Blog: Five Predictions About China’s Looming Census Results

China conducts a national population census every 10 years. The results are closely watched all around the world. After all, any change in China’s demographic data — a huge market of approximately 1.4 billion people — can trigger an immeasurable butterfly effect.

At a March 15 news briefing, a spokesperson for the National Bureau of Statistics (NBS) said that the final review and summary for the seventh national population census data were underway.

“We plan to release the census results at a press conference in April,” the spokesperson said.

But April is already over and the census results have not yet been announced, which has triggered speculation among the public.

As we wait for the census results, here are a few trend-based population predictions for your reference.

Smaller share of Han people

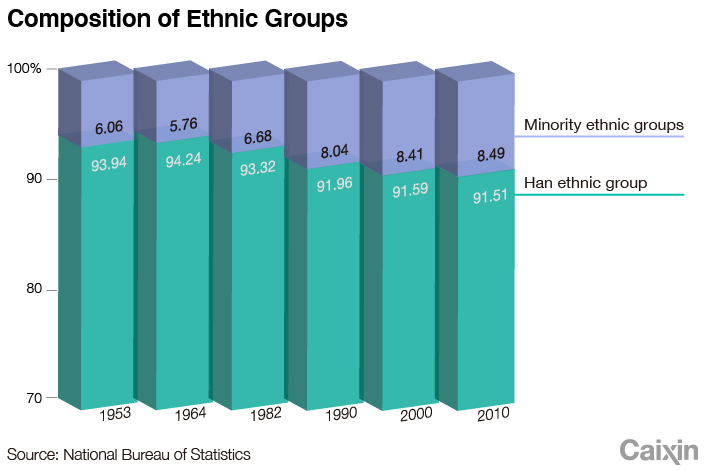

In 1953, the Han population accounted for 93.94% of the national total.

In the following decade, the share increased. But ever since the 1980s when China implemented its family planning policy, there has been a steady decline in the total percentage of the Han population.

|

Compared to just over 50 years ago, the share of Han people has decreased by 2.43 percentage points. Behind this historical trend is a longstanding asymmetry in the population policy.

China’s family planning policy was implemented nationwide progressively over a long period — in inland areas before the border areas, in urban areas before rural areas and for the Han majority before other ethnic groups. Ethnic minorities also enjoyed a more relaxed family planning policy than the Han.

The effects of these disparities can be clearly seen in some of population data.

Between November 2009 and October 2010, 31.2% of Han women of childbearing age gave birth to a second child. This is less than Yi women (32.84%), Uyghur women (33.28%), Tibetan women (34.06%) or Miao women (35.03%) of childbearing age. Only 4.82% of Han women have given birth to a third child, which is less than half the corresponding figure for Miao women and approximately one-third that for Uyghur, Tibetan or Yi women.

Although a two-child policy was universally applied in 2016, significantly closing the family planning policy gap between the Han people and ethnic minorities, it hasn’t made much of a difference.

On the Chinese mainland, the number of births dropped by 610,000 in 2017 to 17.25 million, by 2 million in 2018 to 15.23 million, and by 580,000 in 2019 to 14.65 million.

In urban areas, high costs of housing, healthcare and education have dampened many couples’ enthusiasm to have babies.

Thus, we cannot rule out a further decline in the percentage of Han people in the national population for 2020.

Chengdu, Chongqing emerge stronger

The seventh national population census will present a clear picture of the demographic changes in the southwestern Sichuan-Chongqing region starting from the beginning of this century, which might underscore the significance of the Chengdu-Chongqing Economic Circle and prove its significance in the era of domestic circulation.

|

We can see two stages of population change in the Sichuan-Chongqing region:

From 2000 to 2010, the region saw the trend of population decline (overall).

In the decade leading up to 2010, Sichuan’s permanent resident population shrunk from 82.34 million to 80.41 million and its share in the national total population dropped from 6.58% to just 6%. Chongqing’s permanent resident population also registered a relative decline from 2.44% to 2.15% of the national total.

But in the decade following 2010, Sichuan’s permanent resident population began to rebound, rapidly expanding from 80.41 million to 83.75 million. Chongqing has also made a steady progress, breaking its peak population record set back in the 1990s.

How did it happen?

After China’s accession to the World Trade Organization (WTO) in 2001, many people left the Sichuan-Chongqing region, migrating to China’s coastal areas for work, resulting in local population loss.

But later, Chongqing opened the milestone Second Eurasian Land Bridge and snatched the title of “Laptop Manufacturing Capital” away from China’s coastal areas. It seemed as if the city had built a massive electronic information industry overnight, successfully transforming the traditional heavy industry base into a new high-tech center. Chengdu, meanwhile, has benefited from a favorable business environment resembling that of a coastal city, taking risks and attracting many domestic and international giants to settle there. It has gradually joined the ranks of China’s top 10 cities.

|

Jobs available closer to home have lured both migrant workers and university graduates back to the Sichuan-Chongqing region. It is a miracle unique to Southwest China.

In the 13th Five-Year Plan (FYP) that ended in 2020, the central government’s regional layout strategy was as follows:

“Optimize and enhance city clusters in North China; build world-class city clusters including the Beijing-Tianjin-Hebei city cluster, the Yangtze River Delta city cluster and the Pearl River Delta city cluster; improve the openness and competitiveness of the Shandong Peninsula and the city cluster on the West Coast of the Taiwan Strait; foster city clusters in Central and West China; develop and expand Northeast China, Central China, the middle reaches of the Yangtze River, the Chengdu-Chongqing region, the Guanzhong Plain city cluster ...”

The strategy ranked the Chengdu-Chongqing region behind Northeast China, Central China, and the middle reaches of the Yangtze River.

But the 14th FYP sounds a little different:

“Optimize and enhance city clusters in the Beijing-Tianjin-Hebei region, the Yangtze River Delta, the Pearl River Delta, the Chengdu-Chongqing region, and the middle reaches of the Yangtze River; develop and expand the Shandong Peninsula, coastal areas of Guangdong, Fujian and Zhejiang, central China, the Guanzhong Plain, the Beibu Gulf ...”

In five short years, the strategic value of the Chengdu-Chongqing Economic Circle has skyrocketed. It is now defined as the fourth pillar of China’s economic growth.

In the next 10 years, against the backdrop of the emergence of a new international geopolitical order, the Chengdu-Chongqing region — 1,500 kilometers inland from the coast — will definitely experience explosive development.

Guangdong a big winner

From 2010 to 2020, metropolitanization and urban shrinkage has existed side by side. The expansion of megalopolises largely depends on the huge siphoning effect they have on smaller cities.

If the original trend had continued, Beijing and Shanghai would have raced blindly toward the scale of 30 million people, becoming the world’s most crazed “population harvesters.”

But a few years ago, that historical trend came to a halt. Ever since Beijing and Shanghai formulated major strategies for decremental development, Guangzhou and Shenzhen have largely taken their place, becoming the most attractive destinations for China’s domestic migrants.

Conservative estimates put the increase in Guangdong’s permanent resident population during the last decade at 11 million or higher, which would be larger than the first and second runners-up combined. Guangdong’s permanent resident population as a percentage of the national total increased from 6.83% in 2000 to 7.79% in 2010, and then to above 8%.

This means that one out of every 12 Chinese lives in Guangdong province. And one out of every 20 Chinese lives in the Guangdong-Hong Kong-Macau Greater Bay Area (GBA). Clearly, Guangdong has come out of the decade as the biggest winner.

A steady flow of fresh blood maintains the Pearl River Delta’s status: it is the youngest city cluster in China. Meanwhile, the Yangtze River Delta is suffering from an overall aging population.

According to data from 2015, the elderly population (ages 65 and above) of Guangdong accounted for about 8.48% of the provincial total, ranking Guangdong sixth from the bottom for degree of aging among China’s 31 provinces, municipalities and autonomous regions. The figure for Shanghai and the provinces of Jiangsu and Zhejiang was about 14%, a moderate aging standard.

In the next 10 years of competition, the Pearl River Delta may be more of a hotbed for science and technology innovation than the Yangtze River Delta.

Northeast China sees significant decline

In some regions, demographics is more of a dark art than exact science.

Many cities publish their permanent resident population numbers every year, but these are just estimates. Only the national population census conducted every 10 years provides accurate data based on household-to-household surveys.

So, for some places, the once-a-decade census constitutes a major test. After all, no one wants to be seen “swimming naked.”

But Northeast China is facing this exact kind of embarrassment.

For many years now, Jilin province has stopped gathering statistics on the permanent population of its prefecture-level cities.

In the three provinces of Northeast China, permanent population figures have basically become “confidential data,” with the exception of only a few cities, like Shenyang. The registered population numbers are updated annually, but the exact numbers for the permanent population are never provided.

Conservative estimates suggest that at present, at least one-third of prefecture-level cities in Northeast China are experiencing a population decline — which means not only are they not growing any larger; they’re actually growing smaller over time.

Due to population aging and the region’s slow industrial transformation, the three provinces are facing a possible decline of 1.6 million from 2010 to 2020.

Shanghai and Liaoning first to age

According to standards established by the United Nations, a region where more than 7% of the population is 65 or older is considered a mildly aging society. When that proportion exceeds 14%, it’s considered a moderately aging society.

Five years ago, Tibet, Xinjiang and Ningxia used to have the youngest populations among the provincial-level administrative regions on the Chinese mainland. All three are ethnic minority areas. It’s worth noting that Tibet is the only region in China that does not have an aging population; only 5.7% of its population is 65 or older.

In terms of aging population, Sichuan, Shanghai, Liaoning, Chongqing and Jiangsu rank high, with the proportions of their elderly populations each exceeding 12.5%. With changes over the last five years, these areas are most likely to cross the threshold of a moderately aging society this year.

A population is the basis of all forces of production. The quality of a population’s structure directly affects the destiny of a nation. The “Lost 20 Years” of Japan is not only an economic problem, but also a demographic challenge.

However, a number of Chinese cities have recently revealed that their local birth rates dropped by 10% to 30% from 2019 to 2020. Even culturally conservative provinces with large populations, such as Henan and Shandong, are showing a downward trend in fertility.

In response to the aging problem, the 14th FYP definitively states the need to formulate a long-term population development strategy and improve fertility rates. Fertility policy should be made more inclusive and get support from relevant economic and social policies. This is a very clear sign that China is going to further adjust its family planning policy.

According to Ren Zeping, chief economist and director of Evergrande Think Tank, “the call to completely remove fertility restrictions is beginning to catch attention.”

The unknowns

There are still many unknowns in China’s population data.

One unknown is the average number of persons per household. In 1990, the number was nearly 4. In 2010, it had dropped to 3.09.

If this number has fallen below 3 in the 2020 census, it means that the most typical Chinese household is no longer a three-person family. There must be many more two-person or just single-person households than we imagine. The traditional family structure has been completely overturned, which will force changes in the design of furniture, automobiles, electrical appliances and other products as well.

|

Another unknown is whether the number of newborns in China fell below 13 million in 2020. If it did, that means the number of newborns is continuing to decrease at an average rate of 1 million per year — even after the implementation of the universal two-child policy.

We are also wondering if large cities like Harbin and Changchun are experiencing decline in their permanent populations.

The suspense surrounding these issues can only be cleared by the release of the Seventh National Population Census results.

After that, I believe there will be numerous adjustments to existing policies and release of new ones.

Huang Hancheng is a partner of ZG Trend, an economic and data analysis service based in Guangzhou.

Contact editor Michael Bellart (michaelbellart@caixin.com)

Support quality journalism in China. Subscribe to Caixin Global starting at $0.99.

Follow the Chinese markets in real time with Caixin Global’s new stock database.

- PODCAST

- MOST POPULAR