Charts of the Day: China’s Developers Should Expect Fewer Sales in 2021

China’s real estate developers are expected to sell fewer square meters of property next year, analysts said, as the industry faces a tougher financing environment with regulators maintaining a tight grip on the industry.

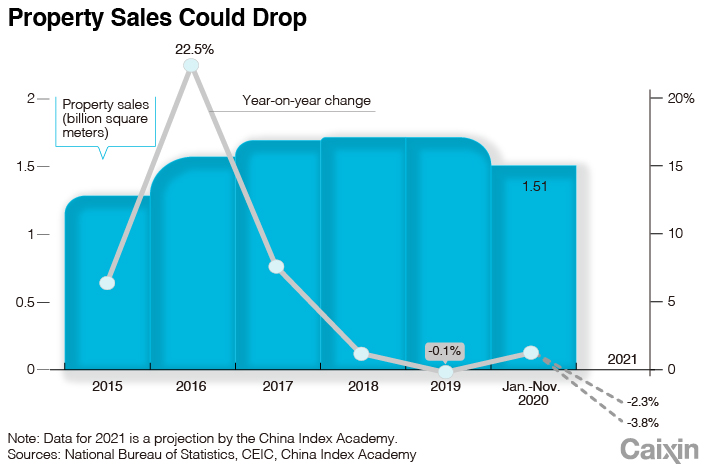

Property sales by area are expected to slip between 2.3% and 3.8% in 2021 to between 1.65 billion and 1.68 billion square meters, according to Huang Yu, an official at China Index Academy Ltd., a property research firm. “By floor space, property sales are expected to hit a record high this year, but may decline next year,” Huang said in a speech to a meeting in the southern metropolis of Shenzhen last week.

In the first 11 months of the year, property sales rose 1.3% year-on-year to 1.5 billion square meters, according to data (link in Chinese) from the National Bureau of Statistics (NBS). The previous full-year record was in 2018, when total floor space sold hit 1.7 billion square meters.

According to the NBS, the property includes residential housing, commercial property and offices.

|

The tightened financing environment for the industry will be a headwind for sales, some analysts said. Sales will be subdued as regulators implement prudent financing policies in an effort to keep the industry’s debts under control, Huang said.

This year, financial regulators have warned more than once about the threat that the real estate industry poses to China’s financial system given the large amount of leverage carried by both developers and buyers. Regulators have tightened their grip over the industry to rein in leverage and speculation.

Some residents of small and midsize cities may be less willing to buy homes next year as they expect the price increase to be modest amid the tightened oversight, analysts at Ping An Securities Co. Ltd. said in a report last week.

Read more

Developers Face New Debt Limits as Property Crackdown Continues

China Index Academy does not expect the value of property sales to fall next year, citing solid sales in large cities, among other factors. A report (link in Chinese) by the firm forecasts a 3.9% to 5.4% increase in the average property price for 2021.

Sales revenue will become more important for developers as they are set to face tighter limitations in terms of adding to their debts, the Ping An analysts said.

In August, regulators drew “three red lines” with regard to the finances of the country’s 12 top real estate firms, which are widely expected to apply to other developers when the time is ripe.

|

Many property developers are already working to reduce their leverage. At the end of September, the overall net debt-to-equity ratio of 130 Chinese mainland-listed real estate companies fell to 90.9% from 99.7% a year earlier, an analyst at the research arm of brokerage Shenwan Hongyuan Securities Co. Ltd. wrote in a report issued last month.

Contact reporter Guo Yingzhe (yingzheguo@caixin.com) and editor Michael Bellart (michaelbellart@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

- PODCAST

- MOST POPULAR