Charts of the Day: Foreign Investors Love China’s Multitrillion-Dollar Mutual Fund Market

China’s mutual fund market has grown at a fast clip in recent years, attracting more and more foreign investors who seek to sell mutual funds independently in the world’s second-largest economy.

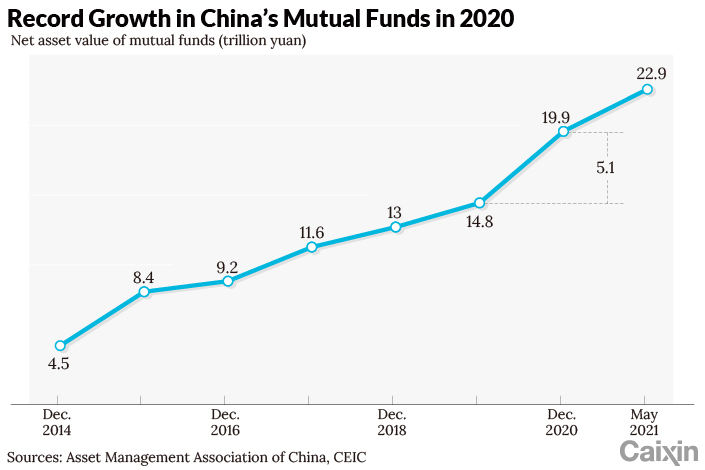

The net asset value (NAV) of mutual funds in China reached about 23 trillion yuan ($3.6 trillion) at the end of May, nearly double the 13 trillion yuan recorded three years earlier, according to (link in Chinese) data from the Asset Management Association of China, an industry group.

|

The NAV of China’s mutual funds grew by 5.1 trillion yuan in 2020, the fastest annual expansion on record, amid a bull stock market and a broader economic recovery from the domestic Covid-19 epidemic.

Meanwhile, the mutual fund sector in China has become increasingly competitive, as more and more foreign investors have sought licenses to operate a wholly owned mutual fund subsidiary in the country, including Fidelity International Ltd., Neuberger Berman Group LLC, and JPMorgan Chase & Co.

BlackRock Inc.’s Shanghai-based subsidiary, BlackRock Fund Management Co. Ltd., started operations earlier this month, becoming the first wholly foreign-owned mutual fund management company in China.

|

In 2018, China lifted the cap (link in Chinese) on foreign ownership of mutual fund management companies to 51% from the previous 49%, delivering on the promise it made the previous year during U.S. President Donald Trump’s visit to Beijing. In April 2020, it scrapped the limit (link in Chinese), to further open up the market.

Contact editor Lin Jinbing (jinbinglin@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- PODCAST

- MOST POPULAR