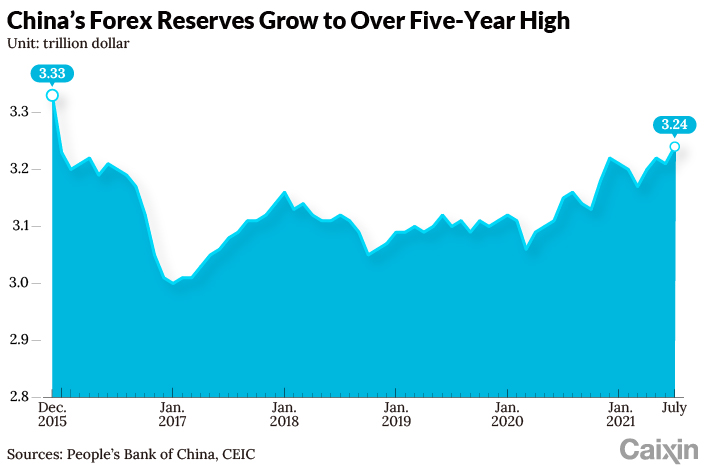

China’s Foreign Currency Hoard Hasn’t Been This Big in More Than Five Years

China’s foreign currency reserves rose to the highest level in more than five years at the end of July, driven by stronger non-U.S. dollar currencies, official data showed.

The reserves rose to $3.236 trillion at the end of last month, up $21.9 billion from the end of June and marking the highest level since December 2015, data from the State Administration of Foreign Exchange (SAFE) showed Saturday. The reading beat market forecasts of $3.228 trillion, according to a research note released by UBS Group AG on Monday.

|

The increase was affected by changing exchange rates and asset prices, according to a SAFE Q&A statement (link in Chinese) released on Saturday. China’s foreign exchange reserves are denominated in dollars. As non-U.S. dollar currencies strengthened, China’s holdings in the currencies have risen in value after converting them into dollars, the statement said.

The Dollar Index, which measures the value of the dollar against a basket of six other major currencies, closed at 92.17 on July 30, falling 0.3% from the end of the previous month.

China’s strong trade performance and foreign capital inflows also contributed to its rising foreign reserves, said Wen Bin, chief analyst at China Minsheng Banking Corp. Ltd. (600016.SH). In July, exports of Chinese goods grew 19.3% year-on-year in dollar terms, beating the median forecast of an 18.4% rise by economists polled by Caixin.

Wen said yuan-denominated assets are still attractive to global investors and are expected to lure further foreign capital inflows, which can underpin China’s foreign reserves.

China’s sovereign credit risk remains relatively low, as the economy has recovered at a faster pace than many other nations amid a stable epidemic situation, SAFE spokesperson Wang Chunying said at a press conference on July 23 (link in Chinese). In addition, government bonds in China have higher yields than in many other countries which have implemented easing monetary policies. This can also help attract foreign capital inflows, she said.

China’s total outstanding external debts amounted to $2.5 trillion by the end of March, growing 5% from the end of last year. That was mainly because foreign investors increased holdings of onshore bonds, said Wang.

Nonetheless, the U.S. Federal Reserve has signaled plans to shrink its balance sheet, raising concerns that such a tightening monetary policy could strengthen the dollar and cause massive capital outflows from emerging economies, including China.

In response, Wang said the impact of Fed’s future policy adjustments to China’s cross-border capital movements is “generally controllable,” as the Chinese economy is healthy and stable enough to fend off external impacts.

Contact reporter Tang Ziyi (ziyitang@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- MOST POPULAR