Update: China’s Second-Quarter GDP Grows 7.9%, Falling Short of Expectations

China’s GDP grew 7.9% year-on-year (link in Chinese) in the second quarter this year, falling short of market expectations in a sign that the economy’s strong recovery from the Covid-19 pandemic is moderating, official data showed Thursday.

The figure came in below the median estimate for 8.2% growth (link in Chinese) in a Caixin survey of economists. The actual rate was lower than the 18.3% year-on-year surge in the first quarter of 2021, which had been chiefly due to a low comparison base a year earlier, when vast swathes of the Chinese economy were shut down.

|

In the first quarter of both 2021 and 2020, GDP grew 5.5% year-on-year on average, according to data from the National Bureau of Statistics (NBS). The figure, which plays down the impact of disruptions caused by the Covid-19 pandemic, suggests China’s economic growth is close to its pre-pandemic expansion pace.

For the first half of this year, the GDP growth rate was 12.7% year-on-year.

“In the first half of this year, the economy continued to recover steadily. The cycle of supply and demand was smooth. The fundamentals laid a relatively good foundation for economic operation in the second half of this year,” NBS spokesperson Liu Aihua said at a Thursday press conference (link in Chinese). “Overall, the factors that support further economic recovery and improvement are gradually accumulating and increasing.”

“However, it should also be noted that the pandemic continues to evolve globally, and there are many external uncertainties. The recovery of the domestic economy is uneven, and we still need efforts to consolidate the foundation for recovery and development,” she said.

The June performance of China’s economic gauges showed that private domestic demand saw a stronger growth momentum, Chen Jingyang, an economist with HSBC Bank PLC, wrote in a Thursday research note. Economic growth engines are gradually shifting from property investment to manufacturing investment and household consumption, she added.

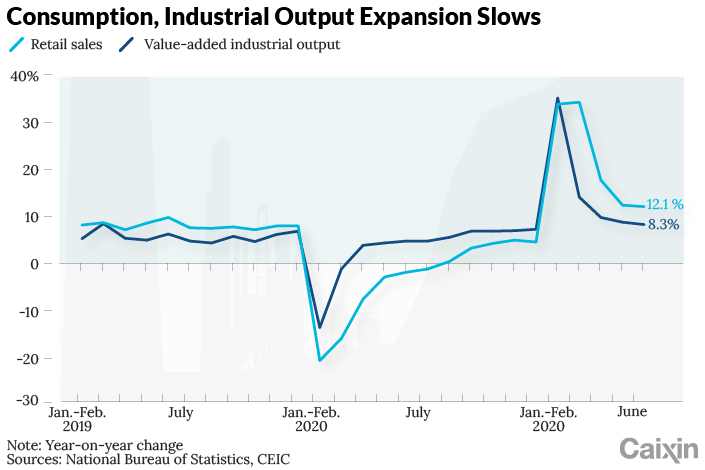

Retail sales — which include spending by households, governments and businesses — rose 12.1% year-on-year (link in Chinese) in June, beating the median estimate of 11% growth by Caixin’s pool of economists. That was thanks to the accelerated vaccination campaign in China and a limited impact from the Covid-19 resurgence in South China’s Guangdong province, as the public may have become accustomed to sporadic Covid-19 outbreaks, economists at Nomura International (Hong Kong) Ltd. wrote in a note.

Other than consumption, value-added industrial output — which measures production by factories, mines and utilities — rose 8.3% year-on-year in June (link in Chinese), above the median estimate of 7.8% in the Caixin survey, though slower than 8.8% in May. The growth was supported by China’s stronger-than-expected exports in June, which were bolstered by a post-pandemic recovery in major economies such as Europe, multiple analysts said.

|

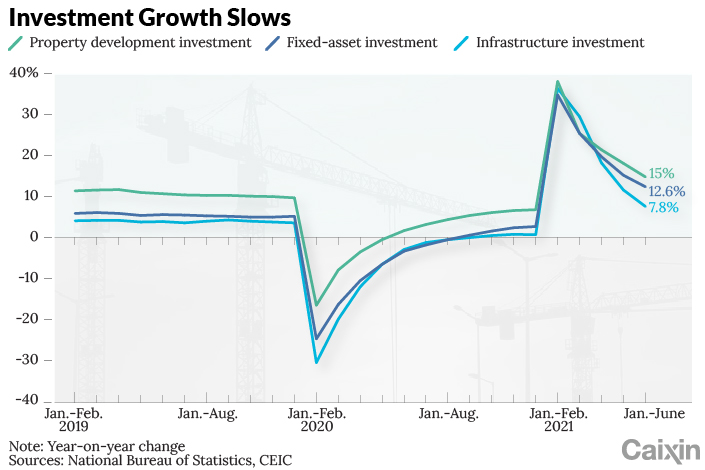

On the investment side, fixed-asset investment, a key driver of domestic demand, grew 12.6% year-on-year (link in Chinese) in the first half, decelerating from a 15.4% rise in the January-to-May period. The rate of expansion also beat the median expectation of 12.1% growth.

Infrastructure investment — which includes spending on road and railway construction and is generally led by the government — rose 7.8% year-on-year (link in Chinese) in the first six months, slower than the 11.8% growth in the first five months. The slowdown was caused by China’s crackdown on local government debt, said economists at Macquarie Group Ltd.

Read more

In Depth: Record Local Government Debt Is Back in Policymakers’ Crosshairs

The Macquarie economists said that the property sector seems to be slowing a bit too fast, after policymakers tightened restrictions on financing in the sector. In the first six months, property development investment grew 15% year-on-year (link in Chinese), slower than the 18.3% growth in the first five months.

|

The country’s surveyed urban unemployment rate was 5% in June (link in Chinese), the same as the previous month’s.

As for future growth, the economists at Nomura expect China’s GDP growth to further slow to 6.4% in the third quarter and 5.3% in the fourth quarter. They expect downward pressure on growth to increase significantly in the second half of this year, especially in the fourth quarter, due to several factors: pent-up demand subsides, exports weaken as the reopening of developed countries leads to a shift back to services consumption, property tightening measures finally bite, and surging raw material prices suppress real demand.

The Macquarie economists have similar projections, predicting the GDP growth could slow to around 6% in the third quarter and around 5.5% in the fourth quarter.

Read more

Opinion: China’s Worrying Economic Signs That Only the Government Has Noticed

Contact reporter Tang Ziyi (ziyitang@caixin.com) and editor Michael Bellart (michaelbellart@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- PODCAST

- MOST POPULAR