Weekend Long Read: How the Big Four Iron Miners Squeeze Chinese Steelmakers, and What China Can Do

Fluctuations in iron ore prices have long been a headache for China. They fell significantly in September from a period of all-time highs beginning in May. Guaranteeing the availability of the resource can be especially hard when prices are up, as it detracts from Chinese steel company profits while weakening overall competitiveness among manufacturers downstream. Hopes of identifying solutions for China’s steel companies lie in revisting the market controls and costs at play for the “Big Four” international mining companies — Rio Tinto PLC, Vale SA, BHP Group Ltd. and Fortescue Metals Group Ltd.

Price swings

Over a long period from the early 1980s to the early 21st century, international iron ore prices remained relatively stable. At the time, Japan was the biggest international trader of iron ore, and the price was stable at around $20 per ton.

China overtook Japan as the world’s biggest iron ore trader in 2004, at which point demand for iron ore in the booming economy became the leading factor affecting price changes. This was when the Big Four leveraged their weight in the market to negotiate aggressive long-term agreements, driving up the price of iron ore.

|

|

Annual pricing — the longstanding industry method — was abandoned when long-term negotiations ended in 2010. Since then, the Big Four have adopted an index pricing mechanism that is closely linked to spot market prices, tightening the relationship between iron ore’s negotiated and spot prices. Compared with annual pricing, the mechanism is more flexible, with wider price ranges and greater fluctuation.

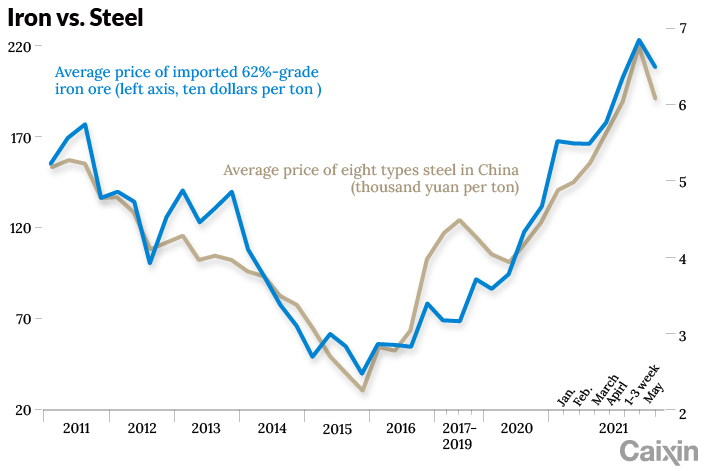

From 2011 to 2015, in the wake of the global financial crisis, the global steel industry, including China’s, was mired in overcapacity — pushing steel prices and profit margins down. Iron ore prices declined in step, from $193 per ton in 2011 to $38 per ton in 2015, its lowest point in nearly a decade.

|

China’s steel industry, however, found success in resolving its overcapacity problem to lead the global steel industry’s sustained rapid development in the four years up to 2020. Crude steel production surged, and the price of iron ore began to rebound in 2016, reaching a reasonable range below $100 per ton through the third quarter of 2020. Relatively fair iron ore prices have facilitated the sound development of the steel industry globally.

However, in the fourth quarter of 2020, the coronavirus pandemic, China-Australia relations and quantitative easing monetary policies in Europe and North America triggered a series of irrational rises in iron ore prices. Since the beginning of this year, the steel industry has witnessed a rise in both quantity and price, with iron ore prices hitting repeated record highs.

Behind the price hike was China’s promising economic recovery from the pandemic, with factors including high demand, high crude fuel costs, the constraints of the carbon peaking and carbon neutrality goals, environmental policy restrictions on production, capital speculation and expectations of reduced volume.

But why iron ore prices have came down in recent months is that although short-term quantitative easing monetary policies targeted economic recovery, the world economy is far from pre-pandemic levels. Also, in the context of the twin carbon goals, China’s steel industry — which produces more than half of world’s total output — is seeing less demand, in turn reducing the demand for iron ore.

How the Big Four control the market

In terms of supply-demand fundamentals, the price of iron ore correlates to a large extent with the development of the steel industry, but behind this lies a deeper pattern — the Big Four use their high-quality resources and low-cost advantages to establish market dominance and take in greater benefits. They manage to do this in several ways.

First, controlling high-quality resources, and financializing iron ore

The Big Four possess the world’s best iron ore resources. Their combined production accounts for approximately 46% of the global total and trading volume accounts for approximately 68% of the global total. Their market concentration demonstrates obvious strengths. In addition, the indexation and financialization of iron ore pricing have given the Big Four greater control over iron ore pricing rights.

Indexes serve as pricing bases for long-term and spot trading. However, there are a number of problems that arise from relying on an index, such as the impact of the futures market, sample quantity, and failure to fully or objectively reflect true supply and demand conditions. The result is that the spot market price (only 20%–30% of the total market) determines long-term negotiated prices (which makes up a much larger share of 70%-80% of the market). Exponential samples are mainly provided by traders and small to midsize steel companies. Large steel companies use mainly long-term agreements, seldom purchasing spot goods, so indexes cannot effectively reflect their trading prices.

Besides that, the Big Four can leverage their market positions and major shareholders’ financial background to control the spot market price through capital markets, shipment markets and business operations such as shipment control, which further affects the futures market and sends iron ore prices beyond the reasonable range determined by supply-demand relations. Iron ore derivatives such as swap contracts and index futures also provide channels for speculative funds. Pricing trends in the spot market are largely affected by the price of iron ore financial products. When it comes to the over-financialization of iron ore, the international Big Four are the biggest winners.

Second, leveraging cost advantage to expand market share

Starting in 2011, the Big Four began leveraging their high-quality mineral resources and concentration advantages, as well as their low costs, to squeeze high-cost mines. They then drove up prices by virtue of mines’ long recovery cycles and slow pace of construction on newly invested mines, thereby earning even higher business profits.

From 2011 to 2015, in the face of weak iron ore demand and a continuous decline in prices, the Big Four actively expanded capacity and upped production against the trend to neutralize the negative impact of the dropping prices. They also made use of their cost advantage to squeeze high-cost miners, including those in China, out of the market and quickly expand their market share. Restricted by a low industrial concentration, a heavy tax burden, low operating efficiency, high costs and environmental policy, small and midsize mines gradually withdrew from the market. Chinese mines saw a continuous decline in production since the peak in 2014. The Big Four were thus able to consolidate their control over the world’s ore market, forcing China’s steel industry into increasing dependence on imported ore. They laid the foundation for a new round of iron price hikes that would bring even greater benefits to their businesses.

Third, accurately predicting demand in the Chinese market

Since the beginning of the new century, international mining giants have had quite a good grasp on the development cycle in the global steel market. They have accurately predicted market demand and actively developed a picture of the Chinese market. Despite the financial crisis and overcapacity in steel from 2011 to 2015, China’s iron ore demand is one thing they have remained confident about.

From 2016 to 2020, a structural reform of the supply side of the steel industry successfully phased out more than 150 million tons in excess production capacity and cleared more than 100 tons of substandard steel, hitting the country’s 13th Five-Year Plan target well in advance of schedule. 2016 brought other good news too. First, the steel industry stopped turning a loss; companies’ operating efficiency began to take a turn for the better; market operations improved.

Second, industrial benefits drove investment, and there was a surge in crude steel production. Iron ore prices began to rise in 2016, and China’s reliance on imported iron ore also showed sustained growth, exceeding 80% of capacity for five consecutive years. In 2020, the average price of China’s imported iron ore came to approximately $101.65 per ton, a year-on-year increase of 7.2%. With rises in both the quantity and price of imported ore, the Big Four once again made plans based on China’s economic trajectory and iron ore demand for maximum benefit.

What’s the main cost for the Big Four?

Let’s start with what China has paid. The landed costs for China’s imported iron ore include offshore cash costs and shipment costs.

Offshore cash costs are made up of mining and beneficiation costs, management and maintenance fees, royalties and mine-to-port freight. Meanwhile, China’s landed cash costs consist of offshore cash costs and ocean freighting to the port of Qingdao in Shandong province. The cost data only includes cash costs, excluding the Big Four’s financing and depreciation expenses.

• Offshore costs of iron ore are very low for the Big Four, at around $20 per ton, not exceeding $30 per ton. In the past two years, the Big Four’s average offshore costs have risen to varying degrees but remained at an overall low level.

• Shipment costs for the Big Four’s ocean freight do not significantly fluctuate under normal conditions. In order to ensure the long-term transportation capacity of iron ore, the Big Four generally mitigate the impact of freight price fluctuations through long-term chartering agreements, generating no costs related to shipbuilding, ownership or operations in the process.

In 2018, for example, Vale negotiated with shipowners to reach an agreement on long-term chartering; the corporation would rent 47 new-type super-large ore carriers with a capacity of 325,000 tons. The shipowners planned to build new ships in China, South Korea and Japan for delivery between 2019 and 2023. These will be equipped with engines resembling the ones used on second-generation Valemax ships, but more fuel-efficient and with lower overall shipment costs. Vale is thus expected to maintain relative stability in its iron ore shipment costs, or even see a fall in such costs.

• China’s average landed costs, from 2015 to 2020, the Big Four’s average did not exceed $40 per ton. Compared with the fluctuation in iron ore prices, the fluctuation in costs is rather small, effectively supporting the Big Four’s massive profits.

Since 2020, iron ore prices have remained high. Recently they have even surpassed $230 per ton. Meanwhile, the Big Four have seen little change in their iron ore costs. The Big Four’s abnormally high profits have severely reduced profit margins for steel companies downstream, which is harmful to downstream manufacturing and the sound development of the entire industry chain.

Policy suggestions

The huge difference between the Big Four’s main iron ore costs and prices offers a clear conclusion: irrational ore prices that have led to the Big Four’s abnormally high profits, which has had a directly negative impact on the sound development of the global steel industry. The strategic security of iron ore resources is a crucial issue for China’s steel industry in the next stage of national development.

Relevant departments should execute high-quality, top-level design and policy guidance on long-term mechanisms for the strategic safety of iron ore resources. We should coordinate construction of iron ore bases overseas, and research and establish a national mechanism for the strategic reserve of iron ore resources. In addition, we can encourage mergers and reorganization among domestic mines as well as their green and intelligent development and build multilevel platforms guaranteeing the strategic safety of iron ore resources. Chinese regulators, industry and enterprises should all act to guarantee the strategic security of iron ore resources.

Meanwhile, we should pay close attention to the iron ore market, squeeze out capital speculation, establish an order model and a scientific, reasonable pricing mechanism conducive to long-term upstream-downstream cooperation.

Zhang Longqiang is the director of the China Metallurgical Information and Standardization Institute.

Contact editor Heather Mowbray (heathermowbray@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- PODCAST

- MOST POPULAR