Opinion: China’s Worrying Economic Signs That Only the Government Has Noticed

What the market misses, the government sees.

Last week, the Chinese government suddenly announced a comprehensive cut to the reserve requirement ratio (RRR), something that the market was not expecting. Although China has experienced a slowdown in its year-on-year economic growth over the last few months, overall growth is still much higher than the targets set at the beginning of the year. The slowdown in macroeconomic data is mainly caused by consumption, while other data, such as industrial growth and imports and exports, show steady increases. So why has the government announced this RRR cut? Has it noticed something that the market has missed?

In our opinion, it is possible that the market has indeed ignored some weaknesses in the economy.

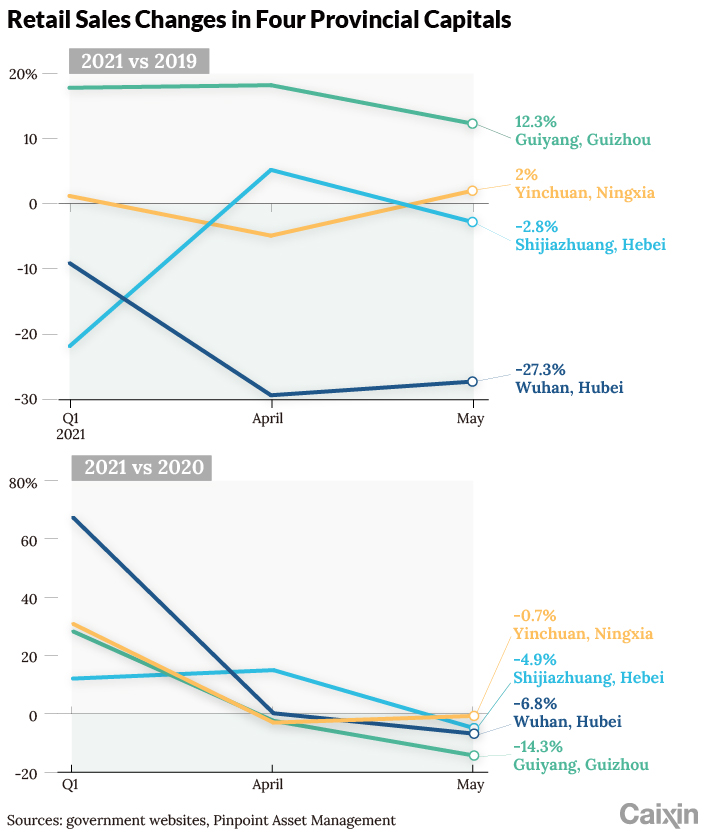

The government’s action may be correlated with an economic slowdown in some provinces and cities. Currently, China is challenged by the perhaps most serious economic divergence of the past few decades, leading to a second dip in consumption in some cities and regions.

|

Among 28 provincial capitals in China, four saw total retail sales shrink in May from the same period last year. Before the Covid-19 outbreak, retail sales had never shrunk in these provincial capitals. Even when the domestic outbreak was at its height last year, year-on-year growth was only negative for a few months before it turned positive in the second half of the year. Therefore, it is worth noticing that their year-on-year growth once again turned negative in May 2021.

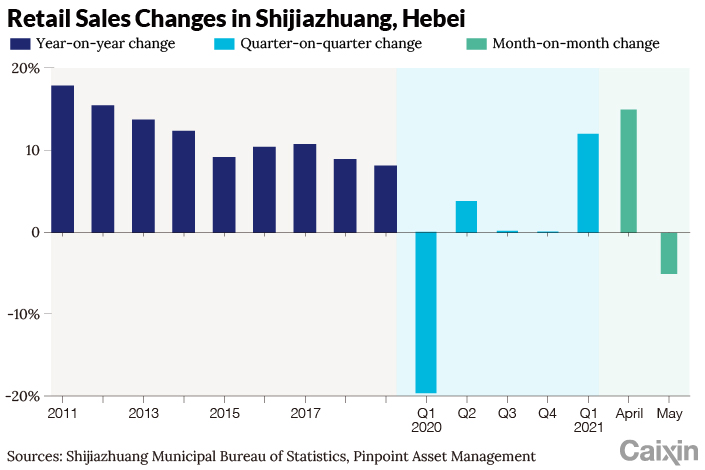

At present, only a few cities have suffered a second dip in consumption, so this phenomenon is not noticeably reflected by the macroeconomic data. However, our study shows that an increasing number of cities have suffered a drop in consumption. If the government had not adjusted the policy, more cities (such as Wuhan in Central China’s Hubei province and Shijiazhuang in North China’s Hebei province) would possibly also see negative growth of total retail sales in the third quarter of this year.

|

Neither the media nor the market has paid attention to these signs of an economic slowdown. That’s partially because national economic data has almost always shown the same trends as the regional data in the past due to high correlation between China’s regional and national economies. Consequently, the regional data has been neglected by the market. However, the divergence is serious this time. The economic slowdown in some cities is much faster than that of the country as a whole.

Hence, the central government should not only highlight the national economic data, but also listen to feedback from the local governments. Doing so will make it easier to gain relevant information and build a more comprehensive understanding of the economic situation.

Zhang Zhiwei is president and chief economist of Pinpoint Asset Management Ltd.

Read more

Update: China’s Second-Quarter GDP Grows 7.9%, Falling Short of Expectations

Contact editor Michael Bellart (michaelbellart@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- PODCAST

- MOST POPULAR