China Carbon Watch: Trading Price Hits Record Low

Week at a glance (Oct. 18 to 22)

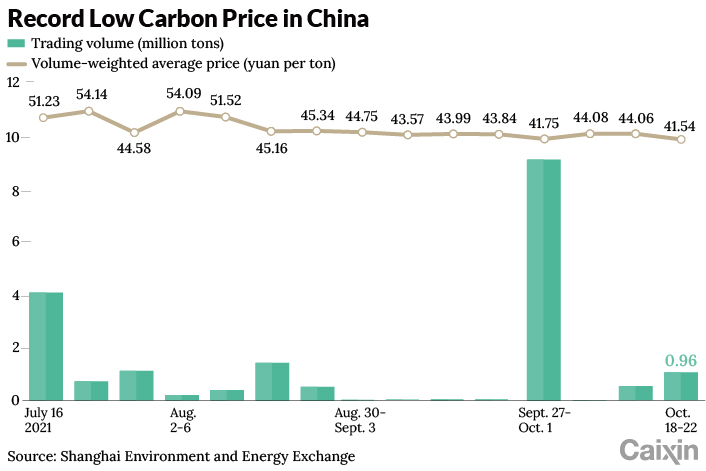

• China’s national carbon emissions allowance (CEA) market continued its recovery after the National Day holiday. Still, the high levels of block trades did not stop the volume-weighted average price hitting the lowest since the market’s July launch, at 41.54 yuan ($6.51) per ton.

• Trades of China certified emission reduction (CCER) credits increased almost fivefold to their highest level in months, with Tianjin accounting for 56.6% of the nine markets’ total CCER trades.

• China outlined plans to develop standards related to green development, ranging from industry-specific energy consumption limits to standards used for the verification and validation of emissions generated in the process of manufacturing essential products.

Carbon markets update

• China’s national CEA market continued its rebound after the National Day holiday week.

|

The CEA market ended the week with a total volume of 960,536 tons, up 92.8% from the previous week. A breakdown shows that open market transactions totaled 120,536 tons, while block trades again accounted for most of the activities at 87.5%.

Prices for open market transactions closed the week down 2.07% to 42.99 yuan per ton, while their volume-weighted average price was down 3.61% to 43.05 yuan per ton. Since early September, open market prices have stabilized at around 44 yuan per ton, after a steep drop from more than 50 yuan per ton in August.

Including block trades, the total volume-weighted average for the week was down 5.73% to 41.54 yuan per ton, hitting its lowest since the week of July 30.

• CCER markets’ total weekly volume hit a multiple-month high of 4,343,292 tons, a nearly sixfold increase from the previous week.

|

Tianjin led the markets, accounting for 56.6% of the total volume, followed by Shanghai and Chongqing. Chongqing also hit its highest volume since January. Beijing had a single ton of weekly trades for the second week in a row. The Fujian market did not have any CCER activity for the seventh consecutive week, while Hubei did not see any CCER trades for the ninth week.

Of the nine regional markets, only Shanghai, Beijing and Hubei display daily CCER price information. Guangdong reported weekly averages each Monday before Sept. 27. After an absence of three weeks, it resumed reporting on Oct. 18 for the week of Oct. 11 to 15. Shanghai discloses its cumulative total values, from which the offline trade price can be inferred.

Climate policy update

• China has issued a blueprint for developing industry standards.

At an Oct. 19 press conference, officials from six central government agencies discussed the recently published Outline for National Standards Development. This blueprint spells out the goals and measures to develop industry standards by 2035 to support economic activities ranging from natural resources development and manufacturing to health care and artificial intelligence.

The document devotes an entire section to relevant standards for ensuring the country’s green development. Standards to be improved or further developed include energy consumption limits, energy efficiency requirements for products and equipment, energy consumption verification and validation, regional and industry-specific carbon emissions verification, greenhouse gas emissions standards for critical industries and products, as well as carbon capture, storage and utilization.

Read more

Energy Insider: China Releases Potash Reserves to Stabilize Fertilizer Market

Scientific developments

• A latest modeling study in Nature estimates a modest reduction of total global energy expenditures in a warming world.

A team of researchers from the U.S. and China, led by the University of Chicago, concluded in their study “Estimating a Social Cost of Carbon for Global Energy Consumption” that for every ton of carbon dioxide released into the atmosphere today, annual global energy expenditures could decrease by between $1 and $3 by 2099. The study results suggest that electricity spending could increase in tropical and subtropical middle-income regions (e.g., parts of China, India and Mexico), but this spending could be offset by decreasing expenditure on fuels such as coal and natural gas heating in colder high-income countries. The reduction of global energy spending in colder climates is clearly not all good news, especially when most of the increases will occur in lower-income countries. At the same time, the benefit of lower energy spending goes to richer countries.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

Get our free ESG newsletter.

- MOST POPULAR