Power Shortages Take the Juice Out of China’s Manufacturing, Caixin PMI Shows

Activity in China’s manufacturing sector held steady in September from the previous month, a Caixin-sponsored survey showed, as a power shortage and rising raw material prices dampened factory production.

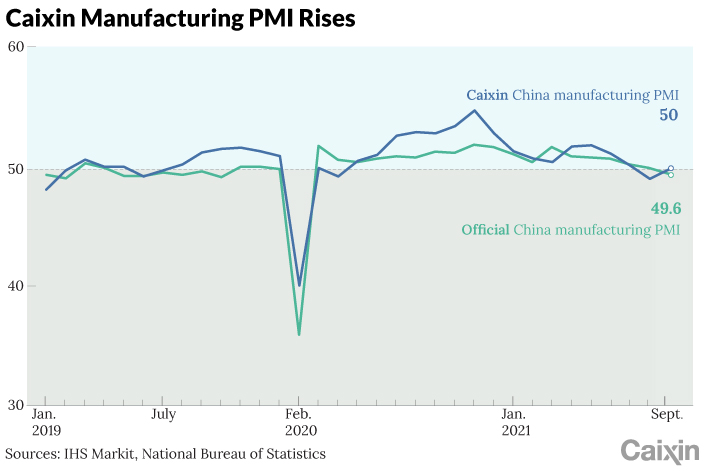

The Caixin China General Manufacturing Purchasing Managers’ Index (PMI), which gives an independent snapshot of the country’s manufacturing sector, rose to 50 in September from 49.2 the previous month, according to the survey report released Thursday. A number above 50 signals an expansion in activity, while a reading below that indicates a contraction.

The indicator is closely watched by investors as one of the earliest available monthly barometers of the health of the world’s second-largest economy. The September reading was the second-lowest in 17 months following the figure for August, when the index fell below 50 for the first time since April last year.

“(C)onditions in the manufacturing sector picked up in September from the previous month, though the improvement was limited,” said Wang Zhe, a senior economist at Caixin Insight Group. “The Caixin China manufacturing PMI came in at 50, indicating the downward pressure on the economy was still high.”

Supply in the manufacturing sector continued to shrink, while demand improved, the survey showed.

The breakdown of the September manufacturing PMI showed that goods producers’ output contracted for the second month in a row in September, while total new orders increased for the first time in three months. Still, the recovery of domestic demand was modest and imbalanced. “The demand for intermediate goods and investment goods was relatively high, while the demand for consumer goods was weak, reflecting consumers’ lack of purchasing power,” Wang said.

New export orders further shrank in September, at a faster clip than the previous month. Overseas demand was relatively weak, which was dragged down by the emergence of the epidemic overseas and a shortage of shipping capacity, Wang said.

|

Employment in the manufacturing sector contracted at a steeper rate in September than in the previous month. Surveyed enterprises said they were cautious about hiring new workers. As a result, the gauge for backlogs of work, staying in positive territory, rose to the highest since March 2020.

In September, the measure for input costs rose in expansionary territory, reaching its highest level in four months, a sign of the growing inflationary pressure facing manufacturers. That was mainly because of a sharp increase in the prices of energy, industrial metals and electronic components, the survey showed. The rising cost pressure was transmitted downstream to consumers, with output prices growing at the fastest pace in three months.

Manufacturers maintained a positive outlook for their businesses for the next 12 months, with the measure for future output expectations rising to its highest in three months in September. Surveyed enterprises were optimistic about the prospects for the market and for getting the Covid-19 outbreak under control.

The survey, which was carried out from Sept. 13 to Sept. 22, came as many regions in China were in the grip of a power shortage. Electricity cuts are being felt by both industry and residents alike. An export boom, lack of coal and local government efforts to curtail industrial energy use and meet carbon reduction targets have contributed to this new wave of electricity cuts, which could further drive up costs of industrial production and disrupt the global supply chain, analysts said.

Read more

What’s Behind China’s Regional Power Outages

Economists at Nomura International (Hong Kong) Ltd. said that local governments in some key economic powerhouses, including Jiangsu, Zhejiang and Guangdong provinces, have imposed draconian measures to limit power usage, which could put a dent in the country’s manufacturing activity, according to a report released Monday.

They cut their estimation for year-on-year GDP growth in this year’s third quarter to 4.7% from 5.1%, and cut the fourth quarter GDP growth forecast to 3% from 4.4%. Economists at Macquarie Capital Ltd. also wrote in a Monday note that their 8.5% GDP growth forecast for 2021, which was set a year ago, is facing downside risks due to the power crunch.

“(I)n the coming months, the government should focus on improving epidemic prevention and control and alleviating supply-side pressure,” Wang said. “It should also find a balance among multiple objectives, such as promoting employment, maintaining the stability of raw material prices, ensuring a stable and orderly supply, and meeting targets for controlling energy consumption.”

Contact reporter Tang Ziyi (ziyitang@caixin.com) and editor Michael Bellart (michaelbellart@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- PODCAST

- MOST POPULAR