Caixin ESG Biweekly: China Makes a Breakthrough

Hello ESG Biweekly readers, this week we have expert view from Chen Wenhui, vice-chairman of National Council of Social Security Fund (NCSSF). Chen was a veteran regulator and has extensive working experience in the financial sector. He has helped manage China’s largest pension fund since 2018.

Expert View

Here is Chen Wenhui’s take on the development of ESG and ESG investing in China.

“An important breakthrough”

China’s emission peak and neutrality goals offer a breakthrough for the country’s ESG, Chen said at the Caixin Summer Summit 2021. Apart from President Xi’s pledge, the new five-year plan also elevated the importance of high-quality sustainable development to an unprecedented level. China has achieved political consensus on integrating economic development with environmental protection, social responsibility, and governance improvement. Therefore, the implementation of carbon goals will accelerate the integration of ESG factors into the country’s development.

“Align financial with socio-environmental interests”

On ESG investing philosophy, it is not easy to integrate wealth with responsibilities. Many fund managers will struggle to explain to investors if they can’t fulfil their fiduciary duty when investing. Regarding this, Chen encouraged investing in industries with sustainable development goals. On many occasions, Chen spoke highly of China’s new-energy vehicle sector, and regarded the sector as a way to achieve win-win results financially and socio-environmentally.

“International cooperation is warmly welcomed”

On ESG investing experiences, Chen said NCSSF has conducted specific research projects on ESG investing to establish a disclosure system that fit the realistic situation of the fund while aligning with international practices. As an influential asset owner in China’s capital market, the fund, according to Chen, will take a leading role in the promotion of ESG ideas and practices in China. At Caixin Summit 2020, he expressed his warm welcome toward international investors, “NCSSF hopes to work with domestic and foreign asset owners, asset management institutions and relevant international organizations to jointly promote the development of ESG investment.”

Top News Items

National Development and Reform Commission (NDRC)

On June 11, the NDRC announced that wind and photovoltaic power projects shall no longer enjoy national subsidies. According to the “Notice on Issues Concerning the 2021 New Energy Feed-in Tariff Policy (关于2021年新能源上网电价政策有关事项的通知)”, the NDRC declared that starting from 2021, newly filed PV power projects and newly approved offshore wind power projects will no longer receive central fiscal subsidies. They will instead directly adopt the local coal-fired nominal electricity price for grid parity.

Ministry of Ecology and Environment (MEE)

On May 30, the MEE published the “Guiding Opinions on Enhancing Ecological Environment Source Prevention and Control of High Energy-consuming and High-emission Projects (关于加强高耗能、高排放建设项目生态环境源头防控的指导意见),” proposing the inclusion of carbon emissions in the environmental impact assessment system and environmental impact assessment (EIA) pilots for high energy-consuming and high-emission projects. The MEE also required action plans for achieving peak carbon dioxide emissions with policies including clean-energy substitution, clean transportation and coal consumption control.

People’s Bank of China (PBOC)

On June 9, the PBOC issued the “Assessment Plan for Green Finance of Banking and Financial Institutions (银行业金融机构绿色金融评价方案),” to be effective July 1. The major revision that this edition introduces is the inclusion of green bonds in the financial assessment system. Financial institutions are now expected to increase green bond investments. “Green finance assessment” refers to a comprehensive quarterly assessment conducted by the PBOC regarding banks’ green credit and green bond business. The assessment results will be included in PBOC policy and prudent management tools such as the PBOC financial institution rating.

Ministry of Housing and Urban-Rural Development (MOHURD) and 14 other authorities

On June 12, MOHURD and 14 other authorities published the “Opinions on Strengthening Counties’ Green and Low-carbon Construction (关于加强县城绿色低碳建设的意见)” to guide counties’ high-quality development via the green and low-carbon concepts. The regulation calls for the counties to adjust energy-intensive urban development mode and strengthen green construction and ultimately realize a peak in carbon dioxide emissions and carbon neutrality.

China Banking and Insurance Regulatory Commission (CBIRC)

On June 11, the CBIRC and the Zhejiang provincial government held a joint meeting on “accelerating the development of green finance in China.” The regulator vowed to perfect the rules and standards and improve institutional frameworks for green finance. Specifically, the CBIRC will strengthen financial support on renewable energy and green manufacturing. For potential financial risks during carbon reduction, the regulator said it would explore methods of risk measurement suitable for green finance products.

China Development Bank (CDB)

On June 12, the CDB issued the “Work Plan for Supporting the Strategic Target of ‘Peak Carbon Dioxide Emissions and Carbon Neutrality’ in the Energy Sector,” which announced the establishment of a 500 billion yuan ($78-billion) loan specifically for supporting carbon goals in the energy sector during the 14th Five-Year Plan period, 100 billion yuan ($15.6 billion) of which will be allocated in 2021. The special loan will mainly be used to support integrated energy bases (able to store energy from wind, solar, hydropower, coal and other sources), hydropower in major river basins, coastal nuclear power, wind power with fair on-grid prices, photovoltaic (PV) power, offshore wind power, cross-area transmission channels, pumped storage, hydrogen energy pilots, natural gas systems and coalbed methane extraction and utilization.

Li Gao: Achieving carbon goals requires foresight and precision

In an exclusive May 31 interview, Li Gao, director of the Department of Climate Change of the MEE, said that, considering there are fewer than 10 years until the 2030 target of carbon emissions peak, China needs to consider the 2035 Long-Range Objectives and the 2060 carbon neutrality goal at the same time, which are big challenges given the tight schedule. However, Li believed that achieving the carbon goals did not run counter to economic development, and would not like to see measures such as uniformly cutting off power to simply meet the emission target. Instead, he proposed to pursue a stable and orderly transformation.

Yi Gang: Aiming to complete climate-related information disclosure standards by yearend

On June 4, PBOC Governor Yi Gang, Fed Chair Jerome Powell and ECB President Christine Lagarde met for the first time at the Green Swan Conference and discussed cooperation and the progress of their respective countries in climate-related information disclosure, green standards and other fields. As for China’s readiness to support the Task Force on Climate-related Financial Disclosures (TCFD), Yi said that the PBOC has kept close contact with the Financial Stability Board (FSB) regarding the TCFD standard, and China’s largest commercial bank — the Industrial and Commercial Bank of China (ICBC)— has joined the TCFD to attempt disclosing information in accordance with the TCFD standard. According to Yi, China will continue to work with the G20 Sustainable Finance Working Group, first to finish drafting the Overall G20 Sustainable Finance Roadmap. China will also work with the U.S. and the rotating chairmanship of Italy to hopefully finish drafting climate-related information disclosure standards by the end of the year.

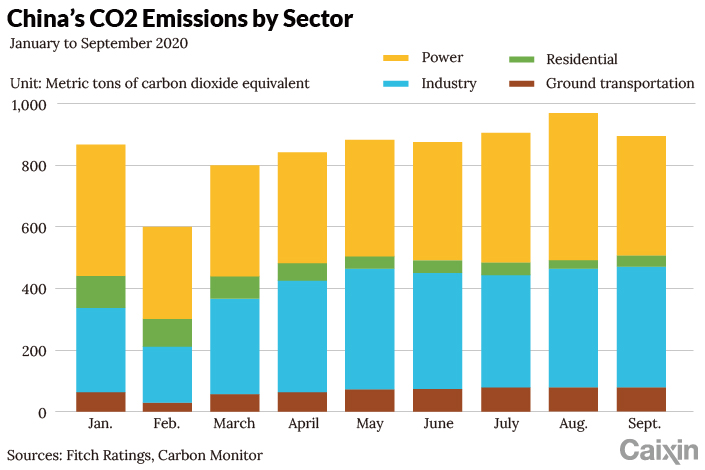

Chart of the Week

|

China’s national emission trading scheme (ETS) is about to start trading within this year. The first batch of over 2,225 coal-fired power generators will trade their quota in this market. A report by Fitch Ratings pointed out that the ETS will initially only cover the power sector, which accounts for around 30% of domestic carbon emissions, but will ultimately cover other sectors, including petrochemicals, chemicals, building materials, steel, non-ferrous metals, paper and domestic aviation. Certain sectors that make up a significant proportion of overall GHG emissions, such as transport, agriculture and construction, are still excluded from the scheme.

Caixin Global launched a daily energy sector watch – energy insider. You can check out the content here.

You can update your newsletter preferences here.

Download our app to receive breaking news alerts and read the news on the go.

Follow the Chinese markets in real time with Caixin Global’s new stock database.

- MOST POPULAR