China’s Factory Prices Surge Amid Higher Commodity Costs, Supply Shortages

Inflationary pressure in China continued to build in April as factory-gate prices jumped at the fastest pace in three and a half years and consumer prices rose the most since September, official data showed Tuesday,

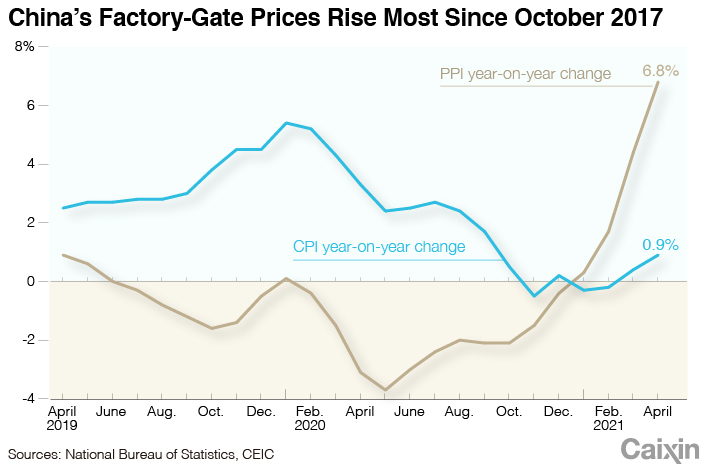

The producer price index (PPI), which gauges changes in prices of goods circulated among manufacturers and mining companies, rose 6.8% year-on-year, accelerating from a 4.4% pace in March, data from the National Bureau of Statistics (NBS) showed (link in Chinese). That was the biggest jump since October 2017 and exceeded the median estimate of a 6.5% rise in a Caixin survey (link in Chinese) of economists.

The consumer price index (CPI), which measures changes in prices of a basket of consumer goods and services, rose 0.9% year-on-year (link in Chinese), more than double the pace in March although slightly lower than the median estimate of a 1% rise in the Caixin survey.

|

Concerns are growing worldwide that inflation in major economies is accelerating too quickly, fueled by a recovery in global demand as the Covid-19 pandemic is being brought under control in most major economies, supply constraints including a semiconductor shortage, surging commodity prices and rising shipping costs. Accelerating price gains often lead central banks to raise interest rates to tamp down demand, but the surge in the PPI is unlikely to sway the People’s Bank of China (PBOC) into taking action and policymakers are more likely to take action to try to improve supplies, analysts say.

“Policymakers may see [the] recent rise in PPI as largely imported inflation pressures due to global factors (demand stimulus and supply bottlenecks) rather than Chinese domestic demand,” economists at Morgan Stanley wrote in a report Tuesday. “A policy rate hike would thus increase borrowing costs on top of rising pressure from input costs, which could weight on corporate confidence.”

It is core CPI inflation rather than PPI that has been the major consideration for the PBOC when deciding whether to increase interest rates, and in previous inflationary cycles the central bank only started to act when consumer inflation started to show signs of economic growth overheating, they said. Instead, Chinese policymakers are more likely to fine tune the pace of controls on industrial production that have been put in place to contain carbon emissions, they wrote.

As the government’s priorities are boosting employment and containing financial risks, interest rates are unlikely to move higher, Xing Zhaopeng, an economist at Australia and New Zealand Banking Group Ltd. wrote in a report Tuesday. “We believe any significant policy responses to the looming inflation will focus on the supply side,” Xing wrote. “Policymakers at the Politburo meeting on April 30 had placed emphasis on stable supplies and prices. To increase the supply of steel, the authorities have adjusted duties and tariffs for some steel products.”

A breakdown of the PPI shows that prices of production goods rose 9.1% year-on-year in April, 3.3 percentage points more than the previous month and far outpaced the 0.3% growth in consumer goods prices. Factory-gate prices in the oil and gas extraction industry surged by 85.8% year-on-year, compared with a 23.7% increase in March, while ferrous metals mining prices rose 38.3%, reflecting the jump in international prices of commodities.

Read more

Cover Story: Is Global Inflation About to Take Off?

The increase in consumer prices was more muted as the slump in pork costs, which fell 21.4% year-on-year, depressed the overall gain in the CPI. Core CPI — which excludes more-volatile food and energy prices and may better reflect long-term inflation trends — rose by 0.7% last month, up from a 0.3% rise in March and the fastest pace since June 2020. The increase in the CPI is well within the target for 2021 –– Premier Li Keqiang said in March that the government wants to keep consumer inflation below 3% this year.

Although some consumer goods companies have already announced plans to increase prices as they cannot absorb all of the increase in their raw material costs, many analysts say they don’t expect the surge in the PPI to fully feed through into the CPI.

Consumer demand is not that strong and the rise in household income has been limited, Zhang Zhiwei, chief economist at Pinpoint Asset Management Ltd., told Caixin. “As the economic recovery is imbalanced, it is hard to say producers can easily transmit their rising costs to consumers,” he added.

Economists at Nomura International (Hong Kong) Ltd. estimate PPI inflation could surge to 8.5% in May and remain between 8% and 9% from June to October before falling back to below 7% by the end of the year. CPI inflation will likely accelerate to 2.3% in the third quarter and 2.8% in the fourth quarter as higher industrial inflation feeds through into consumer prices, they wrote in a Tuesday report.

“[T]he PBoC is unlikely to tighten policies to control PPI inflation, and in our view, the relevant question is whether the rapid rise of raw materials prices will dent real demand, given pre-determined credit growth (with the same amount of money, higher prices mean less real demand),” they wrote. “Furthermore, there is broad anecdotal evidence suggesting real demand in downstream sectors has already declined, potentially undermining China’s growth recovery.”

Contact reporter Guo Yingzhe (yingzheguo@caixin.com) and editor Nerys Avery (nerysavery@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Follow the Chinese markets in real time with Caixin Global’s new stock database.

- PODCAST

- MOST POPULAR