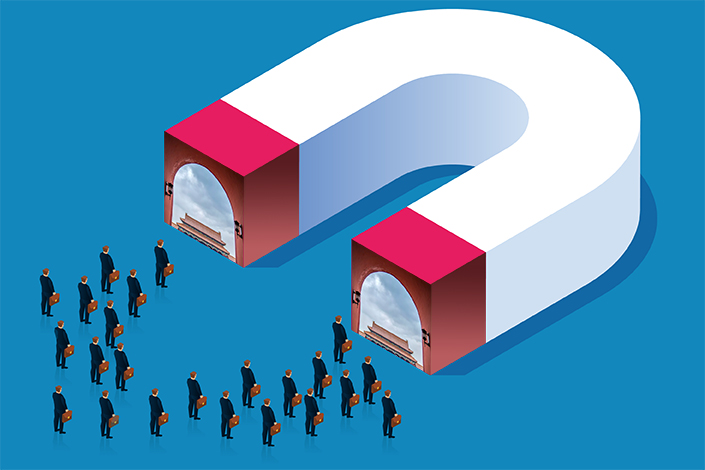

In Depth: China’s Opened Its Doors to Foreign Financial Firms — Can They Prosper?

Over the past three years, China has accelerated the opening-up of its financial sector, giving foreign institutions unprecedented access to investors in the world’s most populous nation and to one of the biggest capital markets.

After pledging in 2017 to remove barriers to ownership, the government finally started to give the green light in 2020 for companies including Goldman Sachs Group Inc. to operate wholly owned companies on the Chinese mainland for a range of financial services including mutual fund management, life insurance, and securities and futures broking.

- PODCAST

- MOST POPULAR