In Depth: Regulators Turn Blind Eye to Banned Zero Down Payment Property Deals

Listen to the full version

Disguised zero down payments, which are officially banned in China, have become a growing trend in some cities as developers of new homes and owners of pre-owned homes are desperate to sell in a sluggish market. Experts warn that such practices will distort home price statistics and increase risk for mortgage lenders.

In the southern city of Huizhou, Guangdong province, the developer of a new housing project is attracting buyers with a range of incentives such as zero down payments, complimentary parking spaces and five years of free property management.

Unlock exclusive discounts with a Caixin group subscription — ideal for teams and organizations.

Subscribe to both Caixin Global and The Wall Street Journal — for the price of one.

- DIGEST HUB

- Developers and homeowners in China are using disguised zero down payments to attract buyers in a sluggish market, raising concerns about distorting price statistics and increasing lenders' risks.

- Officially, paying less than 20% as a down payment is illegal in China, yet developers in cities such as Huizhou and Dongguan are reportedly offering incentives like complimentary parking and property management.

- Despite the risks, banks remain cautiously optimistic, maintaining low non-performing mortgage rates, while local governments and developers seek sales boosts, sometimes overlooking the illegal practices.

Disguised zero down payments are gaining traction in some Chinese cities, despite being officially banned, due to the sluggish property market and the desperation of both new home developers and pre-owned home owners to attract buyers.[para. 1] In Huizhou, Guangdong province, developers employ incentives such as zero down payments, free parking spaces, and several years of complimentary property management to lure buyers. For instance, a property listed at 1.1 million yuan ($152,000) is effectively reduced to 880,000 yuan ($122,000), with the developer covering the 20% down payment on behalf of the buyer.[para. 2][para. 3]

This sales strategy has appeared in various cities, with Dongguan's real estate agency association condemning it as illegal and urging agents to stop offering such schemes.[para. 4] According to Chinese law, a down payment for residential properties must be at least 20-30%, as enforced by the central bank to mitigate risks associated with falling house prices.[para. 5] However, with the market stagnating, some local governments are overlooking these illegal practices in favor of prioritizing market stabilization.[para. 6] This results in homes being sold at prices significantly lower than advertised, thus distorting property market statistics and affecting policy decisions.[para. 7]

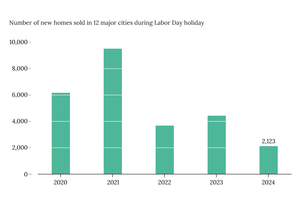

In Huizhou, for example, the listing price of a residential project fell from 18,000 yuan per square meter in 2021 to 14,000 yuan by the end of 2022, a 22% drop[para. 8]. Official data, however, show only a 2.8% decline in new home prices for the same period, a discrepancy attributed to zero down payment schemes.[para. 7][para. 8] Additionally, Huizhou has implemented policies to stabilize home prices, like mandating that prices should not fall below 70% of the registered price; however, developers circumvent this by offering cash rebates or disguised discounts.[para. 9][para. 10][para. 11][para. 12]

The zero down payment tactic manifests in various forms, including loans and installment plans. For example, in Shenzhen, mortgage intermediaries have proposed partnerships to help buyers secure down payment loans.[para. 13] Developers in other cities, such as Dalian and Xuzhou, offer further incentives like gold gifts and free parking.[para. 14] For pre-owned homes, buyers manipulate appraisal values to qualify for larger loans, effectively reducing their down payments, a practice facilitated by selective referencing of recent sales by appraisal agencies.[para. 15][para. 16][para. 17][para. 18]

Despite these practices, major lenders have managed to keep non-performing mortgage rates low, between 0.83% and 1.37% among China’s six largest state-owned banks in 2023. Banks monitor and revaluate collateral regularly to manage risk.[para. 19][para. 20] Although official bans on zero-down-payment loans exist, local regulators often turn a blind eye due to the prolonged market slump. Regulatory bodies have issued warnings and penalized violators, but demands for policy relief persist, with some suggesting more flexibility around the ban could benefit buyers who struggle with high down payments.[para. 21][para. 22][para. 23]

In a broader context, consistent income growth and economic stability are essential for people to afford mortgages confidently, indicating a more profound need to build trust in the market’s long-term viability.[para. 24][para. 25][para. 26]

- Centaline Property

- Centaline Property, based in Guangzhou and led by General Manager Huang Tao, advocates for policy relief in the property market. Huang emphasizes the need for consistent income growth to build trust in the market's long-term viability, highlighting current concerns about the stability of household incomes over the next 20 to 30 years.

- PODCAST

- MOST POPULAR