China’s Services Activity Sees First Contraction in 16 Months, Caixin PMI Shows

Activity in China’s services sector contracted in August for the first time since April 2020, as companies were hit by the impact of fresh outbreaks of Covid-19 across the country, a Caixin-sponsored survey showed.

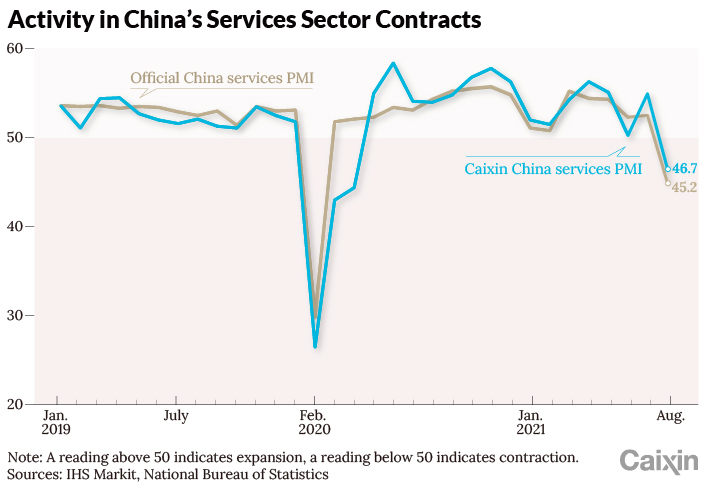

The Caixin China General Services Business Activity Index, which gives an independent snapshot of operating conditions in the sector, fell to 46.7 in August from 54.9 the previous month, according to the survey report released Friday. A number above 50 indicates an expansion in activity, while a figure below that points to a contraction.

|

The indicator, also known as the Caixin services PMI, is closely watched by investors as one of the earliest available monthly barometers of the health of the world’s second-largest economy. The drop in the Caixin services PMI mirrors the contraction in the government-surveyed services PMI released on Tuesday, and follows a decline in the Caixin China manufacturing PMI for August, released Wednesday, to 49.2 from 50.3.

Overall, the Caixin China General Composite PMI, which covers both the manufacturing and services sectors, slumped to 47.2 in August from 53.1 the month before, according to the survey, which was carried out from Aug. 12 to Aug. 20. It marked the first contraction in the Caixin composite PMI since April last year, when the country was in the grip of the first Covid-19 outbreak that shut down vast swathes of the economy.

“The Covid-19 resurgence has posed a severe challenge to the economic normalization that began in the second quarter of 2020,” said Wang Zhe, senior economist at Caixin Insight Group. “Official economic indicators for July were worse than the market expected, indicating mounting downward pressure on economic growth. Authorities need to take a holistic view and balance the goals of containing Covid-19, stabilizing the job market, and maintaining stability in prices and supply.”

The breakdown of the August Caixin services PMI showed total new business recorded its first contraction since April last year, although the gauge of new export business returned to expansion after contracting the previous month. The index for employment fell below 50 for the second time in three months in August. Some survey respondents said they readjusted their workforce numbers in line with business activity, while others said that they had not replaced voluntary leavers.

The reduction in workforce numbers contributed to an increase in outstanding business in August, though the expansion was milder than the previous month. Input prices rose last month, although at a weaker pace than in July, with survey respondents attributing the growth to higher staffing costs and increased transport fees amid the Covid flare-ups. The measure for prices charged fell back below 50 as companies lowered prices to attract and secure new business.

Services companies remained upbeat about the outlook despite the contraction in the headline services PMI reading, although the degree of positive sentiment dipped from July and remained below the long-term average. Concerns persist over how long it will take to bring the pandemic under control and for market conditions to normalize, the report said.

China’s official services PMI, released by the National Bureau of Statistics on Tuesday, slumped to 45.2 (link in Chinese) in August from 52.5 the previous month, marking the first contraction since February last year.

Economists at Nomura International (Hong Kong) Ltd. said they expect the official services PMI will rebound in September as China appears to have contained the latest wave of Covid-19 and is lifting restrictions. But there are still risks that the services sector could be hit again in the coming months, given China’s zero-tolerance Covid strategy and the potential for more infectious variants of the coronavirus to appear, they wrote in a research note released Tuesday.

On top of the impact of Covid-19 flare-ups, recent regulatory challenges facing the after-school tutoring industry also weighed on employment in the services sector.

Analysts at Huatai Securities Co. Ltd. said there could be larger-than-expected downward pressure on the Chinese economy in the near term due to the resurgence of the coronavirus and tougher regulatory scrutiny of local government financing vehicles and the property sector, as well as tightening policies on other industries. They lowered their forecast for China’s real GDP growth for 2021 to 8.9% from 9.2%, and estimated the pace of expansion in the third quarter would fall to 6.9% year-on-year from 7.9% in the second quarter, sliding further to 5.5% in the fourth quarter.

Economists at Macquarie Capital Ltd. have even lower forecasts. In a report released Wednesday, they estimated GDP growth could slow to 5.5% year-on-year in the third quarter and to 5% in the fourth quarter.

The Nomura economists said they expect China will ramp up policy easing to support slowing economic growth. Tightening policies will be maintained for certain sectors such as property, but the government could ramp up bond issuance and fiscal spending. The central bank is expected to increase liquidity injections via targeted reserve requirement ratio cuts and various lending facilities, they said.

Contact reporter Tang Ziyi (ziyitang@caixin.com) and editor Nerys Avery (nerysavery@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- PODCAST

- MOST POPULAR