Charts of the Day: Pandemic Brings Chinese Luxury Shoppers Back Home

While 2020 is a year most luxury brands would rather forget, one of the few relatively bright spots in the market has been China. Much of the consumer world that buys brands like Gucci and Coach has remained in some state of lockdown for most of the year as local governments try to halt the spread of the Covid-19 pandemic.

But China has been one of the few major exceptions, with most stores open under nearly normal conditions in the second half of the year as the country bought its outbreak under control. Not surprisingly, even the wave of second-half buying wasn’t enough to salvage the year as Chinese mainland consumers are expected to spend about a third less on luxury goods this year than they did in 2019, according to new report by Bain & Co. and the luxury division of e-commerce giant Alibaba Group Holding Ltd.

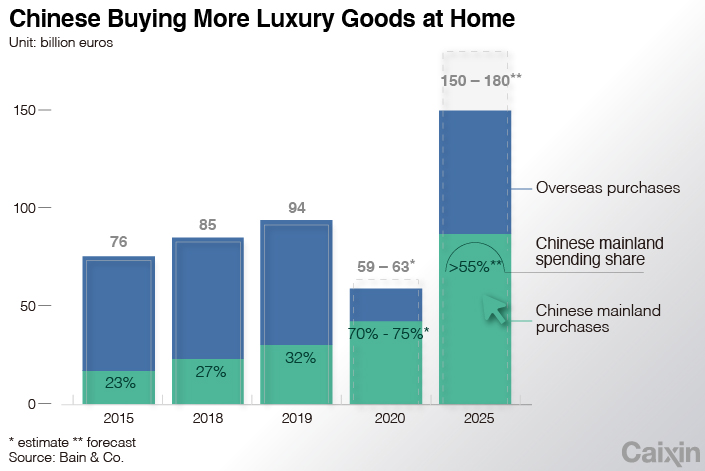

One of the biggest trends for the year was a major shift in where mainlanders buy their luxury goods, as international travel ground to a near standstill starting in March and April. Before the pandemic, Chinese did about two-thirds of their luxury goods shopping abroad to take advantage of lower prices. But that proportion flip-flopped under Covid-19.

|

“The domestic sale of luxury goods in China recovered strongly in the wake of early Covid-19 lockdowns,” Bain said in its report. “A decrease in global travel prompted Chinese consumers to make their luxury purchases nationally rather than in international bargain hubs.”

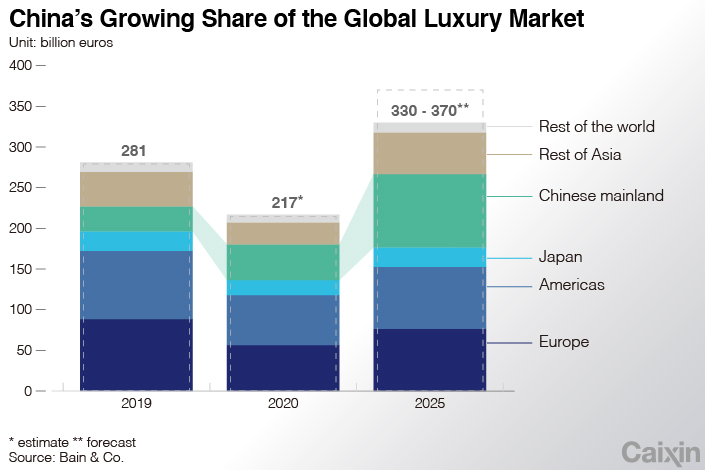

China’s early recovery also helped to boost its overall share of the global luxury market, and many of the world’s top brands have pointed to the country as one of the few bright spots in their most recent earnings reports. Bain forecast that China’s share of the global luxury market nearly doubled to 20% this year from 11% in 2019, though it also pointed out that the overall global luxury market is expected to shrink 23% this year.

|

“This year, our research … indicates that four engines powered China’s luxury goods market in 2020,” the report said. “These forces are further repatriation, millennial and Gen Z shoppers, continuing digitalization and the Hainan island duty-free stores — a new factor with a key role in this year’s growth.”

|

That final factor refers to China’s efforts this year to transform its southern Hainan Island into a vacation paradise by adding duty-free shopping to its list of attractions, complementing its famous beaches. In July, China unveiled a master plan to develop Hainan over the next 15 years and make it an “internationally influential, high-level” port by 2050. Shortly after that, it rolled out a new policy allowing visitors to purchase more duty-free products with fewer limits.

Contact reporter Yang Ge (geyang@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.