. Demand in the country for high-end logistics facilities continues to rise and the supply shortage is widening, Ping An analysts said in the report. High-quality facilities only account for 5% of the total, they said.

The average return on investment in logistics projects in China’s most developed cities — namely the four tier-one cities including Beijing and Shanghai — is 6.5%, higher than the 4% to 5% rate of return for commercial real estate projects and 2% to 3% for residential ones, an analyst at Founder Securities Co. Ltd. said in a report last month.

Chinese logistics real estate enterprises have developed rapidly in recent years. But the biggest player was still foreign-invested Global Logistic Properties Ltd., which held 35.4% of market share as of 2018 and is now known as GLP Pte. Ltd., according to the Ping An report.

Contact reporter Guo Yingzhe (yingzheguo@caixin.com) and editor Joshua Dummer (joshuadummer@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

- MOST POPULAR