Coffee Goes off the Boil in China as Tims, Luckin and Starbucks Report Q1 Slump

Listen to the full version

China’s coffee market declined in the first quarter, as leading brands like Tim Hortons, Luckin Coffee, and Starbucks struggled to meet expectations amid economic uncertainties and shifting consumer behaviors in the world’s fastest-growing coffee market.

TH International Limited, known as Tims China and the exclusive operator of Canadian brand Tim Hortons coffee shops in China, released its financial results for the first quarter Wednesday. Despite a 3.1% increase in revenue, growth was primarily driven by franchise and other revenues, while self-operated store revenue rose a mere 0.2% year-on-year, and same-store sales fell by 11.7%. The company reported a net loss of 143 million yuan ($20 million), a slight improvement from the same period last year.

Unlock exclusive discounts with a Caixin group subscription — ideal for teams and organizations.

Subscribe to both Caixin Global and The Wall Street Journal — for the price of one.

- DIGEST HUB

- China's coffee market experienced a downturn in Q1, impacting Tim Hortons, Luckin Coffee, and Starbucks with disappointing performances.

- Tims China saw a 3.1% revenue increase mainly from franchising but reported an 11.7% drop in same-store sales and a net loss of ¥143 million ($20 million).

- Luckin Coffee and Starbucks reported significant losses and drop in same-store sales due to economic uncertainty and intense competition, with Starbucks experiencing an 8% revenue drop.

- Tims China

- Tims China, the exclusive operator of Tim Hortons in China, saw Q1 revenue increase by 3.1%, primarily due to franchise growth, though same-store sales fell 11.7%. The company reported a net loss of 143 million yuan ($20 million), slightly improving from the previous year. Since its 2019 entry, it has expanded to 903 stores and plans to exceed 2,750 by 2026. Despite initial successes, it struggled to meet economic and consumer expectations.

- Luckin Coffee

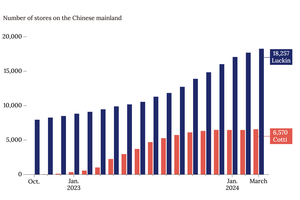

- Luckin Coffee, the largest coffee chain in China with 18,590 stores, reported challenges in the first quarter, including a non-GAAP net loss of 13.1 million yuan ($1.8 million) and a 99.3% year-on-year drop in operating profit. Same-store sales fell by 20.3%, attributed to reduced prices from promotions and high expansion costs. CEO Guo Jinyi emphasized expanding market share despite fierce competition, expecting challenges to continue into the second quarter.

- Starbucks

- Starbucks reported an 8% drop in first-quarter revenue in China, with comparable same-store sales falling 11%. Transaction volumes and unit prices decreased by 4% and 8%, respectively. CEO Laxman Narasimhan expressed disappointment with the performance and projected single-digit declines in same-store sales in China for 2024.

- 2019:

- Tims China entered the Chinese market.

- 2022:

- Tims China went public in the United States through a special-purpose acquisition company.

- June 2023:

- Luckin Coffee started its aggressive 9.9 yuan-per-cup marketing campaign.

- Late third quarter of 2023:

- Luckin’s operating margin started to decline.

- End of March 2024:

- Tims China operated 903 stores, including 302 franchised locations.

- First quarter of 2024:

- China’s coffee market faced a downturn.

- First quarter of 2024:

- Tims China reported a net loss of 143 million yuan ($20 million).

- First quarter of 2024:

- Luckin Coffee reported a non-GAAP net loss of 13.1 million yuan ($1.8 million).

- First quarter of 2024:

- Luckin Coffee's operating profit fell 99.3% year-on-year to 5 million yuan, with a razor-thin operating profit margin of 0.1%.

- First quarter of 2024:

- Starbucks reported an 8% drop in revenue in China with comparable same-store sales falling 11%.

- Wednesday, June 5, 2024:

- Tims China released its financial results for the first quarter.

- PODCAST

- MOST POPULAR