After Slow Start, New-Energy Carmakers Accelerate Into Second Half of 2017

A host of policy changes at the start of 2017 dampened sales for China’s new-energy carmakers in the first half of the year, but improving conditions and growing clarity since spring are leading manufacturers to predict strong momentum into year-end.

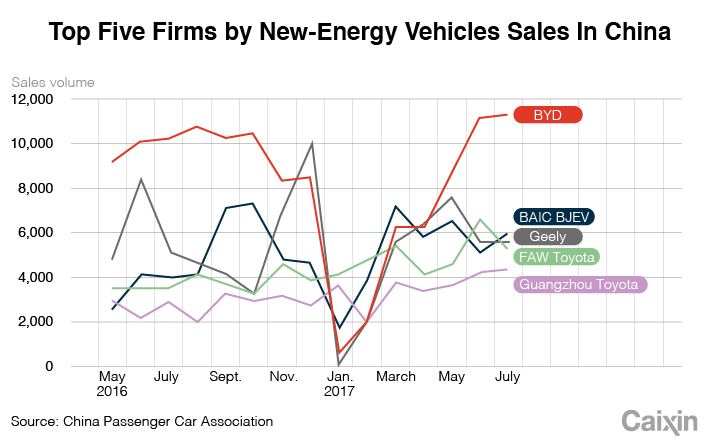

The first-half weakness showed up in results for BYD Co. Ltd., China’s leading manufacturer, which reported that revenue from its new-energy car business rose just 2.1% in the first half of the year to 15.6 billion yuan ($2.4 billion), accounting for about a third of its revenue. The actual number of new-energy vehicles sold fell to nearly 40,000 in the six through June, down about 18% from the first half of 2016. That weak performance dragged on BYD’s profit, which sank 24% for the period.

“In the first half of 2017, under the influence of policies such as the scaling down of subsidies and policy adjustments which changed the qualification requirements for the subsidies, the sales of new-energy automobiles of the group experienced a year-on-year decrease to a certain extent during the period,” BYD said in a statement with its interim results.

|

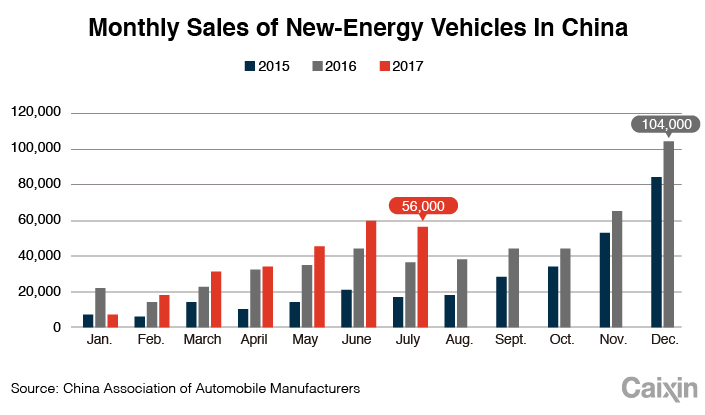

Just weeks earlier, rival BAIC Motor, the nation’s biggest maker of pure electric vehicles (EVs), said it sold just 36,000 vehicles in the first seven months of the year, putting it well off its target for selling 170,000 units for all of 2017. Industrywide, the figures were better, with new-energy vehicle sales growing 21% in the first seven months of the year to 560,000 units, according to the China Association of Automobile Manufacturers.

But even that growth was less than half the rate for all 2016, when the government began an overhaul of a subsidy system that was designed to promote the sector, but instead resulted in widespread fraud from both manufacturers and buyers. The former group took advantage of state grants to boost their income, even as they developed cars that sometimes never entered mass production. The latter group often purchased cars to get similar subsidies, even though they never intended to drive them.

System overhaul

To remedy the situation, the government forced carmakers to re-register all their models with the government after the end of last year, saying only models that met its standards could be sold. At the same time, it rolled out a new policy requiring all vehicles to be driven for at least 30,000 kilometers before buyers could collect government rebates and other subsidies.

“The entire country’s new-energy carmakers are facing similar challenges,” said the sales manager at a midsized carmaker, speaking on condition of anonymity because he wasn’t authorized to speak to the media. “One of the main reasons is the 30,000 kilometer restriction. In addition, the new-energy car industry has already entered into a kind of cycle where a big portion of sales come in the second half of the year.”

He added that his own company’s sales were weak in the first half of the year, but declined to give specifics.

The latest monthly data showed that after the slow start to the year, sales industrywide are slowly gaining momentum as more cars receive government approval and the broader system overhauls start to take effect. Following the central government’s lead, many local governments are also adjusting their own local incentive programs, and many of their newer plans are only now being rolled out.

As that happens, sales growth has been accelerating, reaching 34% in June and zooming ahead by 55% in July, according to the automobile association’s data.

|

BYD Chairman Wang Chuanfu said that his company’s own sales have been recovering since April, and returning to a growth track. He added his own belief that retirement of the old subsidy system was positive, despite short-term difficulties, and would help the industry’s development over the longer term.

“With the continuous technological evolution of new energy automobiles and the increasing attractiveness of new-energy automobiles to consumers, the development of new-energy automobile industry will gradually migrate to performance-driven from policy-driven in the future, and the performance and safety advantages of new-energy automobiles over traditional fuel vehicles will become the key factors influencing customers’ choices,” BYD said in its statement.

Contact reporter Yang Ge (geyang@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas