In Depth: China’s Insurers Prepare to Shine a Light Into Their Financial Black Box

Listen to the full version

China’s insurance companies are going through a seismic change that should make their opaque finances more transparent and give investors and regulators a better understanding of their underlying financial health.

But analysts say the overhaul, which stems from two new global accounting standards, could also make insurers’ profits, revenue, assets and liabilities more volatile, and affect their tax liabilities and key regulatory metrics, including their solvency ratios, a measure of their financial strength.

Unlock exclusive discounts with a Caixin group subscription — ideal for teams and organizations.

Subscribe to both Caixin Global and The Wall Street Journal — for the price of one.

- DIGEST HUB

- China's insurance sector is undergoing changes due to two global accounting standards (IFRS 9 and 17), intended to improve financial transparency but also causing volatility in profits and revenue, especially affecting solvency ratios.

- IFRS 17 notably forces the recognition of profit over the life of an insurance contract rather than when premiums are received, slashing reported revenue by up to 65% for life insurers.

- The adjustments lead to increased profits due to changes in reserve and investment accounting, though the standards result in larger OCI figures, suggesting a focus on balance sheets for investor assessments.

China's insurance industry is undergoing significant changes driven by the introduction of two new global accounting standards, IFRS 9 and IFRS 17, by the International Accounting Standards Board (IASB). These standards aim to increase transparency in the financial health of insurers by providing clearer insights into their assets and liabilities, ultimately benefitting investors and regulators. However, despite these intentions, the overhaul may lead to increased volatility in insurers' financial metrics, including profits, revenues, and solvency ratios [para. 1][para. 2].

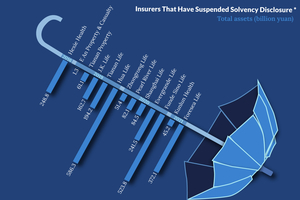

The adoption of these standards has already been reflected in the financial results of some Chinese insurance companies. For instance, China Life Insurance Co. reported a 2023 net profit of 21.1 billion yuan under Chinese accounting standards, which dramatically surged to 46.2 billion yuan under the new standards. The Ministry of Finance has mandated that overseas-listed insurers adopt these new rules by 2023, with all others required to comply by 2026. The implementation is complex and costly, and some insurers, particularly those facing financial difficulties, are struggling to begin the process [para. 3][para. 4].

Financial reports in the insurance industry are usually difficult to interpret due to the emphasis on balance sheets over profit and loss accounts. Insurers focus heavily on assets like unearned premiums and liabilities such as reserves, affected greatly by actuarial assumptions. The new standards are designed to demystify these reserves, making it harder for insurers to manipulate annual profits through liability adjustments [para. 5][para. 6][para. 7][para. 8]. The key metric in understanding insurers' financial health is their solvency ratio, which examines their capacity to withstand risks such as falling asset prices [para. 8].

IFRS 9 redefines how companies recognize risks associated with financial assets, compelling earlier loss recognition to ensure more forward-looking provisions. IFRS 17 standardizes profit recognition for insurers, focusing on delivery rather than receipt of premiums and requiring transparency in future profit expectations. This shift in revenue recognition heavily impacts life insurers, transforming how and when revenue is recorded, thus curbing tendencies to rapidly expand revenue by acquiring new business [para. 9][para. 10][para. 11]. The Ministry of Finance's prior test highlighted that these changes could reduce reported insurance revenue, notably affecting life insurance firms more severely [para. 12][para. 13].

Increased profits for insurers are reported as a result of the changes, partially due to shifts in accounting for reserves and investment valuations. For example, China Post Life Insurance saw a notable profit turnaround with the new standards. These changes are influenced by declining yields on Chinese government bonds, used by insurers as a benchmark for discount rates in valuing future liabilities [para. 14][para. 15][para. 16]. Under the new rules, insurers can redirect reserve changes due to discount rate variations from their income statements to other comprehensive income, affecting their net income calculation and possibly inflating profits [para. 17][para. 18].

The new standards also introduce challenges for determining solvency ratios and tax liabilities, potentially leading to increased volatility in net assets and tax burdens as total profits surge. Despite these financial boosts, analysts advise cautious interpretation, suggesting a greater emphasis on balance sheets and comprehensive income statements in evaluating insurer performance. Due to the significant components within other comprehensive income, traditional income statements might not provide an accurate financial depiction for these companies [para. 19][para. 20][para. 21][para. 22].

- China Life Insurance Co. Ltd.

- China Life Insurance Co. Ltd., a top life insurer in China, reported a 2023 net profit of 21.1 billion yuan under Chinese accounting standards. However, under IFRS 9 and IFRS 17, this figure more than doubled to 46.2 billion yuan. The company, adjusting to new international accounting standards, showcased a significant change in how assets are valued, impacting profit and solvency ratios significantly. It serves as a key example of the financial transitions faced by Chinese insurers.

- China Post Life Insurance Co. Ltd.

- China Post Life Insurance Co. Ltd. is an unlisted state-owned company that switched to the new accounting standards in 2023. It reversed a net loss of around 12 billion yuan last year to a net profit of 5.7 billion yuan in the first half of this year. This profit boost is attributed to changes in reserve and investment valuations under the new accounting rules, with the decline in Chinese government bond yields playing a significant role.

- 2020:

- The finance ministry organized a test of the potential impact of IFRS 17 on six insurance companies.

- 2023:

- Some Chinese insurance companies have adopted the two new global accounting standards set by the IASB, impacting their financial reports.

- 2023:

- Overseas-listed insurers in China are mandated to implement the new accounting standards.

- First half of 2023:

- China Life shows changes in reserves of 59.9 billion yuan in the OCI statement.

- First half of 2024:

- China Life reports changes in reserves amounting to 121.2 billion yuan in the OCI statement under new accounting policies.

- PODCAST

- MOST POPULAR