Apple, Xiaomi Take Bite Out of Huawei’s Withering Smartphone Share

Huawei’s smartphone sales tumbled by nearly half in last year’s fourth quarter, as its continued suffering under the weight of U.S. sanctions saw it to yield market share to the surging Apple and Xiaomi.

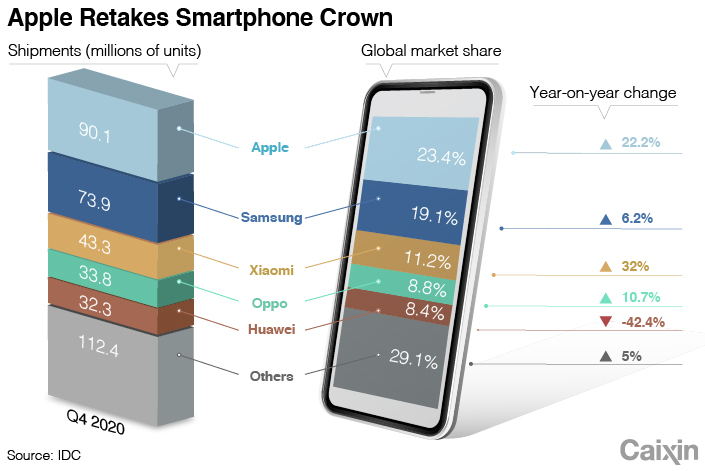

Huawei’s woes came even as the global smartphone market expanded for the first time in a year, with shipments up 4.3% year-on-year to 385.9 million units in the three months through December, according to preliminary data from IDC. Huawei was the only one of the top five brands to record a decline, as its 42.4% sales drop made it the No. 5 vendor with 8.4% market share.

|

IDC attributed the market’s broader resilience to a number of factors, including pent-up demand, continued promotion of 5G phones, and the popularity of low to mid-priced models.

“Vendors also seem to be better prepared for the second lockdown, ensuring they have the right channel set up ready to fulfill orders and reach the end consumer,” said IDC analyst Nabila Popal. “Lockdowns also have people spending less on areas like leisure, travel, and dining out — and smartphones are benefitting from this.”

Huawei first came under the gun when the U.S. added it to an “entity list” in 2019, forcing its American suppliers to get special licenses to keep selling to the Chinese company. The U.S. later turned up pressure on Huawei’s foreign chip partners to cut off the company’s supply of cutting-edge 5G chips. Huawei stockpiled 5G chips before the later actions took effect, and is now rationing the limited pile of supply it has left.

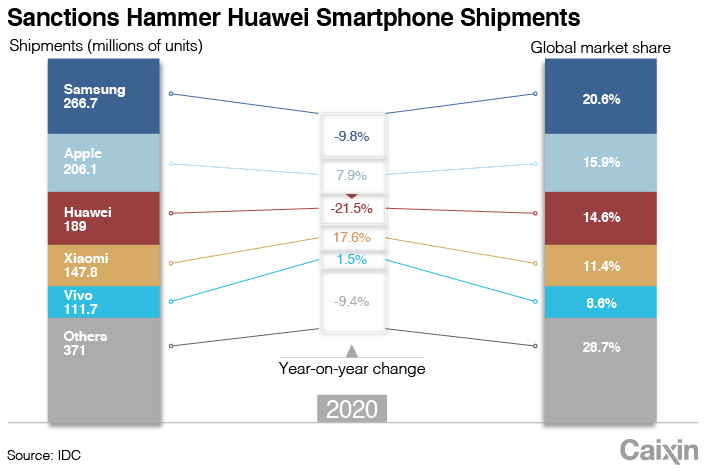

Huawei’s dramatic fourth-quarter decline marks a sharp acceleration of its 22% decline in the previous quarter when the effect of sanctions started to show up. As that has happened, the company tumbled from the world’s No. 1 brand in last year’s second quarter to barely making the top five by the end of the year.

|

“The company continues to suffer under the weight of U.S. sanctions,” said Popal.

Meantime, Huawei’s bleeding share was quickly snapped up by a surging Apple and also China’s own Xiaomi.

Apple’s shipments surged 22.2% in the quarter, enough to lift it past Samsung for the smartphone crown, as the U.S. company shipped 90.1 million iPhones — a record for a single vendor in a single quarter. Apple was notably helped by the launch of its iPhone 12 series, and commanded 23.4% of the global smartphone market during the quarter.

Shortly before IDC released its report, Apple announced its own latest financial results that showed its Greater China sales soared 57% to $21.3 billion in the three months through the end of December. That figure — which accounted for nearly a fifth of Apple’s sales for the quarter — covers all Apple products sold on the Chinese mainland, as well as in Taiwan and Hong Kong.

Back in smartphones, Xiaomi’s smartphone shipments rose by an even stronger 32% to 43.3 million units in the fourth quarter, giving it 11.2% market share. The company’s Hong Kong-listed shares more than doubled last year as its prospects improved as a result of its own global expansion and Huawei’s woes.

But the company was dealt its own blow after the U.S. put it on a military blacklist in the Trump administration’s final days earlier this month, citing ties to the Chinese military. That move forbids U.S. investors from buying Xiaomi’s stock, but is far milder than the earlier moves that banned Huawei from purchasing components and other products from its U.S. suppliers.

“I would expect Xiaomi to continue its aggression this year, including gains in geographies like Europe, the Middle East and Africa, where it is eager to take advantage of Huawei’s stumbles,” said IDC analyst Bryan Ma.

Rounding out the top five, Samsung finished second with 19.1% global market share on a 6.2% increase in shipments; while China’s Oppo finished fourth with 8.8% share on a 10.7% increase.

Concurrent with the fourth-quarter figures, IDC also released full-year data that showed Samsung was the world’s biggest smartphone vendor for all of 2020 with 20.6% of the global market. It was followed by Apple at 15.9%, Huawei at 14.6%, Xiaomi at 11.4% and Vivo with 8.6%.

Contact reporter Yang Ge (geyang@caixin.com) and editor Joshua Dummer (joshuadummer@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

- PODCAST

- MOST POPULAR