Faraday Future Returns Incentive Money to Nevada for Scrapped Las Vegas Plant

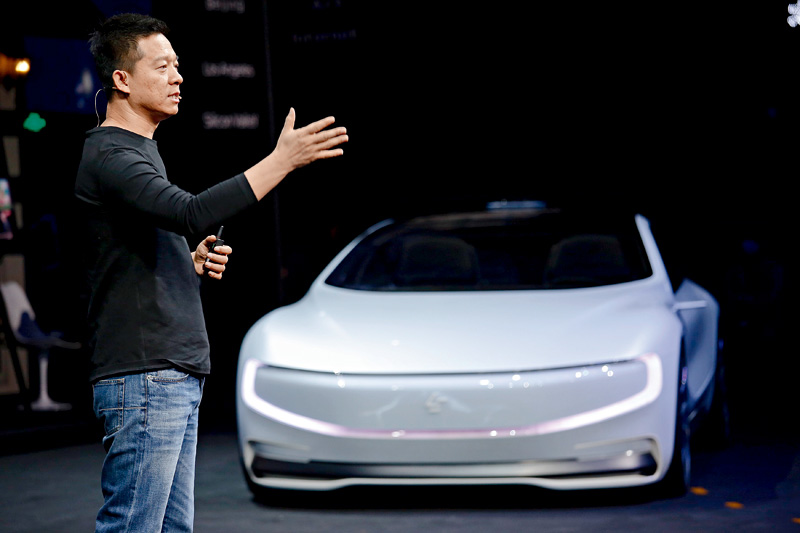

Faraday Future, the electric car start-up backed by the founder of China’s struggling online video firm LeEco, has voluntarily returned all the tax incentives it received from the U.S. state of Nevada, LeEco founder Jia Yueting confirmed on his Weibo blog.

Faraday Future has written the state of Nevada a check for $16,200, as well as forfeited about $620,000 in tax incentives, the Nevada governor’s Office of Economic Development told Caixin.

Staff at the governor’s office said the Faraday plant was no longer a “qualified project” and thus no longer eligible for the tax and land incentive package it received from Nevada. Faraday still owns the land it purchased for the plant.

In 2015, Faraday announced plans to build a $1 billion electric car factory in North Las Vegas. Manufacturing at the 3.4 million-square-foot plant was planned to start in the third or fourth quarter of 2018, with the capability of producing 150,000 cars per year, according to the document filed to the state.

But plant construction stalled last year when the company’s primary investor Jia ran into severe financial difficulty in China, including a government-decreed freeze on assets. Jia was also forced to step down from LeEco’s publicly traded company.

Faraday said in July that it was temporarily putting the brakes on the Nevada factory.

Instead of a more ambitious plan to build a factory from scratch, the company announced in August that it would lease and refurbish an old tire-making factory in Hanford, Calif., to make the FF91, the company’s first electric sedan.

Jia reiterated in his Weibo post on Tuesday that Faraday wouldn’t give up its Nevada plant, but that the cash-strapped company’s priority now is to get the FF91 to market as soon as possible.

The Hanford factory is expected to begin production by the end of 2018. Faraday hopes to able to make around 10,000 cars a year.

Faraday Chief Financial Officer and Chief Operation Officer Stefan Krause told USA TODAY in August that the company is seeking to secure $1 billion in Series A funding.

Krause said Jia has agreed to sell some of his U.S. assets to serve as bridge funding until the Series A money comes in.

A source close to Faraday told Caixin that the company plans to obtain half the $1 billion funding in the third quarter of 2017, and the rest next year.

Jia was spotted in Hong Kong earlier this month where he was to meet potential investors for Faraday.

LeEco previously said that Jia had invested $300 million in Faraday for an undisclosed stake in the company.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas