China Carbon Watch: Trading Volume Hits Weekly Record

Week at a glance (Sept. 27 to Oct. 1)

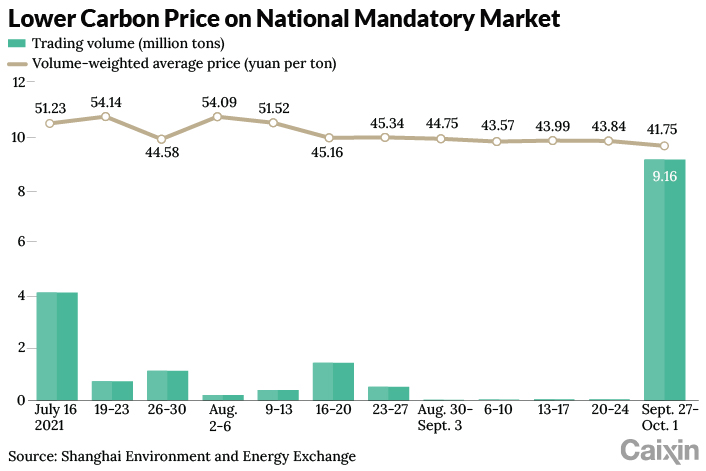

• China’s national carbon emissions allowance (CEA) market, the world’s largest, saw a significant surge in trading volume as block trades returned on the final business day of the week, making it the most active day on record. More than 9 million tons of CEA were traded during the holiday-shortened week, with the price down 4.85%, closing at 42.21 yuan ($6.55) per ton.

• Only 90% of entities covered by the CEA market have opened trading accounts. Most predict a more active market in the final quarter of the year.

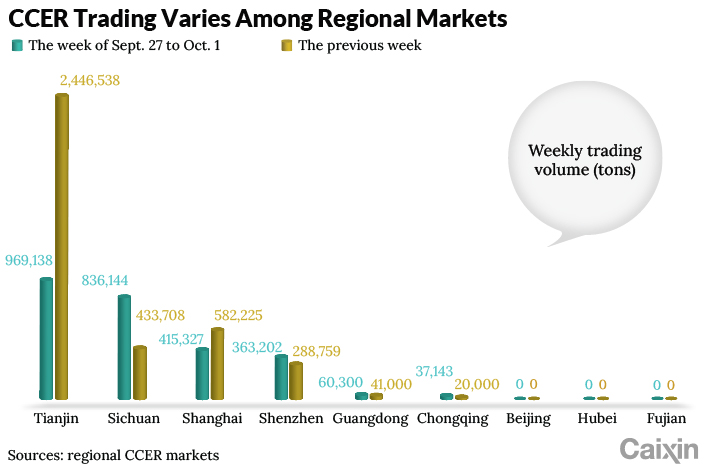

• The total trading volume for China certified emission reduction (CCER) credits across all nine regional exchanges decreased by 29.7% from the previous week, staying over 2.6 million tons.

• The Shanghai Environment and Energy Exchange (SEEE) announced 100% compliance for the eighth consecutive year for entities covered by its CEA scheme.

|

Carbon markets update

• Over the holiday-shortened week, the national CEA market saw a significant surge in total trading volume, but had a lower closing price.

The CEA market ended the week with its total volume increasing almost 800 times from the previous week to 9.15 million tons, surpassing 1 million ton for the first time in six weeks. Block trades came back for the first time in five weeks with a volume of 8.98 million tons, accounting for 98.1% of the total weekly volume. Most of the block trades (8.4 million tons) occurred on Sept. 30, making it the most active day on record. Since the national market launch on July 16, block trades have accounted for 68.1% of the total cumulative volume. Prices for open market transactions closed the week down 4.85% to 42.21 yuan per ton, while the volume-weighted average price was down 3.58% to 42.27 yuan per ton. Including block trades, the total volume-weighted average was down 4.76% to 41.75 yuan per ton.

• CCER markets’ total volume decreased by 29.7%, while individual markets remained unpredictable.

The volume across the nine regional pilot markets decreased to 2.68 million tons, led again by the Tianjin market at 969,138 tons. The Sichuan market saw a near doubling of volume to 836,144 tons, being the second-most active market. Beijing, Fujian and Hubei did not see any CCER trades. This is the third consecutive week without any CCER activity for the Beijing market, the fourth week for Fujian, and the sixth week for Hubei.

|

• Emissions allowance submissions were due on Sept. 30 for the 2020 compliance year for entities covered under the Shanghai emissions trading system.

Sept. 30 was the allowance submission deadline for Shanghai and Chongqing’s 2020 and 2019 compliance years, respectively. Both markets saw relatively healthy CCER trading volume for the week.

Read more

Caixin ESG Biweekly: Province Tries to Balance Its Energy Past With an Industrial Future

Market updates

• 100% compliance in Shanghai’s regional CEA market

By the end of Sept. 30, all entities under the jurisdiction of the Shanghai Municipal Bureau of Environment and Ecology and subject to the Shanghai regional CEA limit had submitted the required number of CEAs for the current 2020 compliance year. The SEEE stated that by the end of September, the Shanghai CEA market had a cumulative spot trading volume of 173 million tons with a total value of 2 billion yuan (link in Chinese). The SEEE also announced in a separate notice that the second regional CEA auction for the 2020 compliance year did not receive any bid from market participants on the auction day (Sept. 30) and therefore did not proceed as planned. The SEEE cited the fact that all covered entities had secured required CEAs for the current compliance year prior to the auction as the reason for the lack of any bid.

Read more

Energy Insider: China Certifies First Carbon-Neutral Oil Shipment

Industry news

• Recent power shortages and restrictions may be market-driven

Under a wave of power shortages and industrial power use restrictions, cctv.com, the official webpage of state-run TV network China Central Television, published an editorial on Sept. 29 outlining three major reasons behind the power crunch — nationwide coal shortage, pricing mismatch between thermal coal and base electricity prices, and the reduction of the net capacity of the connecting lines between power plants and the grid. This editorial also faulted some local governments for their “movement-like” actions to achieve carbon reduction goals after failing to update their industry structure and manage energy usage. The editorial appears to hint at a direct connection between the warning received by provinces like Zhejiang for not achieving reduction goals for total energy usage and energy intensity goals, and the production suspensions implemented in places such as the city of Shaoxing in the province. Multiple media outlets in China have separately reported in recent days that the control over base electricity pricing has been loosened in various parts of the country in an apparent attempt to realign coal and electricity prices and ease the power shortage.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

Get our free ESG newsletter.

- PODCAST

- MOST POPULAR