Charts of the Day: China’s Risk-Loving Retail Investors Take Bigger Shine to Mutual Funds

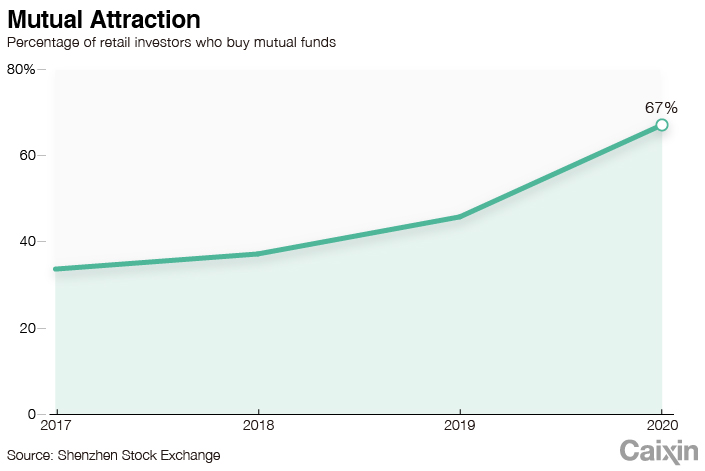

China’s famously speculative retail investors have grown increasingly fond of a product designed to take some of the risk out of stock investing — the mutual fund.

A survey (link in Chinese) by the Shenzhen Stock Exchange found that the share of Chinese retail investors who bought mutual funds jumped 23.1 percentage points from the previous year to 67.1% in 2020.

|

China’s stock market has long been dominated by retail investors, many of whom have a bit of the gamble in them, but as the market evolves, funds created by domestic and overseas institutional investors have become increasingly popular.

The popularity of mutual funds surged last year amid a rallying stock market. Total net assets in China’s open-ended mutual funds grew to $2.7 trillion at the end of 2020, surpassing Japan and Australia to become the largest in the Asia-Pacific region, according to a report by the U.S.-based Investment Company Institute, an investment fund industry organization.

|

China’s retail investors are also changing as more individuals began to recognize the advantages of value investing. The proportion of investors believing in long-term value investment increased from 20.4% in 2015 to 31.1% in 2020, the Shenzhen bourse’s survey showed.

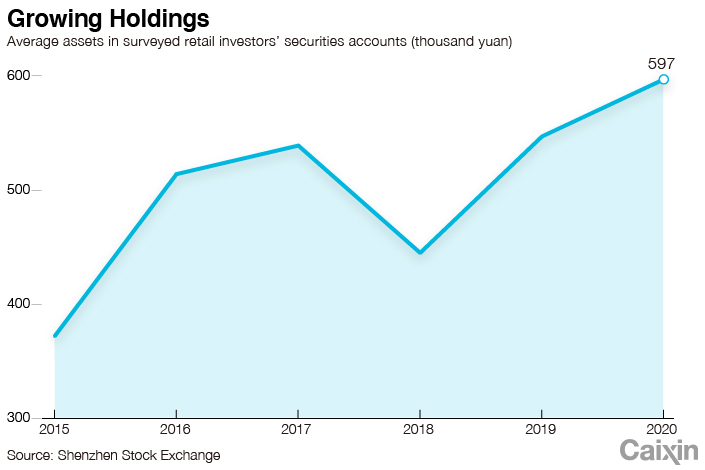

The average value of assets in the polled investors’ securities accounts rose to 597,000 yuan ($92,774) in 2020 from 372,000 five years earlier, according to the survey.

In addition, the average new investor in China is getting younger, the survey showed. The average age of a newly registered investor was 30.4 last year, down from 31.2 in 2017 (link in Chinese) and 36 in 2012.

Contact reporter Guo Yingzhe (yingzheguo@caixin.com) and editor Michael Bellart (michaelbellart@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- PODCAST

- MOST POPULAR