In Depth: China’s Weaker Insurers Skip Early Bond Redemptions Amid Growing Financial Stress

Listen to the full version

Some of China’s weaker insurance companies are choosing not to proceed with the early redemption of bonds issued to bolster their balance sheets, highlighting the financial strains facing many smaller insurers as they struggle to meet capital adequacy requirements.

Two Chinese insurers, both known to have problems with low solvency, announced in the first quarter that they wouldn’t exercise call options on supplementary capital bonds (SCBs), even though they will have to pay higher interest rates on the debt over its remaining term.

Unlock exclusive discounts with a Caixin group subscription — ideal for teams and organizations.

Subscribe to both Caixin Global and The Wall Street Journal — for the price of one.

- DIGEST HUB

- Weak Chinese insurers, such as Aeon Life and Pearl River Life, are not redeeming supplementary capital bonds (SCBs) to maintain solvency.

- Stricter regulatory frameworks and financial strains, partly due to the COVID-19 pandemic and ties to the troubled property sector, have hindered their capital adequacy.

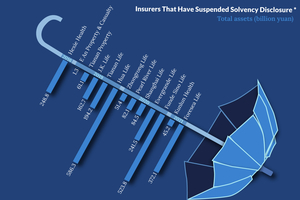

- Industry estimates indicate 20 billion yuan worth of SCBs have been issued by financially compromised companies out of 360 billion yuan outstanding.

Smaller Chinese insurance companies are refraining from early redemption of bonds designed to bolster their balance sheets due to financial strain and the need to meet capital adequacy requirements. Two insurers, Aeon Life Insurance Co. Ltd. and Pearl River Life Insurance Co. Ltd., announced in the first quarter that they would not exercise call options on their supplementary capital bonds (SCBs) issued in 2019, despite facing higher interest rates on the remaining debt term [para. 1][para. 2][para. 3].

Industry sources revealed that the insurers needed the funds to maintain their solvency ratios, which measure an insurer's ability to meet long-term obligations such as settling claims and paying out on policies [para. 4]. A source pointed out that not exercising a call option is a clear indication of financial instability, with bondholders potentially unable to recover their principal once the bond matures [para. 5]. It is estimated that out of the around 360 billion yuan of SCBs issued by insurers, approximately 20 billion yuan is attributed to companies with solvency issues [para. 6].

China's insurance sector, the second largest globally with total assets reaching 30 trillion yuan, has been marred by misconduct and poor corporate governance. To combat this, regulators introduced the C-ROSS regulatory framework in 2016 and an updated version, C-ROSS II, in 2022, pressuring weaker insurers to raise more capital to meet higher solvency standards amid weakened balance sheets and profitability post-COVID-19 [para. 7][para. 8].

Insurance companies generally issue SCBs to replenish capital and improve solvency ratios. These SCBs typically have a ten-year maturity with a five-year call option allowing the issuer to repay the principal and interest in full. Most insurers opt to exercise these options to avoid higher interest rates, which rose from 6.25% to 7.25% for Aeon and Pearl River's SCBs [para. 10]. Regulations from 2015 stipulate that insurers can only exercise a call option if their comprehensive solvency ratio remains at least 100% post-move [para. 11].

The decision by Aeon and Pearl River to incur higher financing costs rather than redeem the SCBs suggests they would likely fall below the required capital adequacy ratio if they returned the bond proceeds [para. 12]. Despite not disclosing up-to-date solvency ratios, the most recent available data shows Pearl River had a solvency ratio of 105.5% at the end of 2021 [para. 15].

Due to their failure to provide necessary information, credit rating agencies announced they would no longer rate the SCBs of Aeon and Pearl River [para. 18]. Both insurers have strong ties to China’s troubled property sector, significantly affecting their financial stability. Aeon’s largest shareholder is Dalian Wanda Group Co. Ltd., which has been selling assets to sustain its property business. Similarly, Pearl River’s owners include multiple developers, and much of its insurance funds are invested in the real estate sector, some of which have defaulted [para. 21][para. 23].

Other insurers like Tianan Property Insurance, Tianan Life Insurance, and Chang An Property and Casualty Insurance have also skipped call options on their SCBs due to operational and profitability challenges [para. 25]. Tianan Property and Tianan Life did so in 2020 after being taken over by the top insurance regulator, while Chang An didn’t exercise its call option in 2021 after its solvency ratio turned negative [para. 26].

- Aeon Life Insurance Co. Ltd.

- Aeon Life Insurance Co. Ltd. is a Chinese insurer known to have solvency issues. In February, Aeon decided not to redeem a 2 billion yuan SCB issued in 2019, leading to higher interest rates on the debt. Its largest shareholder is Dalian Wanda Group Co. Ltd., which has been offloading assets to support its property business. Aeon has also stopped disclosing its solvency ratio data.

- Pearl River Life Insurance Co. Ltd.

- Pearl River Life Insurance Co. Ltd. chose not to redeem a 1.8 billion yuan SCB issued in 2019 to maintain solvency. Its most recent solvency ratio data is from late 2021, showing 105.5%. The company is heavily invested in the troubled property sector, with five of its seven shareholders linked to real estate. It has also ceased providing necessary information for credit ratings.

- Tianan Property Insurance Co. Ltd. of China

- Tianan Property Insurance Co. Ltd. of China, previously controlled by the failed conglomerate Tomorrow Holding Co. Ltd., has faced operational challenges and profitability pressures. The insurer did not exercise call options on its supplementary capital bonds in 2020 following a takeover by the top insurance regulator. Like others, it struggled with financial stability, reflecting broader issues within the insurance sector.

- Tianan Life Insurance Co. Ltd. of China

- Tianan Life Insurance Co. Ltd. of China is among the insurers that haven't exercised call options on their supplementary capital bonds (SCBs) due to operational problems or profitability pressures. Previously controlled by the failed conglomerate Tomorrow Holding Co. Ltd., Tianan Life skipped call options on its SCBs in 2020 following a regulatory takeover.

- Chang An Property and Casualty Insurance Co. Ltd.

- Chang An Property and Casualty Insurance Co. Ltd. saw its comprehensive solvency ratio turn negative in 2018 after paying out billions of yuan on insurance products for lending platforms. These products offered protection to lenders against borrower defaults. Due to these issues, Chang An did not exercise a call option in 2021 for an SCB issued in 2016.

- Dalian Wanda Group Co. Ltd.

- Dalian Wanda Group Co. Ltd. is an entertainment-to-property conglomerate founded by billionaire Wang Jianlin. The group has been offloading assets, including shopping malls and a controlling stake in Wanda's cinema unit, to keep its property business afloat amid financial strains in China's troubled property sector.

- PODCAST

- MOST POPULAR