China Carbon Watch: National Market’s Trading Volume Slips During Holiday Week

Week at a glance (Sept. 20-24)

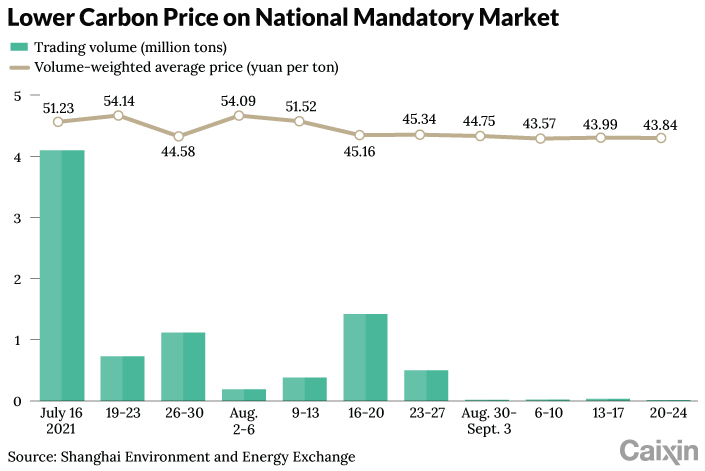

• Last week, China’s national carbon emissions allowance (CEA) market saw a substantial drop in trading volume from the previous week but had a slightly higher closing price. Total volume was down 63.9% to 11,572 tons. The volume-weighted average price was down slightly to 43.84 yuan ($6.78) per ton.

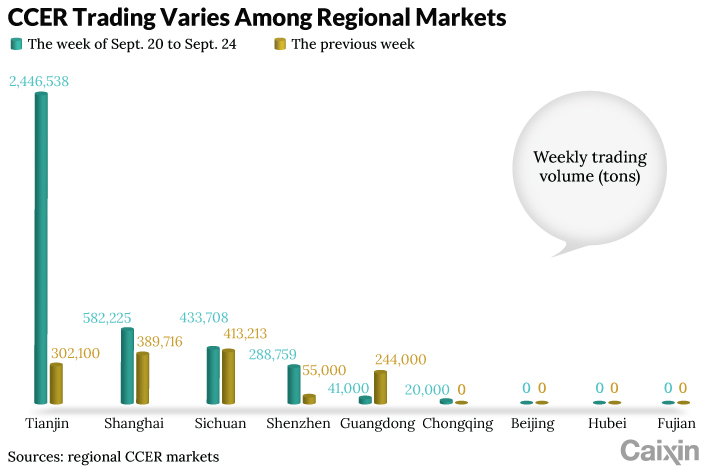

• The total weekly volume of China certified emission reductions (CCER) credits increased 171.5% to 3,812,230 tons, led by an eightfold increase in the Tianjin market. Markets in Shanghai, Chongqing and Beijing are near their respective emissions allowance submission deadlines, with the former two seeing increased activity and Beijing having no activity at all.

• Chinese President Xi Jinping pledged to end construction of new coal-fired power plants outside China in his speech at the United Nations (UN) on Sept. 21.

• The Shanghai Environment and Energy Exchange (SEEE) announced its second regional CEA auction for the 2020 compliance year. The auction will take place on Sept. 30 for 2 million tons of Shanghai regional CEA with a bid price floor set at 48.22 yuan per ton.

|

Carbon markets update

• Over the holiday-shortened trading week (Sept. 22-24), the CEA market saw a substantial drop in trading volume, with a slightly higher closing price from the previous week.

The CEA market ended the three-day trading week with a total volume of 11,572 tons, down 63.9%, making a recovery from the nadir of 658 tons in the week of Aug. 30. Block trades were absent for the fourth consecutive week. Prices for open market transactions closed this week up 2.14% to 44.36 yuan per ton, while the volume-weighted average price was down slightly to 43.84 yuan per ton.

The market appears to be still waiting for measures to improve the market dynamics.

• The CCER market’s total weekly volume jumped 171.5%, while individual markets saw wide swings.

The volume across the nine regional pilot markets increased to 3,812,230 tons, led by an eightfold increase in the Tianjin market, which saw a total weekly volume of 2,446,538 tons, with most of the volume — 1,931,332 tons — traded on Friday, Sept. 24. Shanghai CCER trading was up 49.4% at 582,225 tons, being the second-most active market. The Sichuan exchange maintained its steady pace of trading at 433,708 tons, up 5%. Beijing, Fujian and Hubei did not see any CCER trades.

|

Shanghai, Chongqing and Beijing are approaching compliance submission deadlines. Recent CCER trading on the Shanghai and Chongqing markets has seen a marked increase as the deadline approaches. On the contrary, trading on the Beijing market had ceased entirely for the last two weeks, likely because Beijing announced the compliance deadline in April, and the entities covered have had time to prepare.

Of the nine regional markets, only Shanghai, Beijing and Hubei display daily CCER price information. Guangdong reports weekly averages each Monday. Shanghai discloses its cumulative total values, from which the offline trade price can be inferred. Guangdong separates the credits on its exchange based on compliance eligibility, although corresponding volume information is not disclosed.

Read more

Energy Insider: China Certifies First Carbon-Neutral Oil Shipment

Market news

• Shanghai announces its second regional CEA auction for the 2020 compliance year.

The SEEE announced (link in Chinese) the auction will take place in the morning trading hours of Sept. 30 for 2 million tons of Shanghai CEA. The bid price floor is set at 48.22 yuan per ton, 1.2 times the volume-weighted average price of the open market transactions on the SEEE from Nov. 1, 2020, through Aug. 31. The first auction for the 2020 compliance year was conducted on Aug. 18, with 543,042 tons of Shanghai CEA sold at 39.76 yuan per ton out of the 800,000 tons available, and the bid price floor set at 39.76 yuan per ton. The upcoming auction date coincides with the submission deadline for the Shanghai CEA 2020 compliance year.

Read more

Caixin ESG Biweekly: Monetization of Green Assets on the Way

Policy news

• China will end building new coal-fired power plants abroad.

In a speech at the UN, President Xi pledged to end new coal-fired power plant construction outside China. Xi also reiterated China’s commitment to achieving carbon peak by 2030 and carbon neutrality by 2060. The G-7 countries have also pledged to end building new coal-fired power projects outside their national borders before the end of 2021.

• Zhejiang province orders production suspension to meet energy consumption targets.

On Sept. 22, the provincial government ordered energy-intensive companies to suspend production to meet energy consumption goals set by the central government. Dubbed “double control,” the policy seeks to control total energy consumption and energy-intensity simultaneously. In a grading report published in August by the National Development and Reform Commission, Zhejiang received a “yellow” grade for both controls, meaning reduction targets were not met. About 160 energy-intensive companies have been affected, mainly in the textile, dyeing and chemical fiber industries. The suspension will reportedly last until Oct. 1.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

Get our free ESG newsletter.