The Story Behind ZhongAn’s Blockbuster IPO

Investors are scrambling for a piece of China’s largest online-only insurer – despite its price tag.

Shares of ZhongAn Online Property & Casualty Insurance rose as much as 18% on their Hong Kong debut Thursday, after a hugely popular initial public offering (IPO) that was nearly 400 times oversubscribed.

Despite its short history and a projection of annual losses for this and next year, the final pricing of IPO shares at HK$59.70 ($7.64) each — the upper end of its marketed price range — puts the four-year-old insurer’s valuation at $11 billion. Though it is still a fraction of insurance giants Ping An and China Life’s market valuations, at $144 billion and $109 billion respectively.

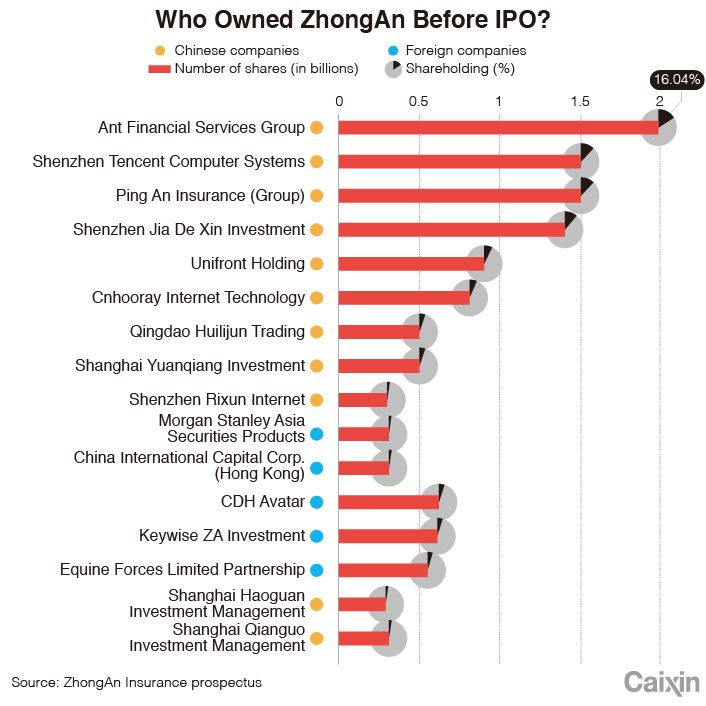

The hype could be explained by the “stars” behind ZhongAn and its offering. Its major shareholders — Ping An Insurance (Group) Co., Alibaba Group Holding Ltd., Tencent Holdings Ltd. — and IPO cornerstone investor SoftBank Group Corp. are all industry leaders, and are famous for their investment track record. Also, ZhongAn is the first internet-only insurer listed in Hong Kong, and that scarcity drew an unusually high demand from investors.

|

But after the glory of being Hong Kong’s second-largest IPO for this year by raising HK$11.53 billion, ZhongAn may have some work to do to convince its investors to stay.

The “three Ma’s” effect

Ma Mingzhe, Jack Ma and Pony Ma. They are chairmen of Ping An Insurance, Alibaba Group, and Tencent Holdings respectively, which all have invested in ZhongAn since it opened for business in October 2013.

“Everyone is talking about the three Ma’s,” said Chen Yingjie, deputy manager of corporate finance at Phillip Securities Group in Hong Kong. “Hong Kong’s (retail) investors do not necessarily know about ZhongAn’s business, most are investing in the founders.”

That SoftBank was the largest cornerstone investor in the IPO also helped turn up the heat. The Japanese telecom and internet conglomerate, known for its smart picks in “new-economy” companies, subscribed to nearly half of all shares offered to institutional investors, and now holds a 4.99% stake in the company.

According to an incomplete estimate by Caixin, mainly based on a survey of Hong Kong brokerages, retail investors borrowed at least HK$49.4 billion through margin accounts at the city’s brokerages to subscribe for ZhongAn’s IPO shares.

Hongkong Chinese Ltd., for instance, said it received 1,500 subscription applications worth HK$13 billion. More than ten of these applications sought the maximum allowable number of shares, which is set at half of all publically offered shares according to Hong Kong stock exchange rules.

The strong demand triggered a “clawback” mechanism, with the retail portion now at 20% of all IPO shares, up from 5% previously.

|

ZhongAn is more expensive than other insurers; but compared to other “fintech” firms, ZhongAn’s price is within an acceptable range, according to China Galaxy International Securities (Hong Kong) Co. Ltd.

From a global perspective, ZhongAn is the first large internet-based insurance company to be listed, making it difficult to find a point of reference for its valuation, China Galaxy said.

ZhongAn’s current valuation is justified only when it is based on metrics that evaluate an internet company, such as number of users and market share, Xingye Securities said. The benchmarks used to value an insurer, however, don’t support ZhongAn’s current valuation, it added.

“As ZhongAn is the first sizeable financial technology firm to list on the Hong Kong stock exchange, there is a scarcity premium,” Wang Hua, investment director at Hong Kong-based hedge fund Efusion Capital, told Caixin.

According to ZhongAn’s IPO prospectus, from October 2013 to end-2016, the company sold a total of 7.2 billion insurance plans to nearly 500 million customers.

Growing pains

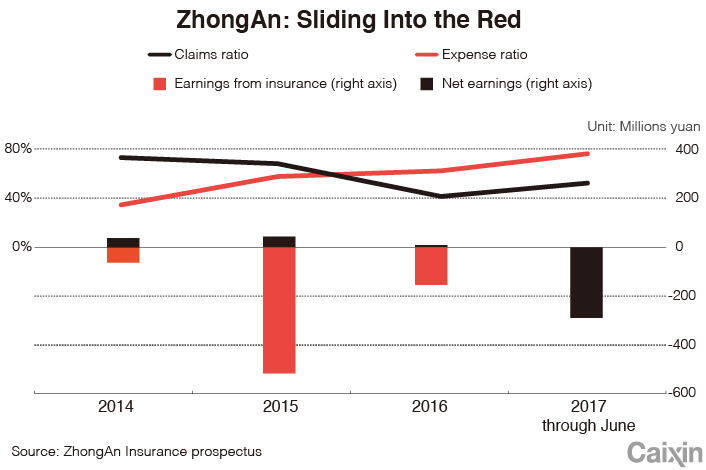

After three profitable years, ZhongAn reported a net loss of 287 million yuan ($43.3 million) in the first half of 2017. UBS Group AG estimates a full-year net loss of 174 million yuan.

Large losses are expected for this and next year, the IPO prospectus warned, citing a few key reasons. First, ZhongAn now needs to pump more money into funds earmarked for future claim liabilities as it is currently selling many long-term plans. Second, operating and administrative expenses are now being buoyed by investments in personnel as well as in research and development. Third, service fees, commissions and consulting fees paid to partners are rising as sales through partners’ platforms continue to rise.

The losses are mainly due to the fact that the company is in an early stage of development and is focused on expanding its operations, ZhongAn added.

In fact, although ZhongAn was previously profitable, this was largely driven by hefty investment income. Its insurance business has never been profitable, according to its IPO prospectus. Its combined ratio, a key metric which measures an insurer’s claims and operating expenses as a proportion of premium income, was 108.6%, 126.6% and 104.7% in 2014, 2015 and 2016 respectively. Percentages higher than 100% mean that a company is making an operating loss on its insurance business.

On the bright side, its claims ratio, a measure of claims payable as a proportion of income from insurance premiums, has been on a downtrend. From 2014 to 2016, ZhongAn’s claims ratio decreased to 42% from 73.4%.

“ZhongAn’s business model is unique, although it is not profitable now, it has a promising future,” said Xu Yibin, CEO of Bright Smart Securities International (H.K.) Ltd. Xu drew a parallel between ZhongAn and Tencent. When Tencent was listed in 2004, smartphones were not yet widely used and the share price was under HK$4, he said. It has since climbed to nearly HK$350, Xu told Caixin, adding that this is etched in the memory of many Hong Kong investors.

Partner problems?

ZhongAn’s business model relies on designing insurance policies which can be embedded in their partners’ existing platforms.

One example is product return shipping insurance, the company’s most popular insurance policy by volume. The product, which reimburses buyers or merchants for shipping costs on returns, is embedded in e-commerce site Taobao’s ordering platform.

As of March, ZhongAn counted 199 partners, including e-commerce giant Alibaba, travel booking platform Ctrip, ride-hailing company Didi Chuxing, and smartphone maker Xiaomi.

In 2014, 2015, 2016 and the first three months of 2017, insurance business brought in by shareholders or related parties represented 98.0%, 87.9%, 73.4% and 59.3% of all ZhongAn’s insurance premiums.

But the problem is: Although ZhongAn has many clients, they come through the platforms its partners operate. The insurer’s control over them is weak, thus putting it in a passive position, a securities firm analyst told Caixin.

ZhongAn admits that competition in the internet insurance sector may lead its partners to increase their fees. ZhongAn paid 663 million yuan in fees to Ant Financial in the three years between 2014 and 2016.

Another concern is whether ZhongAn’s partners will abandon it for their own subsidiaries that provide similar services. “Ping An Group has its own property insurance business. Although it has a cooperation agreement with ZhongAn, Ping An employees will definitely give preference to their own business if under pressure from performance metrics,” an employee at an insurance firm told Caixin.

Ou Yaping’s network

This IPO has also put ZhongAn’s largest shareholder under the spotlight.

Ant Financial now holds 13.82% of ZhongAn shares, Tencent holds 12.09% and Ping An 10.42%. Ou Yaping and his family, through Shenzhen Jia De Xin Investment and Shenzhen Cnhooray Internet Technology, holds 15.35% of shares.

Shenzhen Jia De Xin Investment is a subsidiary of a company controlled by Ou Yafei, the elder brother of Ou Yaping. Cnhooray Internet Technology is a subsidiary of a company held by Sinolink Worldwide Holdings, owned by Ou Yaping.

At 55 years old, Ou Yaping is ZhongAn’s chairman of the board and executive director. His son Ou Jinyu, at just 25 years old, was appointed non-executive director in April to “provide professional opinion and judgment to the Board,” according to a company filing. Ou Jinyu is also a member of ZhongAn’s Investment Strategy Committee.

The reason that Ou Yaping wanted to get his son involved in ZhongAn is because he hopes to pass the company on to his son one day, someone close to Ou told Caixin.

Ou Jinyu worked at US-based investment firm Thrive Capital as an associate between August 2015 and August 2016, according to ZhongAn’s prospectus. Thrive Capital was founded by Joshua Kushner, Ivanka Trump’s brother-in-law. Joshua Kushner is also a founder of Oscar Health Insurance, an internet insurance company. Between 2010 and 2015, Ou Jinyu served as manager of the planning and development department of Sinolink Worldwide Holdings Ltd.

Contact reporter Liu Xiao (liuxiao@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas