China Carbon Watch: Carbon Emissions Allowance Price Slides

Week at a glance (Aug. 30-Sept. 3)

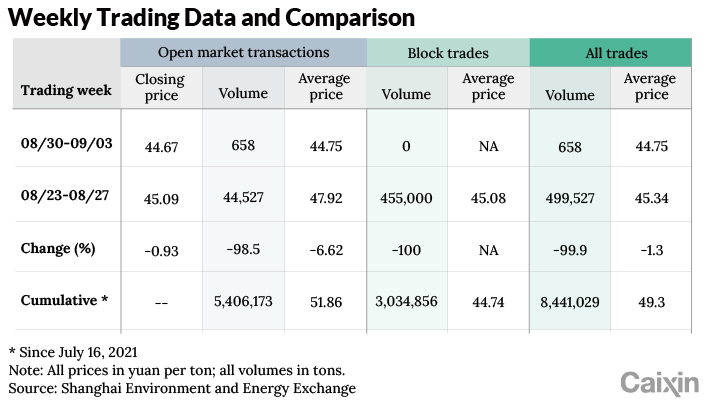

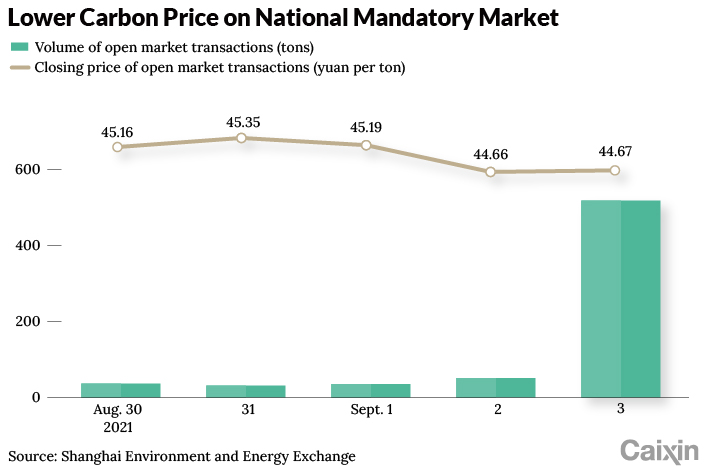

• China’s national carbon emissions allowance (CEA) market, the world’s largest, saw a significant drop in trading volume, only 658 tons of open market transactions and no block trades. The CEA price continued a slight downward trend, closing at 44.67 yuan ($6.91) per ton.

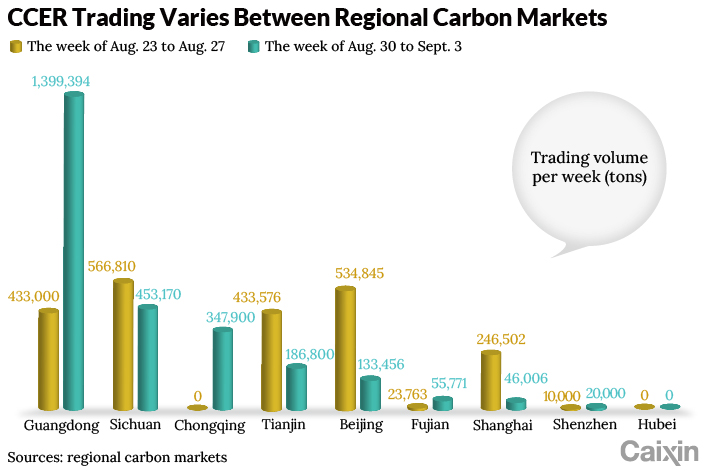

• The total trading volume for China certified emission reduction (CCER) credits across all nine regional exchanges increased by 17.5% from the previous week, reaching over 2.6 million tons.

• A government work group was established to accelerate emissions data accounting standards.

• China and the U.S. held climate talks in Tianjin.

Carbon markets update

• Over the past week, the national CEA market saw a significant decrease in total trading volume, and the price continued to decrease.

The CEA market ended the week with total volume down 98.5% to 658 tons of open market transactions and a 100% decrease in block trades. (Note: Block trades have 100,000 tons or more in volume at a price usually set by bilateral negotiation.) With block trades historically providing most of the total volume, the complete disappearance of block trades last week, coupled with negligible open market transactions, ground activity to a near halt. Calculated from the disclosed total trading volume and value, the average price for all the CEA trades was 44.75 yuan per ton, down 1.3% from the week before. Open market transactions closed at 44.67 yuan per ton, down 0.93%.

|

Between the July 16 launch and Sept. 3, the CEA market had a total trading volume of 8,441,029 tons and an average price of 49.30 yuan per ton. Block trades accounted for 36% of the total volume. Excluding launch day volume, block trades accounted for 70% of the total volume. Average prices for open market transactions and block trades were 51.86 and 44.74 yuan per ton, respectively.

|

• CCER markets’ total volume increased by 17.5%, while individual markets saw wide swings.

The total weekly volume across the nine regional pilot markets increased by a substantial 17.5% to 2,642,497 tons. The Guangdong market had the highest volume at 1,399,394 tons, a threefold increase, accounting for 53% of national volume. The Hubei market did not see any trading for the second week in a row. Sichuan had the second-highest volume at 453,170 tons, making it 17.2% of the national total. Chongqing saw its first trade in six months, with a significant volume of 347,900 tons. Both Shenzhen and Fujian had their volume doubled while Shanghai, Beijing and Tianjin decreased by over 55%.

|

• Emissions allowance submissions will be due on Sept. 30 for the 2020 compliance year for entities covered under the Shanghai emissions trading system (ETS).

Shanghai’s Bureau of Ecology and Environment, the governing agency of Shanghai’s ETS market, announced the submission deadline in a statement dated Aug. 30. The Shanghai ETS has had a 100% compliance record for eight consecutive years. Trading activities on Shanghai’s ETS market are expected to accelerate as the deadline nears.

Read more

Energy Insider: China Starts Trial of Clean Power Trading

Policy updates

• U.S. Special Envoy for Climate John Kerry visits China.

Kerry held talks in Tianjin with his counterpart Xie Zhenhua, Foreign Minister Wang Yi, and Vice Premier Han Zheng. Kerry and Xie have held about 18 meetings since the start of the Biden administration. On Sept. 1, Wang warned Kerry that work between the two countries on climate change “cannot possibly be divorced” from other geopolitical tensions. Similarly, Han urged the U.S. to “create a good atmosphere of cooperation.” After the talks concluded on Sept. 2, Kerry said on a call with reporters that his response was “… climate is not ideological. It’s not partisan; it’s not a geostrategic weapon or tool … It’s a global, not bilateral, challenge.” Xie and Kerry agreed to meet again ahead of international negotiations in Glasgow in November. China’s Ministry of Ecology and Environment characterized the talks as “candid, in-depth, and pragmatic.”

• A carbon emissions statistical accounting workgroup was formed.

The National Development and Reform Commission (NRDC) says the workgroup is to establish a standardized emissions accounting system. The workgroup is led by the NRDC and the National Bureau of Statistics, with the latter responsible for day-to-day operations. Member organizations include 17 government agencies, six industrial trade groups, and the Chinese Academy of Sciences.

• Vice chairman of the China Securities Regulatory Commission says the futures market can serve China’s carbon reduction goals.

In his speech to the 2021 China (Zhengzhou) International Futures Forum on Sept. 1, Fang Xinghai stated that he believes the futures market can help to develop the national ETS by actively developing carbon futures products to produce open, continuous and forward-looking pricing, and to guide the allocation of resources for the transition to a low-carbon economy.

Read more

Caixin ESG Biweekly: No More ‘Campaign-Style’ Carbon Reduction Measures

Industry news

• Hong Kong Exchanges and Clearing Ltd. (HKEX) deepens collaboration with Guangzhou Futures Exchange (GFEX).

On Aug. 27, the two bourses signed a memorandum of understanding (MOU) for “strategic cooperation in promoting sustainability and facilitating the development of the Greater Bay Area.” “Under the MOU, HKEX and GFEX will explore the feasibility of cooperation on product development in both onshore and offshore markets, with the aim of supporting China to peak carbon emissions by 2030 and reach carbon neutrality by 2060,” HKEX said. In February, HKEX paid 210 million yuan for a 7% stake in GFEX, which was established in April, the fifth futures exchange on the Chinese mainland.

• The Xiamen Property Rights Exchange Center builds China’s first blue carbon trading service platform.

According to the Xiamen Daily, the exchange has recently established the platform in collaboration with a team of experts on oceanic carbon capture, led by the Chinese Academy of Sciences, to develop a methodology system for the trading of blue carbon — carbon captured and stored in the marine ecosystems.

Bai Bo is chairman and co-founder of the Cyberdyne Tech Exchange, a digital green exchange based in Singapore.

Contact editor Joshua Dummer (joshuadummer@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

Get our free ESG newsletter.

- MOST POPULAR