China Brands Dial Up More Than Half of India Smartphone Market

(Beijing) — Chinese smartphone brands took more than half of India’s market for the first time in this year’s first quarter, using their experience in relatively high-quality, low-end models to steal share from homegrown players.

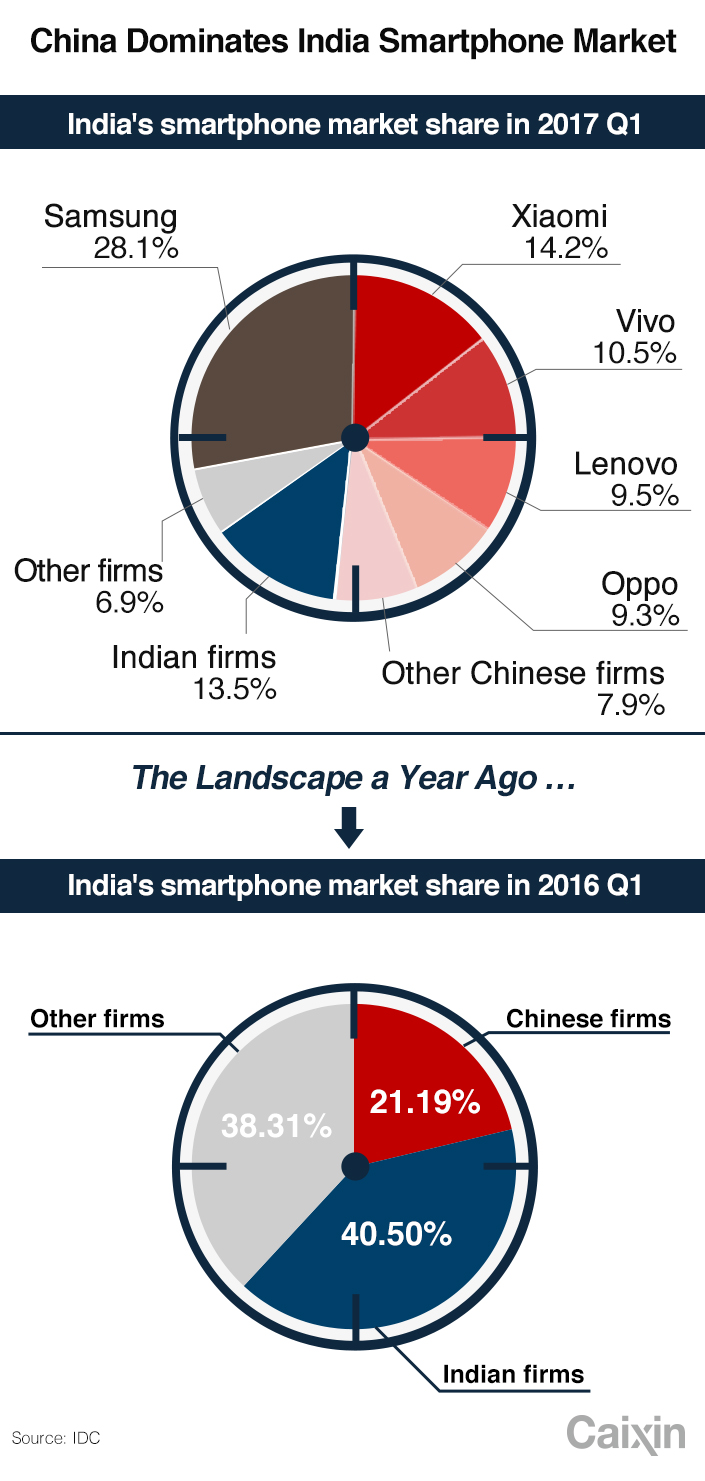

The Chinese brands took 51.4% of the market in the first three months of the year, representing a gain of 16.9% from the fourth quarter and more than double their share from a year ago, according to IDC.

Chinese brands have been flocking to India over the last three years, hoping to replicate their success from their home market where they now dominate. Most have capitalized on their expertise in low-end models that can sell for the equivalent of $100 or less, an important factor in a highly price-sensitive market like India. To further lower their costs, a growing number of Chinese brands are also setting up manufacturing facilities in the country.

Reflecting the strong demand for cheap models, the average price of a phone for the market was just $155 in the first quarter, up from $131 a year earlier, according to IDC.

South Korea’s Samsung Electronics led the market in the quarter with 28.1% share, but all other names among the top five brands came from China. Those were led by Xiaomi, which had 14.2% share and has become the second-most popular brand just three years after entering the market. Xiaomi’s Redmi Note 4, which starts from the equivalent of $155, was the market’s best-selling model during the quarter, the first time a Chinese model earned that distinction by taking the top spot from Samsung’s Galaxy J2.

In overall market share, Xiaomi was followed by Vivo, Oppo and Lenovo, which each had about 10% of the market, IDC said. Most of the Chinese gains came at the expense of homegrown Indian brands, whose share plunged to 13.5% of the overall market from 40.5% a year earlier.

|

“Homegrown vendors are making attempts to recapture the lost ground with new launches in sub-$100 as well as in the midrange segment. But intense competition from China-based vendors continues to be a major challenge and is expected to increase in coming quarters” IDC analyst Jaipal Singh said.

“Recovery of homegrown vendors is necessary for Indian smartphone market not only to fill-in the vacuum created for last few quarters but also to fuel the feature phone to smartphone migration.”

Contact reporter Yang Ge (geyang@caixin.com)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 4Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas