Rising Energy Costs Send China’s Factory Inflation to Record High

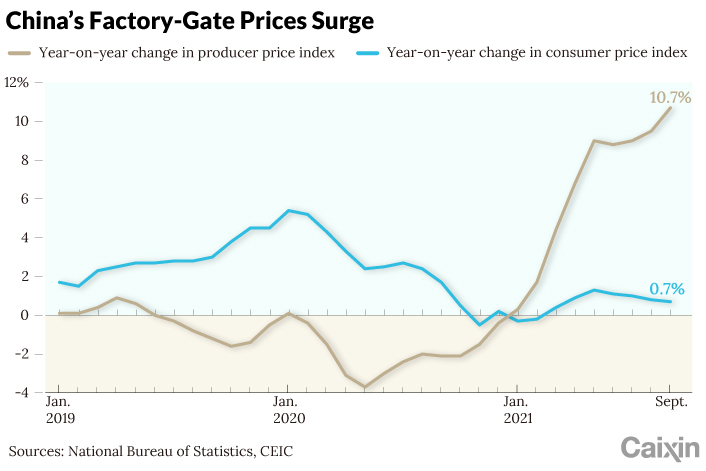

China’s factory-gate inflation leapt to the highest on record in September due to high energy prices, official data showed Thursday.

The producer price index (PPI) rose 10.7% (link in Chinese) from a year earlier, a growth rate that has never been seen in official data going back to 1996, according to the National Bureau of Statistics (NBS). The reading beat the median forecast for a 10.3% gain from a Caixin survey (link in Chinese) of economists.

Meanwhile, the consumer price index (CPI) rose 0.7% (link in Chinese) last month from a year earlier, following a 0.8% gain in August, according to the NBS. Food prices remained a major drag on the index, declining 5.2% year-on-year.

The NBS attributed the accelerating PPI growth (link in Chinese) primarily to the rocketing prices of coal and the products created by industries that require a lot of energy, like aluminum. Last month, prices in the coal mining and washing industry surged 74.9% year-on-year, 17.8 percentage points higher than in August.

The rapid rise in coal prices was a result of some local governments’ moves to curb output, leading to supply disruptions that caused severe power cuts in some places last month, some analysts said. Regulators have since vowed to stabilize coal supplies, and encouraged some coal mines to unleash more capacity (link in Chinese).

Read more

Cover Story: How China Stumbled Into a Giant Energy Shortage

NBS data showed that last month, prices in the crude oil and gas production industry were up 43.6% year-on-year. The increase reflected a global energy crisis, which has been worsening since September, some analysts said.

|

A surge in commodity prices has led to faster growth of prices in downstream processing industries. In the fuel processing industry, prices jumped 40.5% year-on-year in September, higher than the previous month’s 35.3% growth rate.

The outlook for factory-gate prices in the coming months largely depends on how the recently issued policies to restore the coal supply end up working, analysts at Shenwan Hongyuan Securities Co. Ltd. wrote in a note (link in Chinese).

In contrast, sluggish consumer demand was reflected in the milder CPI growth figure for September. Year-on-year growth in the core CPI, which strips out volatile items such as food and energy, stayed at 1.2%, unchanged from the previous month, according to the NBS.

Consumers’ nonfood spending is going through a sluggish recovery due to the repeated flare-ups of Covid-19, as well as structural unemployment, analysts at brokerage Hongta Securities Co. Ltd. wrote in a note (link in Chinese). They also warned that a large gap between the PPI and CPI growth is putting more pressure on corporate profitability and employment.

Contact reporter Guo Yingzhe (yingzheguo@caixin.com) and editor Michael Bellart (michaelbellart@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- PODCAST

- MOST POPULAR