Beijing’s New Bourse to Have Daily Price Limit of 30%, Regulator Says

Stocks to be traded on the new Beijing Stock Exchange (BSE) will not be allowed to rise or fall more than 30% within a single trading day, according to the China Securities Regulatory Commission (CSRC), the country’s top securities regulator.

New listings won’t be subject to any caps on price changes on their first trading day, and the daily price limit will only be applicable from their second day of trading, a CSRC spokesperson announced Friday (link in Chinese), when the commission released a set of draft regulations on supervision of the new exchange.

The draft regulations (link in Chinese), which are open for public comment until Oct. 3, stipulate rules covering listing requirements for IPO candidates, responsibilities of the exchange for supervision of stock issuers, and governance structure of the bourse.

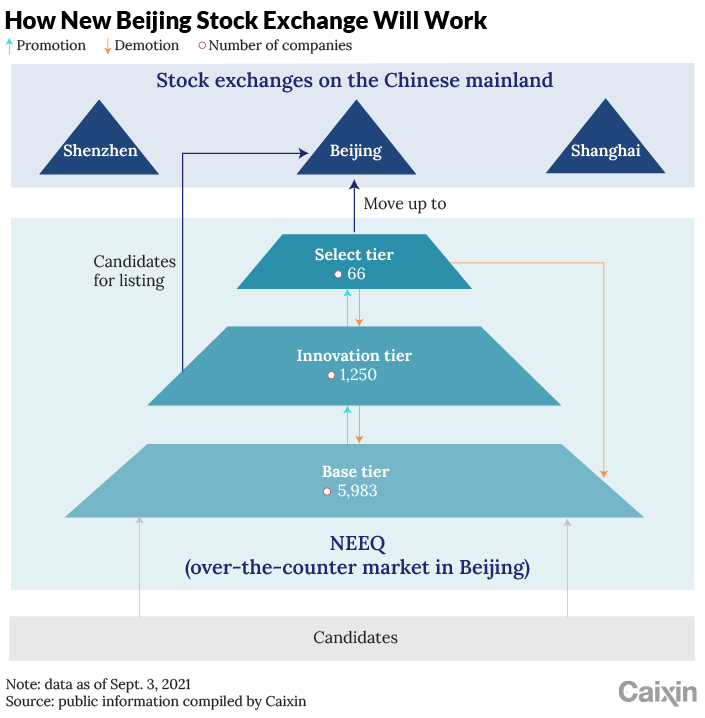

The draft came one day after Chinese President Xi Jinping announced plans to launch the BSE, which is expected to become a platform for innovative small and midsize enterprises (SMEs) to raise money directly from investors. The bourse will be the third one on the Chinese mainland, after the Shanghai and Shenzhen markets.

Read more

Four Things to Know About Beijing’s New Stock Exchange for Small Companies

|

In an earlier statement released Thursday, the CSRC said the BSE will trial a registration-based IPO system (link in Chinese), which is designed to make the listing process more transparent and market-oriented than it is under the older approval-based IPO system. The registration-based system was adopted by Shanghai’s STAR Market in mid-2019, and by Shenzhen’s ChiNext board last year.

Under the draft regulations circulated Friday, the BSE is required to set up an independent appraisal department and a listing committee to review the application materials for IPOs and give opinions before sending qualified ones to the CSRC for review. The exchange is also encouraged to set up an industry advisory committee to provide professional consultation and suggestions to the exchange on the review of IPO applications.

In addition, the BSE will adopt a market-oriented pricing mechanism and will introduce a flexible issuance mechanism to lower funding costs for SMEs, the draft said. The draft regulations also aim to set up listing standards that are tailored for innovative SMEs. Qualified IPO applicants must have traded for at least 12 months in the “innovative tier” category of the country’s over-the-counter stock-trading platform, the National Equities Exchange and Quotations (NEEQ), also known as the New Third Board, the draft said.

Founded in 2012 in Beijing, the NEEQ was designed as an incubator for SMEs to grow, become profitable and improve their corporate governance, and then graduate to list on the Shanghai or Shenzhen bourse. Trading on the NEEQ is currently divided into three categories: a “select tier” which comprises high-quality companies that have good profitability or strong innovation capabilities; an “innovation tier” for well-managed companies that are not good enough to enter the “select tier;” and a “base tier” for remaining ones.

The BSE will become a listing and trading platform for companies in the “select tier,” while those in “innovative tier” will be potential candidates for listing on the bourse in future, the CSRC said Thursday.

Contact reporter Tang Ziyi (ziyitang@caixin.com) and editor Lin Jinbing (jinbinglin@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- MOST POPULAR