Luxury-Car Brands Shift Gears in China Market

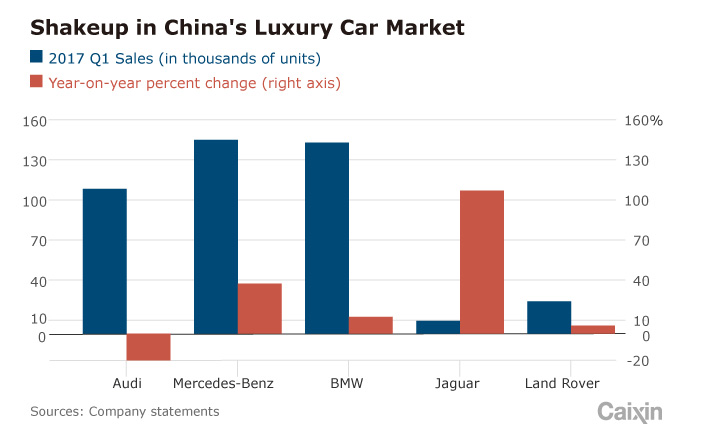

(Shanghai) – China’s luxury-car market is experiencing a shake-up, with Mercedes-Benz speeding past Audi to become the top seller in the first quarter of the year.

BMW AG, whose sales climbed 12.4% in the first quarter compared to the same period in 2016, ended up close behind Mercedes-Benz in second place in one of the world’s most important luxury-car markets. Audi fell to third place.

The three automakers claim most of the China luxury-car market, but the huge swings in sales — Audi’s fell by 20% — underscore how quickly Chinese brand preferences can change.

Jaguar Land Rover Automotive PLC, while far behind in terms of unit sales, saw a 107% gain in Jaguar sales in the period from a year before.

|

The Mercedes-Benz S-Class series, launched four years ago, now sees 30% of its total global sales volume coming from China. Underscoring how important China has become, the automaker launched its latest flagship model Maybach S680 here, with a name that represents luck and fortune in Chinese culture.

Meanwhile, Audi has had to endure not only a sales slump but also distributor disputes. Its owner Volkswagen Group’s proposed tie-up plans with China’s SAIC Motor Corp. Ltd. has upset its longstanding sole partner FAW Group Corp. Management at the FAW-Volkswagen joint venture were said to be “furious” when they learned about the deal last November.

Dealership investors of FAW-Volkswagen Automobile Co. Ltd. also acted against it, demanding that the new partnership be suspended until Audi’s annual sales reach 1 million units — sales are currently only at 60% of that target.

Jochem Heizmann, president and CEO of Volkswagen Group China, said at the auto show that while negotiations with FAW and its distributors are not over, he expects fast progress in reaching an agreement.

Heizmann said the company values the China auto market, especially luxury cars, and Audi will still push its collaboration with SAIC.

Jaguar Land Rover is a relative latecomer to the China market, first driving in in 2010. As a luxury carmaker, it plans to strengthen its sales network in smaller third- and fourth-tier Chinese cities, said Murray Dietsch, the president of its China joint venture Chery Jaguar Land Rover Automotive Co. Ltd.

BMW is the first German automaker to step into the nascent car-sharing business. It will bring its latest project ReachNow to China soon, allowing users to rent a car via smartphone and leave it anywhere. The company will promote the service in the southwestern Chinese city of Chengdu in the second half of the year, said Ian Robertson, a member of the BMW board.

The emerging car-sharing service will be a fast-growing business in China. Consultancy Roland Berger estimated that the domestic market will increase by 45% each year over the next decade.

The overall luxury-car market in China also looks promising, as the country might overtake the European Union to become the biggest luxury auto market by 2020, said Andreas Schaaf, vice president of Cadillac China, on Tuesday, Bloomberg reported.

Contact reporter Coco Feng (renkefeng@caixin.com)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 4Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas