Tianan Property Insurance Defaults on $730 Million Bond in First for China’s Insurance Sector

Listen to the full version

Tianan Property Insurance Co. Ltd. has defaulted on a 5.3 billion-yuan ($730 million) capital supplementary bond — the first such failure in China’s insurance sector — after the troubled firm said it lacked the solvency to make the payment.

The insurer, a former affiliate of the dismantled Tomorrow Holding, said on Tuesday that it could not repay the principal or interest on the 10-year bond, which matured Tuesday. Issued in September 2015, the bond carried a coupon of 5.97% for the first five years, rising to 6.97% for the final five.

Unlock exclusive discounts with a Caixin group subscription — ideal for teams and organizations.

Subscribe to both Caixin Global and The Wall Street Journal — for the price of one.

- DIGEST HUB

- Tianan Property Insurance defaulted on a 5.3 billion-yuan ($730 million) bond, marking the first such default in China’s insurance sector.

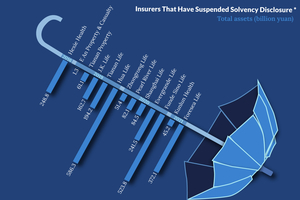

- The bond was excluded from the asset transfer to Shenergy P&C, leaving Tianan unable to repay due to insufficient solvency.

- Other Tomorrow Holding-linked insurers face similar pressures, though some, like Huaxia and Dajia Life, have managed to repay their debts.

- Tianan Property Insurance Co. Ltd.

- Tianan Property Insurance Co. Ltd. has defaulted on a 5.3 billion-yuan ($730 million) capital supplementary bond, marking the first such failure in China's insurance sector. The company, a former affiliate of Tomorrow Holding, cited a lack of solvency as the reason for its inability to repay the bond, which matured in September 2024. This default highlights the ongoing financial distress among firms previously linked to Tomorrow Holding.

- Tomorrow Holding

- Tomorrow Holding, a dismantled entity, previously owned Tianan Property Insurance Co. Ltd. (Tianan). Regulators seized Tianan and eight other Tomorrow Holding-linked financial institutions in July 2020. The collapse of Tomorrow Holding continues to have repercussions, epitomized by Tianan's recent bond default, highlighting financial distress among its former units.

- Shenergy Property & Casualty Insurance Co. Ltd.

- Shenergy Property & Casualty Insurance Co. Ltd. (申能财产保险有限公司) is a newly established entity that has acquired the insurance business, including assets, liabilities, and sales network, from Tianan Property Insurance Co. Ltd. However, Shenergy P&C is not responsible for repaying Tianan's defaulted capital supplementary bond.

- Tianan Life Insurance Co. Ltd.

- Tianan Life Insurance Co. Ltd. is mentioned as another former affiliate of Tomorrow Holding. It has a 2 billion yuan capital supplementary bond maturing on December 25th, and previously opted against a five-year redemption. The repayment status of a 750 million yuan privately placed bond that matured in January is unknown.

- Huaxia Life Insurance Co. Ltd.

- Huaxia Life Insurance Co. Ltd. is a former affiliate of Tomorrow Holding. Despite being a troubled insurer, it successfully repaid an 8 billion yuan bond in 2020. This stands in contrast to other former Tomorrow units that are facing difficulties honoring their debts.

- Dajia Life Insurance Co. Ltd.

- Dajia Life Insurance Co. Ltd. successfully repaid a 15 billion yuan bond in December 2020. This company absorbed the assets of Anbang Insurance Group Co. Ltd. and is mentioned as an example of a troubled insurer that managed to honor its debts, unlike some other former Tomorrow Holding affiliates.

- Anbang Insurance Group Co. Ltd.

- Anbang Insurance Group Co. Ltd. was a troubled insurer whose assets were absorbed by Dajia Life Insurance Co. Ltd. Dajia Life Insurance Co. Ltd. successfully repaid a 15 billion yuan bond in December 2020, demonstrating its ability to honor debts despite its troubled origins.

- September 2015:

- Tianan Property Insurance Co. Ltd. issued a 10-year, 5.3 billion-yuan capital supplementary bond with an initial coupon of 5.97%.

- July 2020:

- Tianan was among nine Tomorrow Holding-linked financial institutions seized by regulators.

- September 2020:

- Tianan Property Insurance skipped a redemption option for its bond, citing an ongoing asset review.

- 2020:

- Huaxia Life Insurance Co. Ltd. repaid an 8 billion yuan bond.

- December 2020:

- Dajia Life Insurance Co. Ltd. repaid a 15 billion yuan bond.

- January 2025:

- A 750 million yuan privately placed bond from Tianan Life Insurance Co. Ltd. matured; repayment status remains unknown.

- Before September 30, 2025:

- Earlier in 2025, Shenergy Property & Casualty Insurance Co. Ltd. took over Tianan’s insurance business, excluding the defaulted bond.

- September 30, 2025:

- Tianan Property Insurance Co. Ltd. defaulted on the 5.3 billion-yuan bond as it matured, citing lack of solvency.

- PODCAST

- MOST POPULAR